Posted on: November 1st, 2018

If you’ve got a trust, you’ve also got a trustee who is in charge of that trust. But there’s one professional you probably don’t have in place but whom you really need: a trust protector—someone to monitor your trustee to ensure your trust is being handled responsibly.

Here’s a look at why a trust protector can be a key ally in your wealth management plan to build, protect and transfer your wealth.

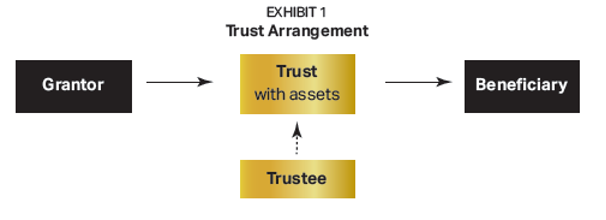

The basic concept of a trust is straightforward: There’s a grantor who creates the trust and contributes the assets. Another person or entity—the trustee—has legal ownership and control over assets, and is responsible for distributing assets to the beneficiary of the trust (see Exhibit 1).

Important: The trustee is a fiduciary, required to adhere to some very high standards when it comes to managing the trust. Among them: The trustee is morally and legally obligated to adhere to the dictates of the trust the grantor created.

While trustees generally meet their fiduciary duties, there is always the possibility they will not—and in reality, trustees sometimes do fail to hold up their moral and legal end of the deal.

For example, there have been situations where trustees have embezzled funds from trusts—using the assets for their own purposes or to benefit people who are not trust beneficiaries. In short, they steal money. There are civil and criminal penalties for embezzling from a trust, of course, but they might not help the beneficiaries once the money has been spent.

It’s rare that we see a trustee loot a trust of millions of dollars and run off to some exotic locale. However, a more common problem than embezzlement is exploitation, which can work like this:

Technically, there is absolutely nothing wrong with using investment advisors who refer business—if, that is, the investment advisors themselves act as fiduciaries and make decisions in the best interests of the beneficiary. If that’s not the case, though, the trustee is not living up to its responsibilities.

Another example: The trustee can also legitimately generate fees that the trust then reimburses. A trustee could, for example, create or encourage conflicts between multiple beneficiaries of a trust—resulting in litigation that drains the trust while enriching lawyers. This is a nefarious, but not necessarily illegal, course of action.

What’s more, the risks posed by trustees aren’t limited to criminal or immoral acts. Trustees can get wrapped up in their own problems that cause them to fail to be good fiduciaries. Say a trustee develops a severe drinking problem and makes bad decisions about the trust. Although the trustee is not being malicious in that case, he or she still isn’t fulfilling the responsibilities and duties of the job.

The upshot: It is often wise to not unconditionally trust your trustee.

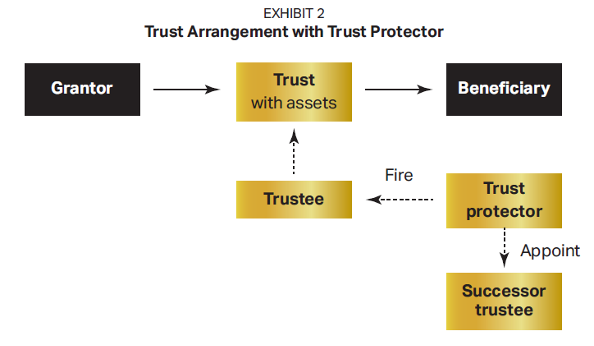

To ensure a trustee is doing a good job, enlist the help of a trust protector (see Exhibit 2). The trust protector is tasked with keeping an eye on the trustee and making sure the trustee is consistently acting as a fiduciary.

The trust protector has the power to fire trustees if there is misconduct. With the trustee dismissed, the successor trustee designated in the trust document takes the reins.

Exception: If no successor trustee has been named, the trust protector can be given the authority to appoint a new trustee. However, the arrangement usually prohibits trust protectors from appointing themselves or anyone close to them as the trustee.

One question that’s commonly asked about trust protectors is this: How does a trust protector know that something is amiss—that a trustee isn’t acting appropriately? Say, for example, a trust’s beneficiaries are under the age of 18 and unaware of what they have waiting for them in trust. How would anyone in that case know whether the trustee is satisfying his or her fiduciary duty?

The answer is that a reputable trust protector will periodically “look over the shoulder” of the trustee, reviewing recent developments and actions taken as well as the performance of the investment advisors managing the assets. The trust protector can also go one step further by having the trust and the assets in it stress tested—an evaluation process in which the goals of the beneficiary are matched up with the current scenario to determine whether everything is on track.

Note: Sometimes, the trust protector is made responsible for arranging for the stress tests. At other times, different professionals are used and the results are provided to the trust protector. The trust protector then uses the results of the stress test to decide whether the trustee is fulfilling his or her responsibilities. If not, the trustee may be fired.

Technically, a trust protector can be anyone. The key is to choose someone whose judgment you trust and who has a good understanding of your goals and preferences when it comes to the assets in your trust. For those reasons, many people name their lawyer or accountant (or a family member or close friend) to be their trust protector.

While the trustee is responsible for following the terms of the trust document, the trust protector’s role is quite limited: He or she is responsible only for monitoring and, if necessary, firing the trustee. Very importantly, the trust protector should never have the option of becoming the trustee.

The only additional powers a trust protector might have are:

In practice, it tends to be useful if the trustee and the trust protector do not have a close personal or professional relationship. Anything that can get in the way of the trust protector being completely objective should be avoided.

Reverse engineering: For existing trusts without a trust protector, it is often possible to decant the trust to add one. Doing so usually necessitates getting everyone involved to approve the change (and it may be dependent on state laws).

Contact your financial professional to explore the possibility of adding a trust protector to any existing trust or trusts you have set up—or putting one to work with trusts you may establish down the road.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.