Posted on: February 1st, 2019

When it comes to learning about options for your wealth planning, it can often make sense to look to how the 1 percent or even the 0.1 percent manage their financial lives. While not all multimillionaires and billionaires make sound financial decisions, our experience tells us that the bulk of them are highly focused on being good stewards of their wealth.

That’s especially true when it comes to the issue of life insurance. After all, not even the smartest billionaire on the planet can escape death. And a great many of them face hefty taxes on their estates when they pass away—even if they take advantage of a plethora of high-level wealth planning strategies.

With that in mind, here’s a look at how savvy multimillionaires and billionaires use life insurance—and how their approach can inform your own use of this often-vital financial planning tool.

The highly affluent are often interested in using life insurance policies to help pay their estate taxes. One reason is that even after using wealth planning solutions to reduce their liability, they’re often still left facing estate taxes. In addition, options to pay estate taxes such as extensions and loans can sometimes be problematic—especially if extensive, intricately structured family businesses or significant nonliquid assets are involved.

Billionaires and their advisors commonly conduct complex risk-return analyses around the value of purchasing life insurance. These analyses tend to turn up two primary driving forces behind life insurance that appeal to billionaires:

Many billionaires can’t actually purchase enough life insurance to cover all the estate taxes they will owe. So, even though life insurance might be the best way for a billionaire to pay estate taxes, he or she might be unable to get enough coverage.

Example: The estate tax obligation for someone with $1 billion in assets residing (and dying) in New York State will easily exceed $500 million! Meanwhile, the total amount of life insurance across more than 25 carriers (including reinsurers) may not be much more than $400 million.

Sourcing life insurance for billionaires is currently the domain of a relatively small number of high-end life insurance specialists. These experts have extensive knowledge and, more important, experience in pulling together the resources needed. They also have very strong relationships with the life insurance companies that they can, and do, leverage.

Because there are only a few ways to secure the very high levels of coverage needed, life insurance policy portfolios for billionaires tend to look quite similar. In effect, the various high-end life insurance specialists are turning to the same life insurance companies for coverage.

If the amount of coverage will not match the estate tax liability, some creativity is required on the part of the specialists. One approach is to “borrow a life.” To obtain higher amounts of life insurance than they can get on themselves, billionaires may need to secure coverage on family members. Taking this approach can work out quite well—if it is tightly integrated into the billionaire’s broader estate plan.

Important: Life insurance may be only one part of a solution to managing estate tax obligations. All applicable wealth planning solutions need to be reviewed against an established long-term family strategy to ensure that the life insurance and related approaches are deployed optimally in pursuit of the billionaire’s goals. The key is how to tie all these pieces together in the context of the billionaire’s estate plan.

Another characteristic of savvy billionaires is that they tend to regularly “stress test” their life insurance portfolios to ensure they will perform as designed. Indeed, they would never be considered savvy if they just accepted—without verification—what their advisors provided to them. Usually these stress tests reveal that everything is in good shape and operating as it should—the result of working with elite wealth managers.* Sometimes, however, flaws are uncovered that need to be corrected. Failing to determine and fix the errors can end up costing estates considerable amounts of money.

Example: If insurance isn’t set up properly (using the right types of trusts or partnerships, for example), the proceeds that the policyholder assumes will be tax-free instead may be fully taxed as part of their estate.

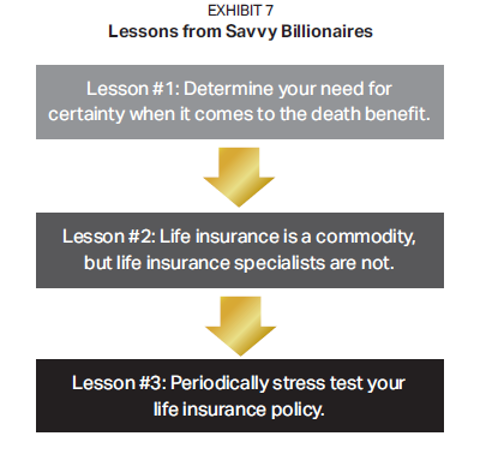

The obvious question is: Why does all this matter if I’m not a billionaire? Glad you asked! The way that savvy billionaires and their elite advisors use life insurance is often very smart. Consequently, there are a number of lessons for the rest of us (see Exhibit 7).

Why do you need life insurance coverage? If you’ll still have an estate tax liability even after using the appropriate legal strategies to mitigate your estate tax liability, you need to ascertain whether life insurance makes sense for you. As noted, there are other ways to deal with the tax, such as your family taking out loans to pay the tax. However, if you are looking for certainty and want what is often the most cost-effective solution, then life insurance may be your best answer.

Bonus: Life insurance has other significant benefits even if you do not have an estate tax issue. For example, many people use life insurance to create wealth for their families with the goal of ensuring their financial security.

The life insurance portfolios of billionaires are very similar. This is because life insurance is a commodity. In principle, any high-end life insurance specialist can access any life insurance company for its array of products. While some life insurance specialists talk about their proprietary offerings, this is…inaccurate (to put it nicely). Again, life insurance is a commodity.

But life insurance specialists are not. There is a broad range of expertise when it comes to the people selling and planning with life insurance. Their expertise and abilities can add value in terms of how life insurance is structured, including how a policy operates within the bigger picture of a broad estate plan. Life insurance specialists’ insights and efforts also become important when assessing the different ways premiums can be paid.

The upshot: You want to work with a high-end life insurance specialist—one who is widely recognized by peers and other professionals as an authority in life insurance and overall wealth planning. Fortunately, they do not work exclusively with multimillionaires and billionaires.

Billionaires strongly adhere to the guiding principle “trust, but verify.” They continually take steps to ensure they are getting (or will be getting) the results they want and paid for. So when it comes to their wealth planning and their life insurance portfolios, billionaires regularly conduct stress tests—meaning they have other professionals systematically evaluate how their plans and their life insurance are performing.

This is good advice for many people with even mildly complex wealth plans. By stress-testing your life insurance policy, you can be confident that it will deliver the results you are looking for. If, on the other hand, it does not stand up to an evaluation, you can take appropriate actions to correct the problems.

If you currently work with a financial advisor you value and trust, consider having a conversation with him or her about the role that life insurance could play in your estate planning. If you already own life insurance, review your current policy with your advisor to ensure it still meets your needs. And get your policy stress-tested to see how it is likely to perform under various scenarios that might play out in the future.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.