Posted on: September 1st, 2020

If you own and operate a family business, what will happen to it after you are no longer involved? How will you ensure the continuity of the company so other family members will always be leading the way and calling the shots?

If you’re like many family business owners, you may not have given much thought to those questions. We see that most family business owners are intensely focused on the daily running of their companies—they’re not often spending time envisioning their companies’ future ten years down the road.

In addition, most owners tend to see themselves running the show for many years to come—even if they’re getting up there in age or experiencing health issues.

As a result, we find that many family business owners don’t focus nearly as much as they should on transitioning the business to family successors. And that can create big headaches.

That’s where family business succession planning comes in. Effective succession planning is often essential to sustaining a family-owned-and-operated company into the future. Failure to effectively transition the family business can have significant adverse consequences, such as:

Family business succession planning is a process—not a one-time event—that happens over time, with modifications and tweaks along the way.

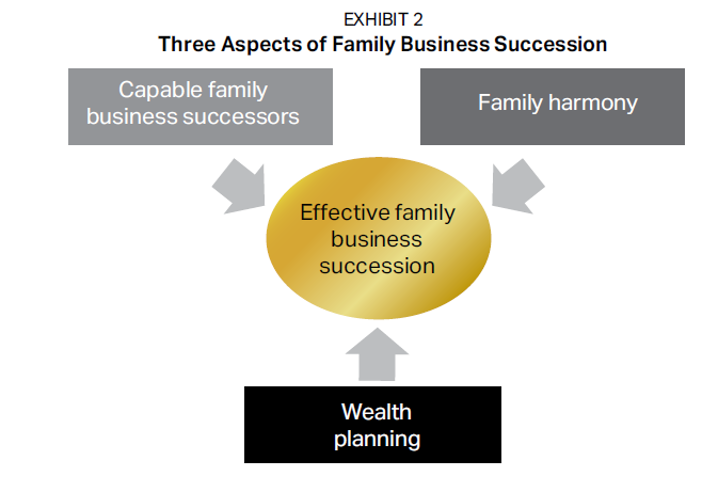

There are three main aspects to family business succession, and they all play important and synergistic roles (see Exhibit 2). For family business succession to deliver intended results, there needs to be:

If any one of these three aspects is out of sync, there will be increased pressures on the family business successors and increased risk that the company (and all those people associated with it) will suffer.

It is not uncommon for heirs to believe they can lead the family business even though an objective, rational assessment would put that conclusion in doubt. It is up to the current family business owners, and perhaps other key family members, to ensure that the intended family business successors are truly prepared to take over the company.

There are various ways families can prepare successors to take over the business, including encouraging them to:

Regardless of the approach, it’s essential that the decision-makers involved in this process are able to identify the list of key attributes and expertise a family business successor needs to have—and be able to check them off the list with a candidate. It’s not always possible to absolutely ensure a designated family business successor is completely up to speed, of course. But the aim should be to work toward that goal, which usually entails staring as early as possible.

Note: In cases where the chosen family business successor is not truly ready, contingency plans can be put in place. When the selected successor meets certain criteria, he or she can then obtain control of the company.

In many family businesses, harmony within the family is a key objective. That doesn’t necessarily mean the goal is for all the family members involved with the business to get along famously. Rather, the intent is often for family members to simply avoid clashing with each other to an extent that could be detrimental to the family business and disastrous for family relationships.

Family harmony is fostered when the respective family members understand what is going to happen to the family business and other assets when the primary owner steps down. This does not automatically mean everyone will be happy about how the family wealth will be divided, of course. The key is for everyone to be aware of the plan and generally accepting of it. When this occurs, it’s often easier to deal with future possible conflicts.

Achieving family harmony and avoiding fights usually require a well-structured wealth plan. There are many subcategories of wealth planning that are relevant to families who own a business. For example:

Warning: Don’t over-focus on wealth planning at the expense of the other two issues outlined above. Some family business owners become so concerned about wealth planning issues—such as getting the company in the hands of heirs without paying taxes—that they lose sight of the bigger picture: ensuring the family business is set up to thrive in the years ahead. The best family business succession plans balance out all three aspects and do not overemphasize any aspect to the detriment of another.

In general, the family business successions that work best for everyone involved often rely on a team of experts to guide the family through the many issues and nuances as well as to provide industry insights.

Certainly, the family member business owners are a key part of that team, as they usually do the job of getting the intended successor up to speed to take over the company. For example, they might arrange for the would-be successor to work in various positions across the business or arrange for the successor to pursue an advanced degree (such as an MBA). In addition, family business consultants are often engaged to help prepare the intended family business successor for taking over the company.

Ensuring family harmony is a trickier matter. We see a growing number of families working with business consultants and even family therapists to help families and their companies avoid conflicts. Family members sometimes fail to recognize the possible adverse consequences of not proactively addressing this issue. Bringing in an expert after a disagreement has grown can be more problematic than nipping challenges in the bud.

Wealth planning is also typically done with professional assistance. Once the family is clear about their desired outcomes, a plan must be set up to legally transfer control and management within the parameters set by the family and the law. There are different types of professionals—from wealth managers to accountants to lawyers to bankers—who can be instrumental when it comes to wealth planning.

In selecting the best experts to help transition a family business to a successor, family business owners commonly rely on referrals from trusted professionals they currently work with or from successful peers who can introduce the owners to experts such as family business consultants or wealth managers.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.