Posted on: July 1st, 2017

Want to pay less in taxes? You’ve got plenty of company!

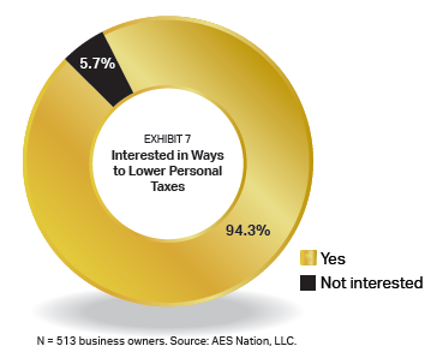

If you’re like the vast majority of your highly successful peers, you see the need to reduce the amount of money you pay to Uncle Sam each year. A full 94.3 percent of successful business owners are interested in ways they can legitimately lower their personal taxes (see Exhibit 7).

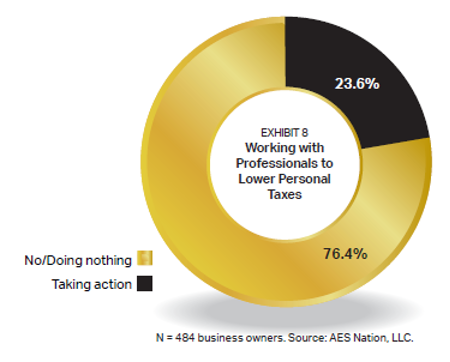

But guess what? The advisors you probably work with to manage your financial life may not be getting the message. As seen in Exhibit 8, not even one-quarter of you are currently working with experts to lower your personal tax bill. That means 76.4 percent of you are not getting professional, proactive tax help!

The upshot: There are sophisticated wealth management strategies and products available that can significantly mitigate the impact of taxes on your personal wealth—the wealth you possess outside of your business. But many of you probably are not hearing about them (or any other strategies and products to reduce taxes, for that matter) from your professional advisors.

Enough is enough. It’s time to fix the problem. Here’s a look at private placement life insurance—a particularly effective way some of the Super Rich and the ultra-wealthy who work with family offices reduce the tax impact on a portion of their investments, and a solution that may very well make sense for you.

When seeking to maximize personal wealth as an investor, what you earn can be less important than what you walk away with in your pocket. Investments with great headline returns can quickly look very mediocre once taxes are taken into account.

EXAMPLE: Hedge funds. Depending on factors such as where you live and your income tax bracket, you could easily pay 50 percent or more in taxes on the profits you earn through a hedge fund investment.

Private placement life insurance helps mitigate the tax bite from a variety of different types of investments and makes it possible to eliminate all income and capital gains taxes.

Essentially, private placement life insurance is a variable universal life insurance policy that provides cash-value appreciation based on a segregated investment account and a life insurance benefit. It may be able to provide savings and minimize the death benefit.

Key benefits of PPLI:

PPLI can help mitigate taxes in your investment portfolio and can be especially useful as a component of more-complicated tax strategies.

EXAMPLE: If you have a significant windfall that results in a large infusion of ordinary income in a particular year, private placement life insurance (in conjunction with a charitable trust) can offset the tax while supporting charities such as private foundations. And with proper planning, the cash-value appreciation and insurance coverage can also escape gift and estate taxes.

BONUS: PPLI can also be structured to provide world-class protection from creditors.

We know that the Super Rich are strongly gravitating toward private placement

life insurance. Why? The effects of tax-free compounding on their investment returns can be astounding—especially if the assets placed in PPLI throw off significant dividends or are in some way tax-inefficient. And because it’s life insurance, it’s extremely versatile in its uses. Some of the Super Rich and ultra-wealthy business owners are capitalizing on private placement life insurance by integrating it into their business strategy (using it to provide deferred compensation and fund corporate benefits) and personal wealth maximization strategy. All told, the possible uses of private placement life insurance are extensive.

NOTE: Even if the government lowers the tax rate going forward, you still come out ahead using PPLI if you give the tax-free compounding enough time. Best bet: Use PPLI with money you won’t need to access for at least five years.

CAVEAT: You won’t be able to use any losses in a PPLI policy to offset gains elsewhere in your portfolio and engage in tax-loss harvesting. The losses are not tax-deductible.

The challenge, however, is finding a high-caliber wealth manager who knows how to use PPLI to achieve optimal results.

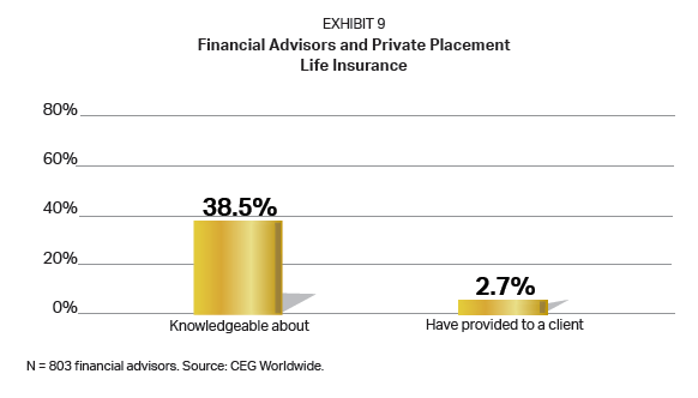

Consider that fewer than 40 percent of the financial advisors we surveyed (which includes any other professionals who are part of their team) say they are knowledgeable about PPLI (see Exhibit 9). More telling is that fewer than 3 percent of financial advisors have provided a client with a private placement life insurance policy.

This can spell big trouble for business owners who may be considering this approach. PPLI is a complex solution that incorporates investments and insurance. If it isn’t structured correctly, it will not qualify as life insurance—and the business owners can face significant penalties. That’s why it’s vital to work with a professional or team that has PPLI experience.

WARNING: Private placement life insurance policies prohibit investor control. This

means that a third party at “arm’s length” must invest the money. This has been known to be a point of confusion for a number of financial advisors and their clients. Consider one investor who was heavily involved in selecting the stocks that the financial advisor was buying and selling inside the investor’s private placement life insurance policy. This resulted in the tax benefits of the policy being invalidated.

If you would like to explore PPLI further, contact your legal or financial professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.