Posted on: July 1st, 2017

As a business owner, you’re also probably what’s known as a family steward—someone who wants to take good care of his or her family, provide for them and help set them on their own paths to success and happiness.

That’s a big reason why estate planning—the process for how you transfer your wealth—is crucial for all successful business owners who want to make certain that after their passing, their loved ones are adequately provided for and taken care of. When done well, estate planning aims both to allow you to pass on your assets as you see fit, and to minimize the state and federal tax bite that often accompanies the transfer of significant wealth.

But if you think that your current estate plan is up to those tasks, you might want to think again. Here’s why your estate plan may need to be refreshed—and how to do it the smart way.

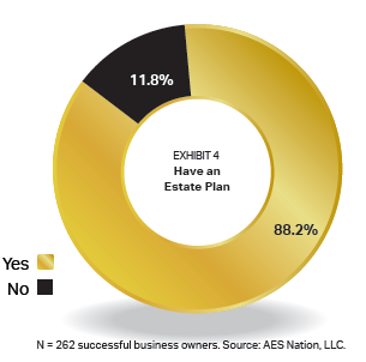

At first glance, successful business owners seem to be in good shape when it comes to planning for the eventual transfer of their estate. Nearly nine out of ten of you have an estate plan—which is defined as having, at a minimum, a will (see Exhibit 4). Having at least a will in place should help your loved ones avoid a great deal of trouble and stress when you pass on.

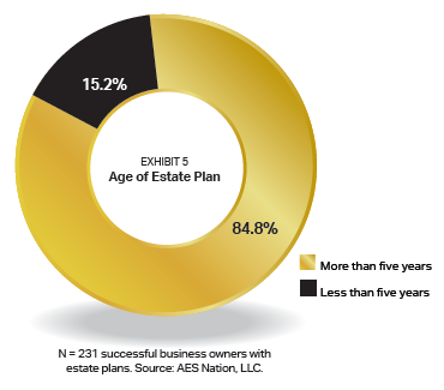

The bad news: A closer look shows that you may not be nearly as well-prepared

for wealth transfer as you think you are. About 85 percent of the estate plans that successful business owners have in place are more than five years old (see Exhibit 5).

Here’s why that’s a big deal—one that should raise a red flag that your plan could be outdated:

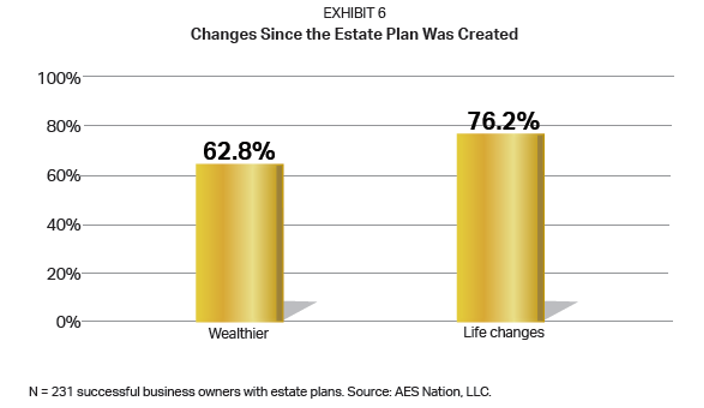

EXAMPLE: More than 60 percent of successful business owners report that they have become wealthier since they created their estate plans, while more than 75 percent say that they have experienced life-changing events since they created their estate plans (see Exhibit 6). These events—from divorce to the birth of children or grandchildren to the death of prospective guardians for minor children, and so forth—can have major impacts on planning for the future.

The message is clear: The current estate plans for a sizable number of successful business owners are almost certainly outdated. In order to attain the greatest benefits from estate planning, you need to stay on top of the matter and revise your estate plans when appropriate—especially as new events develop that potentially affect your company and your personal wealth.

When an estate plan is missing key elements or no longer reflects your wishes or current situation, chaos can occur that harms a business owner’s family.

EXAMPLE #1: An affluent business owner dies without so much as a will. Suddenly, unknown relatives who live thousands of miles away appear and demand a share of the wealth—leaving the immediate family members and closest loved ones with far less. In the worst case, the company itself may need to be dissolved to pay for all the claims and taxes.

EXAMPLE #2: A business has taken on new partners and stakeholders since the estate plan was first written. At the primary owner’s death, family members end up suing each other for control of the assets and fighting over the future direction of the firm.

EXAMPLE #3: An entrepreneur’s bright-eyed 5-year-old boy has become a drug-addicted 20-something. If the estate plan calls for him to receive a huge lump sum with no strings attached upon the entrepreneur’s death, he could squander the money in short order—and potentially put his life at risk if, for example, he uses the money to deepen his dangerous lifestyle.

If you’re among the roughly 85 percent of business owners with estate plans older than five years, what should you do?

Start by answering a few key questions:

If the answer is “yes” to any of those questions, it’s time to update your plan.

Some issues to consider as you assess and rethink your current plan:

PRO TIP: Determine the ideal outcome first. Distributing your assets at death as you want them to be distributed must be the No. 1 driver behind any estate-planning decisions. Knowing what you want to have happen to your wealth is foundational. Don’t start the updating process by seeking out solutions or focusing on how you can cut your estate tax bill by the maximum amount possible. That’s a big mistake.

DANGER: The strategies and products that enable maximum tax benefits come with strings attached that require you to entirely cede control of the assets you want to transfer—an outcome that may be highly undesirable. Always remember: The true goal of estate planning is to transfer your wealth in accordance with your wishes. Tax mitigation, while often very important and very beneficial, should not be the overriding driver of your estate-planning decisions.

If, after reading this article, you suspect your estate plan is out of date, you’ll want to take action soon so you don’t needlessly jeopardize your family’s well-being.

Contact a legal or financial professional who can assist you with your estate planning needs.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.