Posted on: January 1st, 2020

If you think you know the true financial worth of your company, a formal business valuation might change your mind.

If you’re planning to sell your business, or even if you’re just thinking about possibly doing so down the road, you’re going to want to have a formal business valuation conducted. Formal valuations are often very useful in helping all parties by providing, at the very least, a solid starting point for negotiations.

But you might want to value your business even if you have no intention of selling. For example, a formal valuation can be an important step to take if you are looking for credit, determining the ownership percentages of partners or going through a divorce.

As you’ll see, you might be surprised by what you discover when you get your company formally valued.

According to a survey by AES Nation of 208 successful business owners looking to sell their business within the next five years, about 70 percent have had a formal valuation conducted within the previous three years (see Exhibit 2). As business owners get closer to deciding to sell their company, we tend to find that they are more likely to have it valued. That makes sense, given that a formal business valuation is often required when selling a business.

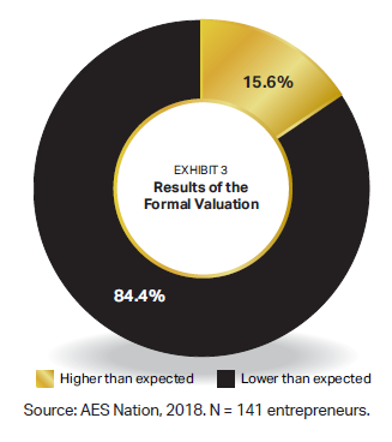

When a formal valuation is done, the results are often unexpected. Consider that nearly 85 percent of the entrepreneurs surveyed by AES Nation said the valuation came in lower than they anticipated (see Exhibit 3). These entrepreneurs clearly had overestimated their companies’ worth—not terribly surprising, given how hard they likely worked to build their businesses and how emotionally invested they are in them.

Still, this finding should give you pause as an entrepreneur. If your perception of your company’s value is too high, you might end up walking away from some solid offers. In fact, if your determination of the value of your company is meaningfully greater than the value determined through a formal valuation, there might not be many buyers taking interest in your business at all.

Note that 15 percent of the entrepreneurs surveyed by AES Nation were pleasantly surprised by the formal valuation because it came in higher than they expected. There are potential problems when you undervalue your company, too. For example, you might take a low offer that is clearly not in your best financial interests.

The most interesting finding, to us, was that not one of the entrepreneurs said the valuation was “just right.” This strongly suggests that a formal valuation is an important step in reconciling perception with reality.

Important: Formal valuations are not necessarily the price your company will ultimately sell for. They are generally the starting point for negotiations and helpful in justifying a price.

So where to begin? There are a number of business valuation methods that entrepreneurs who are thinking of selling their company should be aware of.

The following is a brief overview of six commonly used business valuation methods.

This method can be a good starting point in helping determine what your company is worth, and it helps start the discussions about selling your company. However, it can be imprecise and is often quite subjective. Therefore, your and your team’s ability to negotiate becomes especially important when this approach is used.

With six valuation methods to choose from, which one is best?

The right approach for you will depend on a variety of factors (such as the industry you are in and the size of your company). Valuing companies is part science and part art. A valuation method that might have been appropriate for your business in the past might not be viable now, for example. The growth and size of your company, the changing dynamics of your industry, the stability of your company, and other factors all play a role in determining the “best” valuation approach today.

What’s more, you might end up “trying on” multiple valuation methods to gain deep enough insights into which particular approach makes the most sense given your situation and the goals you’re looking to achieve through the sale of your business.

For these reasons (and others), it’s often helpful to bring aboard a valuation specialist—someone who has the requisite skills to value your company and who doesn’t have any emotional attachment to your business. Such a specialist is likely to deliver a clear-headed, objective valuation and assessment.

Armed with such an assessment, you can take steps to increase your business’s value (if necessary) and negotiate wisely and shrewdly to help you walk away with a better deal in the end.

Contact your financial professional to discuss your business and whether now is a good time to get a formal valuation.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.