Posted on: September 1st, 2020

Here’s an uncomfortable truth you need to accept: Someday—hopefully in the very distant future—you are going to die.

The good news: You can make that moment easier on your heirs by taking a few simple steps.

One of the best ways, financially, to prepare now for that time is to choose a person to be the executor of your estate. Unfortunately, that also can be one of the more overlooked aspects of estate planning—which can spell trouble for your family and your wealth.

Your executor is essentially the CEO of your estate—the person responsible for making sure your will is executed properly. This role can mean handling everything from distributing assets to heirs to ensuring any taxes due are paid.

In other words, your executor is a crucial player on your estate planning team.

Not surprisingly, then, people often find it difficult to choose their executor. The good news: You can choose from virtually anyone. Although in our experience, a family member is the most common option, professionals—lawyers, bankers and others—are also commonly selected. What’s more, family member executors may engage a professional for help doing the job—a move that can potentially help avoid family conflicts over assets.

With larger and more complicated estates, being an executor can become quite complex. The disbursal of the assets is only one aspect. Family relationships can make things problematic.

To get an idea of the complications that can arise, consider the following famous cases.

Notorious New York hotelier Leona Helmsley died in 2007, and most of her billions of dollars were placed in a charitable trust. However, per her instructions, her dog received $12 million—an amount that was reduced after a legal challenge. $15 million went to her brother, $10 million went to each of her grandsons, and two other grandchildren (though initially disinherited) ended up with $3 million.

Years after Helmsley died, the executors–the two grandchildren who inherited $10 million each—along with Helmsley’s former lawyer and a former business advisor submitted a bill for services of $100 million. The executors were already earning $7 million in fees, but they claimed the additional money was necessary for dealing with an extremely complicated estate.

Helmsley’s will did not specify how to determine the executor’s fees. It also said not to use the fee schedule of New York. In many states, executors are paid a fee based on a sliding percentage of the assets in the estate. In New York, for example, the fee starts at 5 percent for the first $100,000 in the estate and declines to 2 percent when the assets exceed $5 million.[1] Additionally, many states allow for extraordinary fees if the estate is especially complicated or in litigation.

Using the New York State schedule, the executor fee would have been about $200 million. The $100 million requested by the executors reflected a rate of $6,437 an hour, based on the amount of time the executors spent settling the estate—an egregiously large amount of money.

Brook Astor was a New York society fixture who died in 2007. Her son, Anthony Marshall, was executor. He had engaged the services of Francis X. Morrissey Jr. to plan Astor’s estate. But Astor’s grandson, Philip Marshall, believed that Anthony took advantage of his mother and brought the matter to court. Each side professed to know Brook Astor’s true intentions.

In 2012 a settlement was reached and Anthony Marshall’s inheritance was cut in half. Marshall was later convicted of larceny, with claims of elder abuse—and Morrissey was convicted of fraud and conspiracy!

The socialite Doris Duke named her butler and a trust bank as co-executors of her $1.2 billion estate. The butler, an admitted alcoholic, was written into the will less than a year before Duke died. After her death, he ended up using the assets in the estate as if they were his own property—living in her mansions, driving her cars and flying in her private Boeing 737. All this was paid for by the estate.

After a lawsuit, the butler resigned as co-executor. He also gave up his seat on the board of Doris Duke’s charitable foundation. However, he was paid his executor fee of $4.5 million—as well as $500,000 annually for the rest of his life.

There are clear circumstances where executors do not fulfill their obligations. Some of the more egregious issues we have seen include:

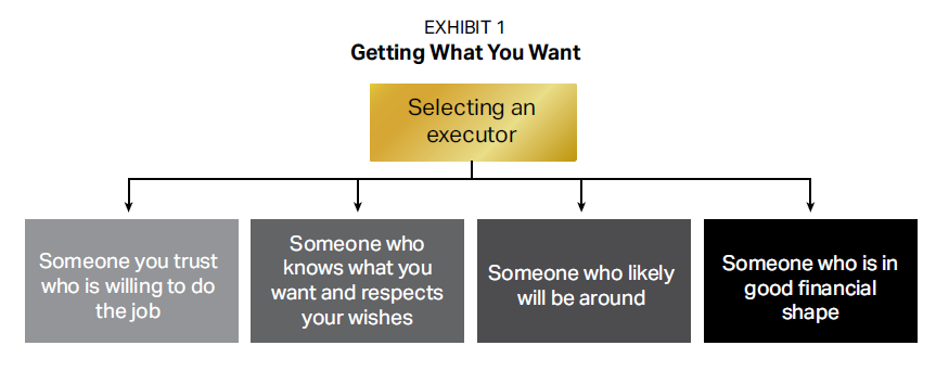

Based on all of this information, we think it makes good sense to select your executor carefully so that your wishes as laid out in your will are honored and followed.

There are a few actions that we believe can potentially help make sure your executor does a good job (see Exhibit 1).

Your executor must also have the time required to do a good job, and be inclined to take on the role and all it involves. This is true even if he or she ultimately engages a professional for additional help.

Important: If choosing a trusted family member or friend isn’t an option for you, you might consider going with a corporate executor who is part of a financial services company. Professionals with experience in matters relating to wills and estates can potentially do the job of executor better than an amateur—especially when complex assets and estates are involved. Note, however, that generally there are higher expenses associated with a corporate trustee.

While it is possible to replace an executor, it is often costly and problematic. The better approach is to carefully and explicitly specify your wishes and choose a person to be executor who will do a good job in the role by following your wishes and preferences.

If you haven’t chosen an executor, it’s a great time to take this crucial step. If you already have one but haven’t revisited the issue in years, you might consider making sure your choice is still the best for you given your situation and goals.

[1] Source: New York City Bar.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.