Posted on: May 1st, 2022

Inheritors have a habit of losing the family assets that come to them. To help ensure that doesn’t happen, it’s imperative that you set up any heirs on your wealth transfer list for success in managing wealth.

But the key steps to take may not be the ones you automatically think of. Here’s how you can start educating your loved ones about being good stewards of wealth.

We find that matriarchs and patriarchs are often worried about their children’s and grandchildren’s ability to take good care of the money and other assets they will one day inherit.

They have reason to be concerned. Consider that 70 percent of wealthy families lose their wealth by the second generation—and a staggering 90 percent see that wealth gone by the third generation, according to the Williams Group wealth consultancy.

That’s one reason why wealthy business owners often take steps to prepare heirs to take the reins of the company. That might mean giving the child hands-on involvement within the business—learning from the ground up. There are also many organizations and professionals—from business schools to life coaches, and from consultants to trusted advisors—that can provide instructional services to inheritors of family businesses.

But what about inheritors who won’t have managerial roles—passive owners? Likewise, what about heirs who may receive investment assets only—such as a sizable portfolio of liquid securities like stocks, bonds and mutual funds?

These heirs need to know how to manage their assets intelligently and effectively so that the wealth they’re entrusted with grows instead of shrinks—or worse, vanishes.

But it’s important to help educate your heirs in ways that they’ll respond to and act on—otherwise, your efforts to enlighten them might be wasted.

Based on extensive conversations and work with wealthy inheritors, we find that the great majority are not interested in learning even the basics of money management and wealth planning. They want to turn to professionals to invest their assets and help them deal with the range of planning issues they may face—from tax matters to protecting their fortunes from legal challenges.

Wealthy heirs—the second, third and fourth generations—as well as others who may inherit significant wealth (such as spouses) tend to share two overarching goals.

Very few wealthy inheritors personally manage their substantial inheritances, in our experience. Most turn over the day-to-day responsibilities to professionals. Even when an heir takes an active role—such as in making direct investments in private companies—professional advisors are usually part of the effort.

That means it’s important to help heirs learn how to distinguish a trustworthy advisor from one lacking the necessary capabilities—or from a Charles Ponzi type seeking to swindle them.

We find the most effective way to find high-caliber experts is to take a page from the playbook of the family patriarchs and matriarchs—who also tend to enlist professionals instead of fully taking the wealth management reins. The three main avenues the exceptionally wealthy use to find professionals to help guide them in managing wealth are:

In addition, four core criteria are central in selecting high-caliber investment advisors and wealth planners:

Extensive technical expertise. It is usually necessary to consider numerous factors in order to effectively evaluate the technical competence of a money manager or wealth planner, including track record, professional experiences, and recognition from peers in the financial and legal communities.

Even though inheritors may not care to learn at an in-depth level how specific legal strategies and investment products work, they often tell us they want to have a big-picture understanding of what they can accomplish with their wealth. Essentially, they seek to understand the impact their inherited wealth can have—on their families, their communities and even the world at large.

The upshot: Inheritors can benefit from getting help developing their wealth agendas so that their assets can be positioned (by a professional) to support those goals. Getting this type of high-level guidance in creating a vision for one’s wealth often means working with an elite wealth manager who focuses upfront on helping clients define their financial values and goals.

All that said, some inheritors do want to learn and be involved in the technical aspects of investment management and wealth planning. If that describes your likely heirs, know that there are organizations that provide programs for teaching the mechanics of investment management to the next generation.

Example: A variety of firms (from wealth management companies to private banks to multi- and virtual-family offices) have developed instructional programs explaining how the markets and specific investments work. These programs address a wide array of issues, from the basic (such as asset allocation) to more advanced investment management concepts (such as investment selection techniques and various forms of fundamental and technical market analysis).

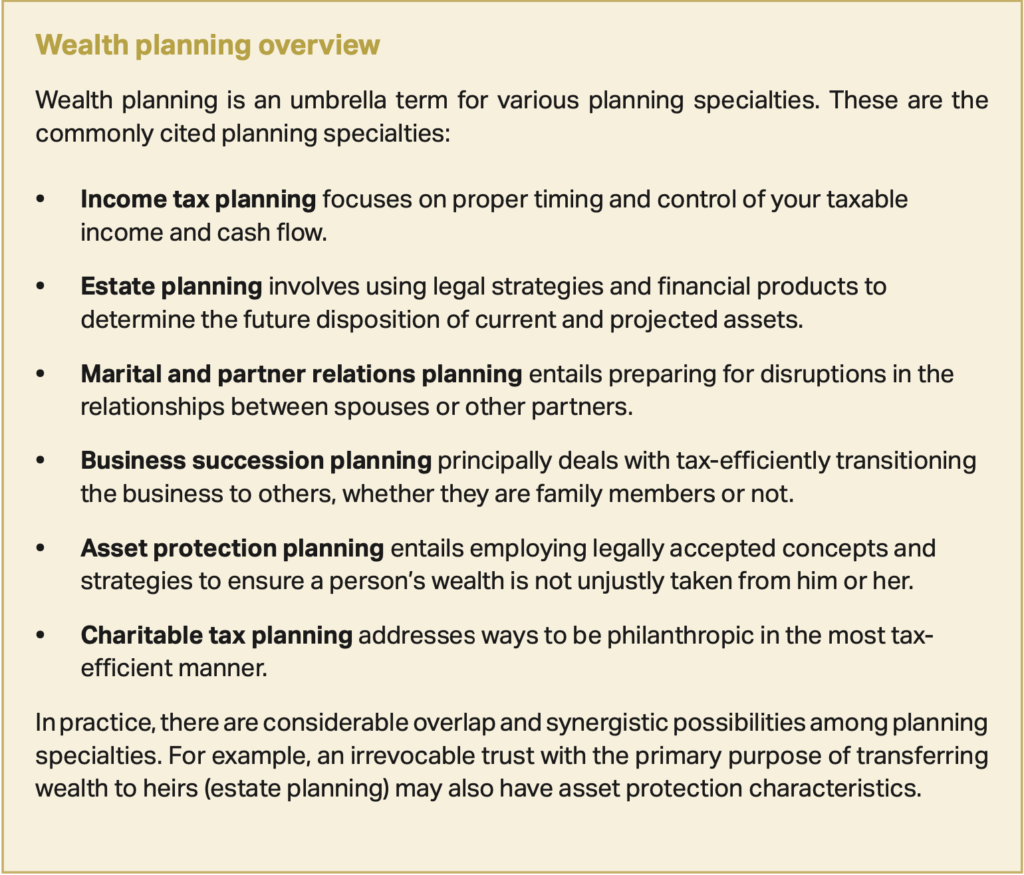

When it comes to wealth planning, the focus is usually on an overview of the different types of planning services (see the wealth planning overview below). Sometimes, the basics surrounding the tools and techniques—such as trusts, partnerships and life insurance—are explained.

The wealthiest families, simply because they have the most wealth, may be especially concerned about how their children will shepherd the wealth they have created. But getting educated on the basics of personal financial management and how to seek out high-quality expert guidance is a vital step for just about everyone. You don’t need to be a member of the top 1 percent or even the top 50 percent of Americans in terms of wealth to benefit from learning how to better manage your own wealth, get the help you need and avoid professionals who don’t have your best interests at heart.

Indeed, taking the right steps to help your children, grandchildren and other loved ones become informed about managing their wealth and accessing expert guidance could be just what helps them achieve the highest levels of personal and professional success.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.