Posted on: May 1st, 2020

The Super Rich—those people with a net worth of $500 million or more—are, not surprisingly, seeking out the very best professionals and other providers to help them achieve their many and often-complex goals.

In short, the Super Rich want to work with the best of the best—and they take smart steps to identify those professionals.

The good news: You can take a page from their playbook to locate professionals and providers who are the best fit for you, based on your goals, needs and level of complexity.

Some people and families with truly serious wealth turn to family offices for their professionals. Family offices are entities designed to address the financial and personal needs (and wants) of extremely affluent families. They may provide in-house expertise and seek out and work with outside professionals too.

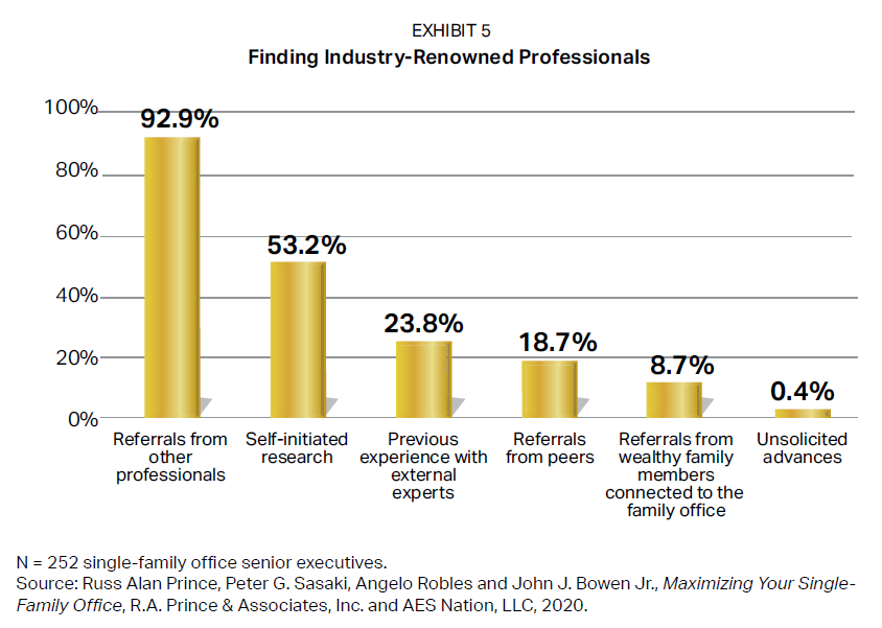

In sourcing external experts, single-family office senior executives (the people running these entities) use multiple approaches (see Exhibit 5).

Their use of each approach is based largely on the particular circumstances of a certain situation involving their clients.

Let’s take a closer look.

Going to leading industry authorities is the predominant way single-family office senior executives source many of the professionals they employ. This is likely because the top professionals in a particular field are often familiar with top professionals in related areas—a great estate planning attorney may very well know of highly skilled accountants, for example. Over time, these professionals’ paths cross as they work with the same wealthy clients and attend the same industry events.

For senior executives at single-family offices, obtaining referrals from professionals they have confidence in is an astute risk-reduction technique. The professional making the referral is often “on the hook” for the referral. This means that if the external expert referred is not as good as promised, then the judgment of the professional can be questioned—with possible adverse consequences for his or her relationship with the single-family office.

Roughly half the single-family office senior executives proactively seek out professionals themselves. Executives at the wealthiest single-family offices might leverage elite conclaves such as the World Economic Forum, Bilderberg and Milken Institute meetings to identify resources. Others might join or speak at mastermind groups of entrepreneurs and advisors to source both expertise and business opportunities. Where there’s proven competency, mastermind group members usually grow to trust one another over time. When needs arise, they turn to each other for support—including referrals to experts.

Related to elite conclaves are high-end educational forums (such as the Family Office Association). These learning environments provide information and insights, and address questions from the single-family office senior executives and family members.

Some of the executives use past experiences as their guide when selecting professionals. Generally, their wisdom is gained from experience, as they have often spent decades in the private wealth industry. Along the way, they may have built strong connections with various professionals they know and trust. They then call on these relationships when appropriate.

Nearly 25 percent of the single-family office executives leverage their former positions and contacts when sourcing external experts. Example: Before taking the top position at a significant single-family office, one executive was a lawyer at a renowned international law firm. In that role he dealt with many other types of professionals. Once ensconced at the single-family office, he reached out to some of the best professionals he knew and asked them to be part of the single-family office’s professional support network.

Peer referrals are somewhat common among single-family office senior executives. About a fifth of the research participants reported being introduced by peers to industry-renowned experts. Here again, peer-to-peer interactions often occur at mastermind groups (also known as CEO groups) where like-minded professionals meet to share advice—and contacts. As more single-family office senior executives attend elite mastermind groups, it is more likely they will source experts based on the recommendations of other members.

There are a few sources of referrals that aren’t particularly popular or common. Occasionally, the family members themselves locate high-quality professionals who are then employed by the single-family office. They often meet these professionals at the types of events and organizations mentioned above.

Finally, a tiny percentage of single-family office senior executives are amenable to unsolicited advances—essentially, cold calls from external professionals to the executives.

Chances are, you don’t currently have the level of wealth to enter the realm of the single-family office. Regardless, you can still benefit by adopting an approach to sourcing professionals that is similar to what the Super Rich and their people take.

Perhaps the biggest takeaway is that you might look to other professionals you’re currently working with when you need guidance and advice from other experts. This approach tends to be effective in helping people find top-quality professionals and ensuring that those professionals give them the time and energy they need in order to accomplish their goals.

Of course, you can also do your own research and hunting. That said, those efforts are likely to be most effective if you are “plugged in” in some way to the people you need—through mastermind groups or the like. By putting yourself in the line of expertise, you may very well boost your chances of identifying professionals who are right for you and your needs.

Finally, be cautious about getting referrals from peers—just as the executives at single-family offices are. Your peers may understand your situation only in a big-picture sense and therefore might make broad recommendations that aren’t a great fit for you. Depending on the complexity of your needs, you might be better off using other sources to look for professionals.

Next steps: Talk with your financial and/or legal professional(s) to discuss your needs and whether they can connect you with a high-quality professional to address them.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.