Posted on: May 1st, 2022

It’s extremely common for financial professionals these days to advertise how well they focus on their clients—and with good reason: After all, you’re probably more likely to consider working with people in just about any capacity who say that they will make the experience “all about you.”

The good news is we see that more financial advisors and wealth managers today are paying greater attention to their clients’ needs and concerns than they did a few decades ago. Back then, much of the focus was on the investment strategies and solutions themselves—how sophisticated they were, how impressively they were structured and so on. Sure, advisors tried to identify their clients’ goals—but that process was often relatively superficial and basic.

The bad news is that although advisors have become better at understanding their clients on a deeper level, we believe too many still don’t go far enough. In contrast, elite wealth managers actually use a process for becoming intensely client-centric—getting to know their clients extremely well so that they can offer a broad range of solutions that are both impressive technically and highly aligned with the results their clients want most.

With that in mind, it’s a great time to assess your advisors’ level of client focus and determine whether you’re getting the experience you want and need.

To be client-centric at an elite level, an advisor must have a way to develop a deep understanding of the person across the table—you—and then be able to provide solutions that are directly tied to that diverse understanding.

To get to that level, however, there has to be a foundation of characteristics on which to build. On a base level, you should be looking to see whether an advisor possesses three qualities that will tell you you’re on the right track.

Consultative. Client-centric advisors approach relationships reflectively and cooperatively to ensure that the views, feelings and input of their clients are always taken into account. Moreover, they’re excellent communicators—meaning they know how to talk to clients in ways that clients both understand and value.

Of course, those traits are subjective and not always easy to identify and assess. When it comes down to it, you want to see whether an advisor takes the time to truly understand you—as a person, a member of your family, an investor, or whatever the case may be. Curiosity is key—but how does the advisor put that curiosity into action?

One of the signs that can indicate that an advisor is client-centric is if they employ a process that helps them know you as a total person across many different areas. Essentially, you want to see that they take steps to profile their clients in ways that help them best understand their clients so they can do a better job of helping them.

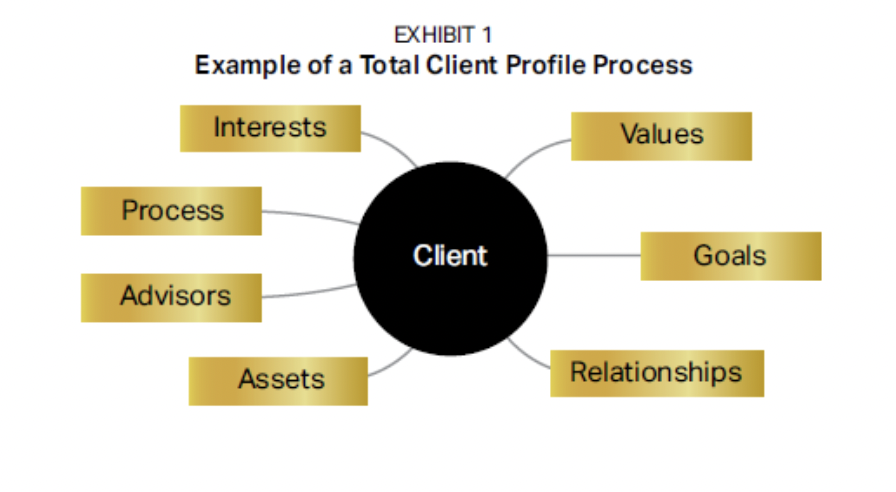

For example, consider the following form of client profiling that homes in on seven areas of a person’s life (see Exhibit 1):

Do you notice anything interesting about these seven categories? Note that just one of them concerns assets. A full six of the seven are focused on helping the financial professional better understand who you are (and what you want to achieve) as a person, a spouse, a parent and so on.

The reason that’s important is because if financial professionals understand you at that deep a level, they can potentially be far more comprehensive in terms of the types of strategies they offer you—and they can better identify the specific solutions within those strategies that really line up well with what you want to accomplish.

For example, if all a professional knows about you is your investments and your retirement goals, the solutions he or she offers you will probably begin and end with those topics. In contrast, if that professional understands the hopes and dreams you also have for your children or grandchildren as well as the concerns you have about their ability to achieve those outcomes, the advisor can potentially craft a broader, more far-reaching plan that takes the full picture of your life into account.

We know which scenario we think is better.

Ultimately, you can view all of this as a process of deep discovery—about you and the people who are most important to you, and what you want most. It’s in many ways a fundamentally different approach than one that focuses entirely on your assets and net worth, which are too often the only areas of interest to financial advisors.

Not every client-centric advisor will have these same seven categories in his or her discovery process, of course. But we find that these seven are quite common among elite wealth managers—as is the emphasis on revealing who you are as a person, not just as a level of net worth or investment risk tolerance.

That said, the one category that we find especially important and that we feel should be part of any discovery process is values. In fact, we think one of the most important conversations you can ever have with a financial professional is about your values.

Why are values so powerful? Because they are one of the core motivations for everything we do in our lives. They have a profound impact on every important decision we make, from what we choose to do for a living to whom we marry to how we spend our free time. That means our values are tightly connected to the amount of meaning we bring to our lives.

For example, say you’re a parent. You probably value your children above almost everything else in the world. As a result, you want to protect them, educate them well and set them onto a smooth path in life. Financially speaking, you might want to build an adequate college fund for their education. This is a common goal, but underlying it is a fundamental value: love of your children.

As important as values are, however, most people are not particularly good at articulating them. While we may act definitively on our values, most of us have not necessarily thought deeply about exactly what those values are. An extremely adept client-centric advisor can work with you to help you clarify your core values and how you want to see them play out in your various financial decisions. The advisor might want to know what is important to you about having wealth, for example. If you say “security”—a common response—the advisor might ask you to talk about why security is important to you. That back-and-forth might go on until both of you recognize the core value or values that drive the bulk of the decisions you make and that give you your personal “reasons for being.”

The upshot: When values and wealth are aligned, the potential for a life infused with meaning becomes more possible.

When you work with professionals who are truly client-centric—who want to know you on a deep level—you put yourself in a superior position to pursue the outcomes that are the “best” and most meaningful to you and the people you care about most.

That’s why it makes sense to look beyond the terms and language an advisor uses and get clear on the process he or she has in place to get to know you. A process that seeks to help an advisor understand you in a full and comprehensive way can be a good sign that an advisor “walks the talk” when it comes to being client-centric.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.