Posted on: July 1st, 2021

In our work with both financial advisors and high-net-worth clients, we see a troubling trend: Too many successful, wealthy individuals and families are getting poor financial advice.

They are simply not getting the guidance, services or products that are most appropriate to help them achieve their key financial goals.

There are a number of reasons for this. But one main culprit is that, overall, there are a relatively small number of financial advisors we would describe as extremely talented and deeply caring professionals.

So it’s a good time to ask yourself: How good is the financial advice I’m getting these days?

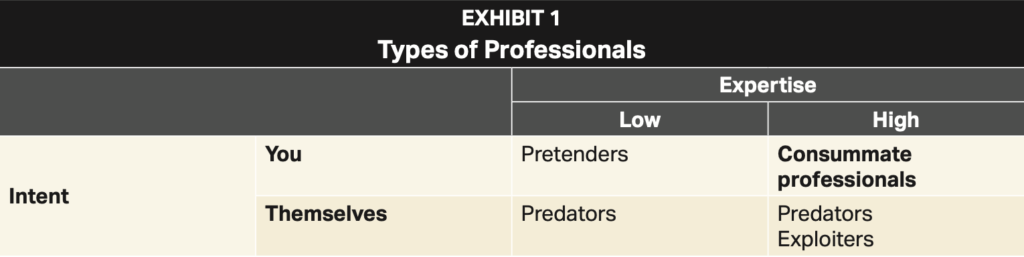

We have been able to segment professionals—financial and legal—into four types, based on their intent and expertise (see Exhibit 1). Of course you want to work with experts who are committed to your well-being and agenda, and who are extremely technically capable. These are advisors we call consummate professionals.

The other three types are best to avoid—which isn’t always easy, given how many of them exist!

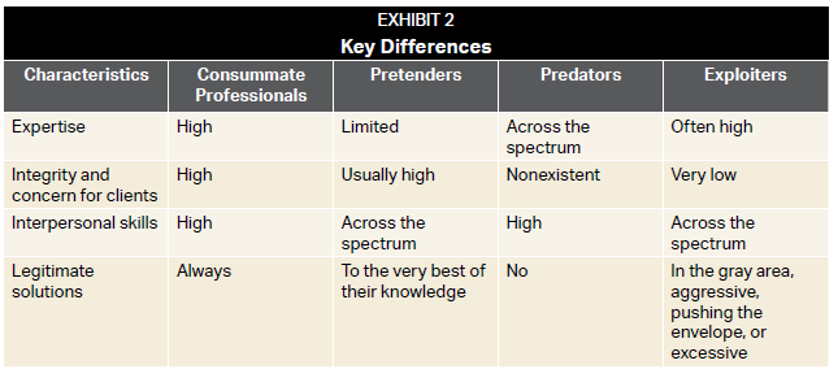

Pretenderstruly want to do a very good job for their clients. They have the best of intentions. The problem: They lack the knowledge and capabilities to do so! Pretenders want to do well, but they “don’t know what they don’t know.”

Regrettably, Pretenders comprise the vast majority of professionals, in our experience. Most financial advisors simply are not familiar with many of the more advanced wealth-building and wealth-protecting solutions in existence. And those who are often struggle to implement them as well as possible. (Some Pretenders lack proficiency with even basic wealth-building and wealth-protecting solutions, and should be avoided.)

Important: Advisors who are Pretenders are not bad people. To the contrary, they tend to be intelligent, hardworking and well-meaning. They want to do what is best for their clients, but from an objective vantage point, they are just not capable. Their earnest, hard work does not change the fact that a great many of them probably are not able to provide you with the high-level, sophisticated tools, strategies and products that are almost always necessary to become meaningfully wealthier, and they probably aren’t adept at the strategies that are so critical to protecting your wealth.

Predators are criminals. Their objective is to separate you from your wealth. Using cunning, guile and duplicity, they seek to capitalize on the greed, naiveté or goodwill of their intended victims. Predators may or may not be technically sophisticated. However, they’re superbly capable of being manipulative and building rapport and trust.

Unfortunately, it can be fairly difficult to spot Predators. They tend to be narcissistic and very clever grifters. Predators can be superficially extremely charming and are usually quite adept at faking caring and concern—so it appears they are very focused on helping you. Unknowingly engaging a cunning Predator as an advisor potentially can be disastrous to your wealth (and likely your mental health).

Exploiters are often quite technically adept—highly skilled in advanced financial strategies. The problem is that the financial and legal strategies they often turn to are technically legal but highly questionable. Thus, there is often a good possibility that the strategies they advocate will blow up on you—often years after you’ve taken their advice. Put simply, Exploiters are not looking out for your best interests.

Exploiters can also be hard to spot, because of their technical skills and because the complex strategies they often promote make it hard for other professionals to effectively question what they are proposing. When Exploiters are also adept at building trusting relationships, they can be extremely persuasive—and therefore potentially very dangerous to your financial security.

The key differences among the four types of professionals are summarized in Exhibit 2.

Without question, you want to work with a consummate professional. The issue then becomes how to find one.

We have concluded that only a relatively small percentage of advisors today are capable of making a meaningful, positive and pronounced difference in the lives of successful individuals and families with significant wealth.

There are a few ways to help give you greater confidence that you are working with a consummate professional.

The way that most of the affluent and the accomplished find exceptional financial advisors is via introductions from professionals they work with. Example: If you need an exceptional money manager, your accountant may know trusted experts he or she can introduce you to. Or if you have an estate tax issue for which life insurance is the best solution, your trusts and estates lawyer likely knows leading life insurance agents.

Going to professionals who have proven themselves to you can be a very powerful way to find other consummate professionals. When accountants or lawyers refer you to a financial advisor, they are putting their reputation and professional judgment on the line. This is not something they are likely to do unless they feel the financial advisor is a consummate professional.

Another consideration is whether the financial advisor is a thought leader. That is, he or she is recognized as a leading authority by other professionals, the wealthy and successful, and even competitors. By identifying true thought leaders, you increase the likelihood of working with some of the most erudite professionals in their fields.

We find that many successful, wealthy individuals and families recognize when something feels wrong—or at least, not quite right—about their professional advisors. For example, entrepreneurs with years of experience building and growing a financially strong company are often able to spot when they may not be getting enough financial value—or when they may be dealing with someone whose advice could get them into trouble down the road.

One of the best ways to deal with a situation where you’re just “not completely sure” or you “feel a little uncertain” is to conduct a stress test.This is a process of critically evaluating key aspects of your current financial situation and how they are being managed. Or it may involve carefully assessing a particular strategy or product you are considering and “putting it through its paces” before deciding whether to move ahead.

Stress testing gives you the opportunity to correct mistakes or use solutions and products that can do a lot more to help you accomplish your goals. Simply put, stress testing often makes a lot of sense if you want to avoid financial advisors who are Pretenders, Predators or Exploiters.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.