Posted on: April 1st, 2019

A growing number of affluent individuals and families want to use some of their wealth to support the causes and organizations they care about most. From helping those less fortunate to facilitating scientific breakthroughs, from providing safe habitats for wildlife to sharing the arts, philanthropy is a core value for many.

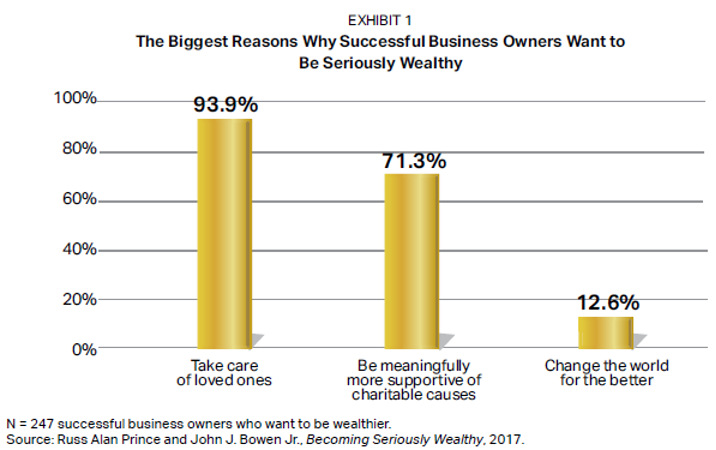

Just look at one affluent group: successful business owners. More than 70 percent of the successful business owners who told us they want to be seriously wealthy are tremendously charitably inclined (see Exhibit 1). By amassing greater wealth, they see themselves as being able to do more to improve the world. (They’re not the only ones seeking to have a strong charitable impact, of course. In working with the affluent for decades, we have consistently found philanthropy to be one of their most important goals.)

Of course, the affluent also know the importance of smart philanthropy—how, by using the appropriate tools and strategies, they can have a much bigger impact than they otherwise could, while simultaneously enjoying benefits that can enhance their own financial security and flexibility. In this way, the affluent seek to—as the old saying goes—“do well by doing good.”

With that in mind, here’s a closer look at one philanthropic tool that many charitably minded people and families use: charitable remainder trusts.

CRTs’ popularity stems from the fact that they are among the most powerful tax-wise charitable giving mechanisms. The possible tax benefits—such as the elimination of capital gains tax on the sale of appreciated assets and potential tax-deferred growth—make charitable trusts highly appealing to many with significant assets.

Let’s start with some CRT basics.

A CRT isn’t right for everyone, of course—few, if any, financial strategies are. Two things to consider if you look into CRTs are:

For the avoidance of doubt, it is possible that the CRT has nothing left to pay the charity. That is permissible as long as at the onset, using IRS-prescribed actuarial rules, the charity should theoretically receive its intended actuarial share.

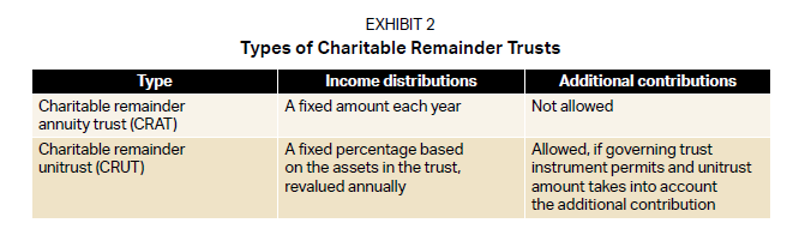

There are two types of CRTs (see Exhibit 2).

You can use a wide variety of assets to fund a CRT. Some examples include:

Think about it: While a CRT is an irrevocable trust, it is probably wise to make it as flexible as possible. For example, you might want to be able to replace the managers of the assets in the trust. Such terms can be written into the trust.

To see the potential power of a CRT, consider these examples.

A charitably inclined small-business owner and spouse in their late 50s want to retire. The business, structured as a limited liability company, is worth $21 million. It started from scratch and has zero basis.

If the couple sold the business directly and paid taxes of 23.8 percent, they’d face a tax bill of approximately $5 million. Instead, they contribute the business to a CRAT—receiving a fixed annual income stream for their lifetime or 20 years (whichever is shorter), with the remainder going to their alma mater.

Once inside the CRAT, the business is then sold. As a result, the CRAT is not taxed on the capital gain. The CRAT pays the couple a fixed annuity of $1.4 million—totaling about $28 million over the course of 20 years. The couple receives a $2.1 million charitable deduction for the actuarial value of the remainder interest. The proceeds from the sale are then invested in a portfolio of securities (stocks, bonds, etc.). Assuming the portfolio grows by 6 percent annually, about $16 million will eventually be left to their alma mater.

An investor in her 40s purchased $6 million of stock in a new company. After a few years, those shares were worth $18 million. If she cashed out, she would have to pay capital gains taxes of 23.8 percent on the $12 million of appreciation—leaving her with a tax bill just shy of $3 million.

Instead, she and her advisors set up a CRUT, which enables her to add more assets in the future. The CRUT will last the shorter of 20 years or her lifetime. She will receive 12 percent of the assets each year—or just over $2 million the first year. Over the course of 20 years, using assumptions of a return of 8 percent annually, she will receive approximately $29 million. She will receive a $1.8 million charitable deduction. And at the end of the 20-year term, the charitable organization she chose will receive approximately $7 million.

Charitable remainder trusts can be extremely useful and powerful wealth planning tools if you’re philanthropically minded and have significant assets. They can allow you to have a major impact on a charity you value—potentially a much bigger impact than you could have otherwise—while also benefiting your bottom line significantly in the forms of lower taxes and a regular income stream.

That said, there can be many details and nuances to CRTs that need to be navigated. The importance of working with an expert in charitable wealth planning cannot be overstated here—as setting up a CRT incorrectly can cause the IRS to negate the tax benefits you can get, as noted above.

Best bet: Make sure your advisor is a professional with expertise in the areas of charitable giving and philanthropic wealth planning—or that he or she has access to such a professional via a network of experts.

Contact your financial professional to discuss your charitable goals and how you might position your wealth to best pursue them.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.