Posted on: September 1st, 2017

If you’re like most successful entrepreneurs, you’re deeply concerned about your family members’ well-being—which means you don’t want to leave them dealing with tremendous financial uncertainty after you’re gone.

But the fact is, estate taxes can be especially bruising to business owners and their families. When the time comes to pay the bill, family members often find themselves struggling to figure out how to get at illiquid company assets—a financial stressor that they most certainly don’t want to suffer as they mourn and work to get back on their feet emotionally.

You can avoid putting your family through that experience with wealth planning—if you do it right.

There are many tools to help you plan your estate and ensure the money is there when it’s needed for taxes and other expenses. One of the most effective methods we’ve seen used among the most successful business owners and the Super Rich—people with a net worth of $500 million or more—is premium-financed life insurance.

Here’s a closer look at how premium-financed life insurance can help you build wealth and ensure liquidity is at the ready during one of the hardest times any family can go through.

With premium-financed life insurance, you borrow the money needed to buy the life insurance that you can eventually use to cover estate taxes. When financing life insurance premiums, you borrow money from a third-party lender. You are, at some point down the road, responsible for paying back the loan (with interest). Sometimes you pay the interest along the way instead of letting it accumulate.

The good news: The internal, tax-free growth of the money inside the life insurance policy can potentially be used to cover some or all of those costs.

Other benefits of premium-financed life insurance:

There are a number of ways to structure a premium-financing transaction. For example, while you borrow the money to pay the premiums, you could pay the interest on the loan annually. Conversely, you can wrap the interest into the loan itself. Depending on the approach you take, the life insurance policy can be used as collateral (or other forms of collateral might be employed).

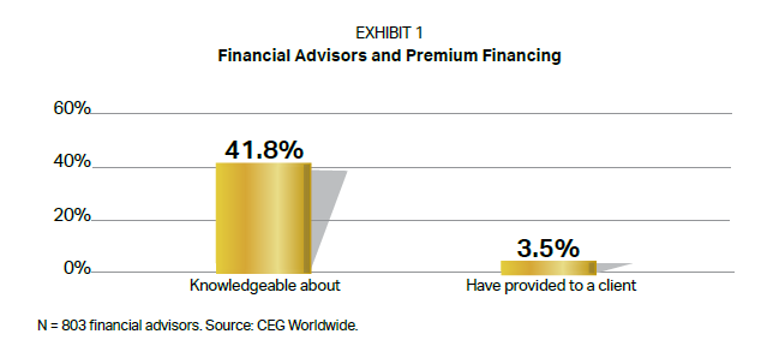

Unfortunately, there are relatively few financial advisors who understand how premium-financed life insurance works and how to integrate it into a business owner’s larger financial situation to achieve key goals.

A little more than 40 percent of financial advisors or the specialists they are associated with report that they are knowledgeable when it comes to financing life insurance (see Exhibit 1). But, according to our research, fewer than 5 percent have completed a premium-financed life insurance transaction with a client.

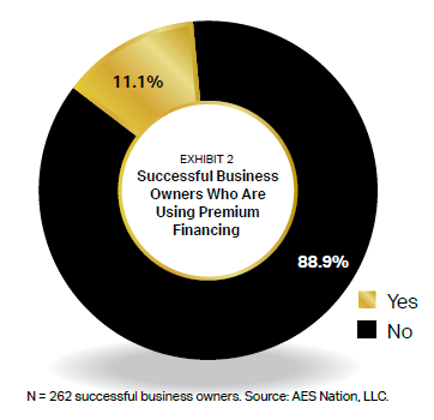

It’s hardly surprising, then, that just a little more than 10 percent of successful business owners are using premium financing (see Exhibit 2).

Estate planning can help you transfer the wealth you have built according to your wishes, desires and goals—giving you peace of mind that the most important people in your life will be taken care of as you see fit. In addition, it can generate tremendous tax benefits that allow more of that wealth to go where you want it to instead of to the government.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.