Posted on: September 1st, 2018

Wealth managers who work with the Super Rich (those with a net worth of at least $500 million) have long used a comprehensive planning process that is designed to manage their extremely wealthy clients’ entire financial lives in a highly coordinated manner.

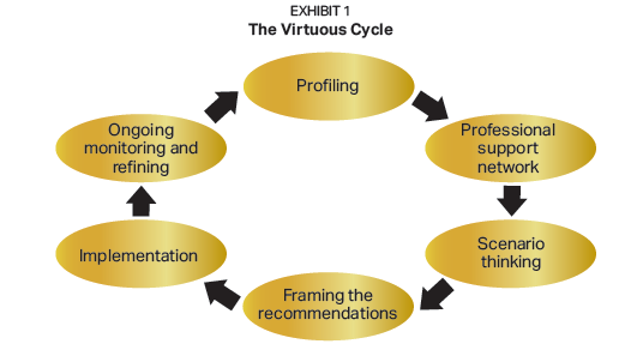

It’s a process we commonly refer to as the Virtuous Cycle. That’s because it’s designed to continually deliver ideal financial outcomes over time.

This comprehensive approach to managing wealth is one reason—one big reason—why the affluent do so well at capturing opportunities to both grow and protect their assets.

The good news: The key tenets and strategies that make up the Virtuous Cycle approach to wealth management are increasingly finding their way into the practices of financial advisors and wealth managers who serve the “merely affluent” crowd. That means you, as a successful business owner who may be aiming to become Super Rich one day, can find more advisors than ever who use this approach.

Here’s a look at this approach to wealth management that is helping successful investors and families address their biggest financial issues.

Operationally, the Virtuous Cycle has six components (see Exhibit 1). That said, it’s also customized to each client. Therefore, don’t think of the Virtuous Cycle as a strictly observed and immutable process. Instead, it’s a broad conceptual model that wealth planners can interpret and adapt to their clients’ wants and needs.

For example, it’s entirely possible that a financial advisor who uses this process doesn’t call it the Virtuous Cycle. The key, then, is not to pay too much attention to the name—but rather, to look for a process with these components.

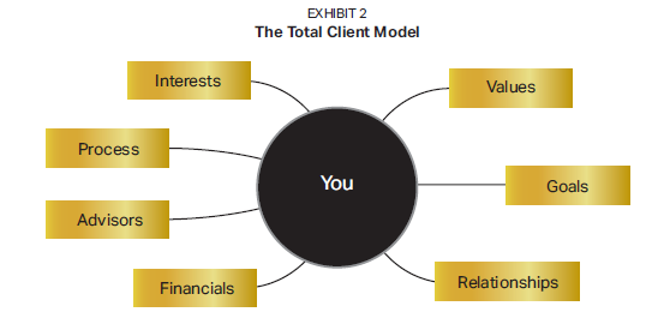

A wealth manager can offer truly effective wealth planning only when he or she has a deep understanding of you and the people in your life who will be involved in, or impacted by, your planning decisions. Without this skill, all the specialized financial expertise in the world is of little use. It’s a lot like a doctor treating a patient’s illness: If the diagnosis is incorrect, the treatment is not likely to be effective in healing the disease.

That deep understanding has to include your financial situation and goals, of course, but also needs to go well beyond that information. Based on our extensive research on the rich and Super Rich and on the best practices of leading trusted advisors, we see that the best approach to gaining that deep understanding is via a Total Client Model process. This approach is highly effective because it systematically uncovers your latent needs—that is, needs that you have but may not be aware of yet.

This Total Client Model (see Exhibit 2) is designed to address eight key areas of your life.

Client demographics

Goals and objectives

Financials

Relationships

Interests

Advisors

Process

Values

By using this Total Client Model, a wealth planner will be able to get an extremely detailed and expansive understanding of you and your world. That information, in turn, allows the planner to work effectively with a professional network of experts.

No one—not even the very best financial professional out there—is expert enough in all areas of managing wealth to deliver the highest-quality advice in all areas to highly successful, wealthy investors. Indeed, the best advisors realize that fact and therefore create and maintain strong networks of other expert professionals to turn to when necessary.

The very best of these professional support networks have four characteristics:

With profiles created and the ability to tap the expertise of a professional network in place, advisors can then engage in scenario thinking with you. Simply put, this is a method of generating alternative futures—it’s the point where all the “what if” questions are asked and answered.

Some examples:

Wealth planners can address these and other “what if” questions. Actually, there are a number of different ways to deal with each of these matters. From the meaningful possible outcomes devised in this phase, the most viable course or courses of action are selected and discussed with the client and other trusted advisors and experts.

At this point in the process, a wealth manager’s job is to communicate the various scenarios and recommendations in a way that makes a great deal of sense to you. Depending on the complexity of your situation, this might be very straightforward or quite complicated. What’s essential is that you understand—in broad stokes or in excruciating detail, depending on your preference—how the recommended solutions can enable you to achieve your agenda and any limitations of those solutions.

Framing the recommendations is a well-developed skill among elite wealth planners. It demonstrates their attentiveness to the human element of managing wealth.

Once you’ve chosen the way you want to proceed, a wealth planner and the team puts the plan in motion. Implementation—taking action—is typically very straightforward, and it should be. By this point, the hurdles have been identified and the approaches to surmounting them have been specified. This doesn’t mean implementation is easy; it often demands a great deal of work. However, it is familiar ground for wealth planners and is something they and their teams do extremely well.

Laws change. Lives change. So it’s smart to ensure that any wealth planning you do stays up to date with such changes, and that it remains positioned to generate the results you want. Therefore, elite wealth managers will continually monitor any and all changes that could impact your future success—and make modifications to the plan as required. This is how the wealthy ensure that their wealth is being managed well consistently through time.

Ongoing monitoring usually comes in four forms:

For the Super Rich, wealth planning is a continuous process of refining goals and needs along with the strategies and tools to achieve them. The same should hold true for you and your wealth plan. Think about it: If your plan becomes dated—it no longer reflects your situation and needs, or the tools it uses are suboptimal—it’s you and the people most important to you who lose out.

Armed with this information about what Virtuous Cycle wealth management looks like and how it operates, you can determine if the process your existing financial advisor is delivering has all or most of these components. If so, it’s likely that your financial life is being managed in a comprehensive, holistic way—so that all solutions work in concert on your behalf.

If not, it may be time to seek out a financial advisor with the capabilities to deliver this type of experience and these benefits. You might consider getting a second opinion on your finances—and on the advice you’re currently receiving about them. A comprehensive review of where you are today, where you want to be, and the gaps that exist may indicate that it’s time to find the expertise that will truly add value to your life—and the lives of those you care about most.

Want to explore further? Contact your financial or legal professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.