Posted on: July 1st, 2017

Chances are, you know someone who has been sued. Maybe that someone is you.

The fact is, your enviable position as a successful business owner comes with a major downside: You’re a potential magnet for lawsuits—which may very well be frivolous and unfounded—and other attacks that can wreak havoc on your financial health.

That means you’ve got to take steps to protect the assets you’ve worked so hard to build. Otherwise, you may jeopardize the financial security of yourself, your company and your family.

The logic of asset protection planning is clear: You build a moat around your assets that is as difficult as legally possible for litigators, creditors and others to cross. Instead of trying to fight it out with you in court for months or years and risk losing, the litigant sees that the only reasonable option from a legal standpoint is to settle for pennies on the dollar—or, ideally, to leave empty-handed.

TAKE NOTE: Asset protection is not meant to “hide” money in any way. To the contrary, you want anyone who might come after your assets to clearly see what you have done, because it shows them the difficult legal path they’d have to take to get to your wealth—motivating them to settle, negotiate or throw up their hands and walk away.

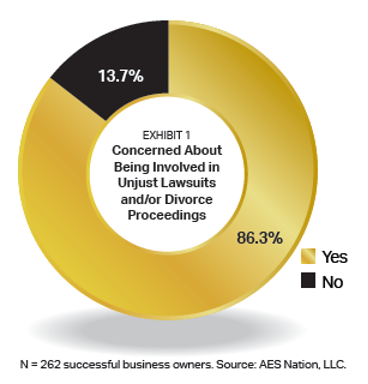

You probably recognize the threats to your wealth from others. More than 85 percent of successful business owners say they are concerned about becoming the object of unjust lawsuits or being victimized in divorce proceedings (see Exhibit 1).

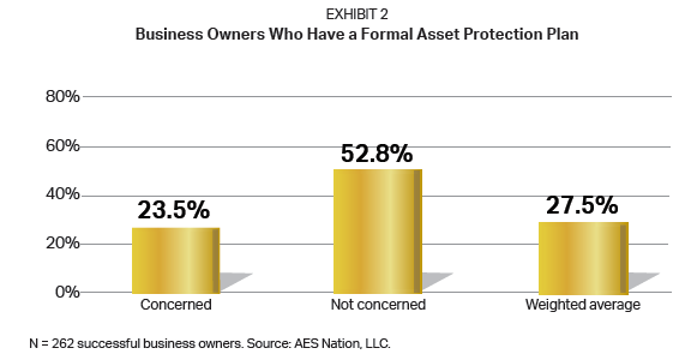

Here’s the bad news: Only about a quarter (27.5 percent) of successful business

owners have a formal asset protection plan in place (see Exhibit 2). The percentage is even lower among those business owners who say they are concerned about protecting assets. Given the risks you and your peers face in our litigious culture, these numbers are likely far too low.

IMPORTANT: Half of the successful business owners who are not concerned

do have formal asset protection plans in place. It makes sense that having these

plans reduces business owners’ trepidation about being unjustly sued, and gives them confidence they are well-protected.

If you’re one of the many business owners who lack an asset protection plan—or you’re curious whether your existing plan is up to snuff—consider these key steps.

WARNING: Be sure you have a great deal of trust in your spouse and your marriage before transferring ownership of assets to him or her. In a divorce, your spouse could potentially walk away with those assets—or you could be forced to fight for them at least as hard as you’d fight a creditor who went after them.

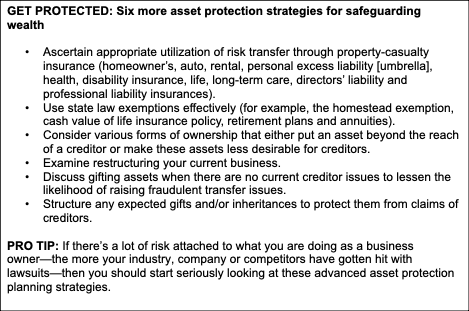

MORE STRATEGIES: Check out the sidebar below for a sample checklist of other asset protection action steps to consider taking.

EXAMPLE: Most advisors don’t appreciate the need to protect business owners on both the professional side and the personal side. Take real estate developers, for example, who commonly place each of their development projects in separate limited liability companies (LLCs). That way, if one project incurs a lawsuit, the others are protected.

The problem: Those LLCs are many times set up so the developers own them directly. If they get hit with a personal lawsuit—they’re involved in a drunk driving accident or their children smash a car into a school bus—all those assets in the LLCs could be up for grabs in the lawsuit.

To discuss asset protection strategies that might be right for your situation, contact your legal or financial professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.