Posted on: March 1st, 2019

We regularly point out the value and importance of elite wealth planning in the lives of today’s highly successful individuals and families—as well as those who are on the path toward great financial success.

So let’s take a minute and remind ourselves of just what elite wealth planning is—and how it can potentially have a powerful impact on your life.

Before we can see what makes elite wealth planning so special, it’s important to understand the various planning strategies that make up the core of most elite wealth planning efforts.

Typically, elite wealth planning consists of eight main types of planning:

In practice, there is considerable overlap between these areas of planning, as well as great synergistic possibilities. Some examples:

Clearly, elite wealth planning is designed to help address people’s needs, wants and preferences across a full spectrum of planning specialties.

Important: When it comes to any of these planning specialties, the tail should never wag the dog. A strategy or tool should be used only if it fits well with a particular and specific goal you want to achieve—not merely because that tool exists and can potentially deliver an exciting benefit. The objectives you have must lead the way. The technical aspects and solutions must then follow from those objectives and be designed to support them. As you will see, your goals—the human element—are the cornerstone of elite wealth management.

The various types of wealth planning listed above are not new, nor are they in any way restricted to the very wealthiest among us. Lots of people can seek help with their charitable giving or income tax planning.

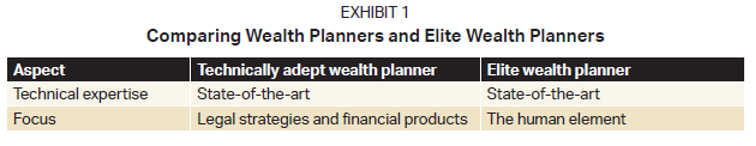

Additionally, the level of technical expertise possessed by a professional wealth manager offering wealth planning isn’t a major differentiator. Note that both technically adept and elite wealth planners can be considered state-of-the-art in terms of their expertise (see Exhibit 1). This makes sense. There are no truly proprietary legal strategies or financial products anymore, so all technically skilled wealth planners should be able to deliver essentially the same menu of solutions to their clients.

Important: Keep in mind that there can be major differences among wealth planners in terms of their talent, know-how and perspective. The two groups shown here are already relative rarities in the planning world. Truly technically adept wealth planners make up perhaps less than one-fifth of all wealth planners in business today—while truly elite wealth planners are even rarer, representing no more than perhaps one in ten of all technically adept wealth planners.

But there is one key characteristic that tends to make elite wealth management so—well, elite: the focus of the particular wealth manager.

Specifically, elite wealth planners focus intently on the human element of the wealth planning process—understanding their clients on deep, personal levels that go beyond the numbers that appear on their tax returns or balance sheets.

In contrast, technically adept wealth planners are generally more focused on the legal strategies and financial products such planners can offer. This doesn’t mean that technically adept wealth planners are not concerned with interpersonal relationships with their clients and the psychology of the affluent. But from an objective standpoint, interpersonal relationships with clients are of much less concern to technically adept wealth planners than they are to elite wealth planners.

While elite wealth planning can include some highly sophisticated thinking and solutions, we strongly believe the human element is much more important. In elite wealth planning, the client—be it an individual, a business owner or a family—takes center stage in all discussions and decisions. The elite wealth planner’s technical capabilities and solutions exist only to serve the client and provide what he or she wants most as a person.

That’s why we define elite wealth management this way:

Elite wealth planning is a comprehensive planning process that incorporates state-of-the-art technical expertise in legal strategies and financial products with the human element.

Too often, the human dynamic is overshadowed by legal and financial expertise. To get truly meaningful results, a wealth planner must be acutely attuned to both the rational side and the emotional side of a person—the logical and the illogical. It’s this awareness of and sensitivity and responsiveness to the human element that we firmly believe makes wealth planning elite.

Bonus: The comprehensive process at the core of elite wealth planning enables both the wealth planner and the client to reveal more about themselves (including the way they like to work, their aspirations and even their limitations). Along the way, elite wealth planning creates a level of security and comfort that is the foundation of a rewarding relationship.

Finally, a warning: There are advisors vying for your business that you want to avoid.

Contact your legal or financial professional to explore this topic further.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.