Posted on: September 2nd, 2019

If you decide to sell your business, you’ll likely encounter two main types of buyers: financial and strategic.

Each type has its own intentions for wanting to buy your business. When you understand what drives and motivates each type, you can potentially maximize your ability to get the best deal terms based on your objectives—including the price you get for your company.

With that in mind, here’s a look at the world of strategic buyers and financial buyers.

Financial buyers are professional investors who are in the business of buying and selling companies. They are solely interested in getting a financial return by purchasing a company. That return usually comes in two forms:

In short, it’s all about the return on investment. That means you’ll probably find that a financial buyer will be willing to pay more if you can make a compelling case that your company will generate strong and reliable profits for years to come.

Buying and then reselling a company is the most common way for financial buyers to profit, so financial buyers tend to be opportunistic. They generally search for undervalued companies—like most investors, they seek to buy low and sell high down the road. They also seek companies with significant growth potential (based on the industry they’re in, their location or some other growth driver). Usually, but not always, financial buyers have deep knowledge about a particular industry or type of business and concentrate their activity in a single area. Example: A financial buyer might focus exclusively on acquiring retail-oriented companies, or go even deeper by buying only apparel retailers.

Your role: Financial buyers see your business as an investment—not as a hands-on enterprise to run themselves. Therefore, they will likely expect you (and some of your team) to remain active in the business after the sale—so you can keep generating those expected big profits.

Financial buyers commonly inject capital into the businesses they buy—potentially giving you (assuming you remain at the helm) greater opportunities to pursue initiatives aimed at driving stronger growth. They also regularly engage in financial restructuring in order to boost the value of the companies they buy—taking actions such as reducing expenses and using debt to expand the businesses. Financial buyers regularly use a substantial amount of leverage when purchasing companies, which can result in the lenders acting as partners in the purchase. When debt is used, the objective is to use operating profits to pay the interest.

There are generally two distinct types of financial buyers: private equity firms and family offices (see Exhibit 2). The vast majority are private equity firms that tend to be quite knowledgeable and sophisticated when it comes to the many aspects of deal making (including due diligence, valuations, legal expertise about acquisitions, and deal structuring).

That said, family offices are increasingly purchasing (or investing in) privately held companies. Entrepreneurship is how many families with family offices became extremely wealthy in the first place, so buying existing businesses is often seen as a natural way to generate additional wealth. As with private equity firms, most family offices have extensive expertise in doing deals.

In contrast to financial buyers, strategic buyers are typically focused on how acquisitions can complement and enhance their existing business or businesses. For strategic buyers, the logic behind a purchase is:

1 already-owned business + 1 newly acquired business =

the power of 3 businesses

In other words, the value of the combined company is greater than the values of the individual companies operating on their own. This is called synergy.

This additional value can be created in several ways, most commonly including:

Strategic buyers are often larger firms that evaluate a business based on what it could be worth if they were at its wheel making the decisions. As such, strategic buyers will often pay more for a company than will financial buyers, because of the enhanced value they expect to derive from the synergies fueled by the acquisition. For strategic buyers, it is less expensive and faster to acquire an existing company and benefit from the synergies than to build the capabilities from scratch.

There are two main types of synergies:

The more likely the synergies, the more valuable your company will be to the strategic acquirer. The better your ability to identify and make the case for a broad range of synergies, the higher the sale price you’ll likely get.

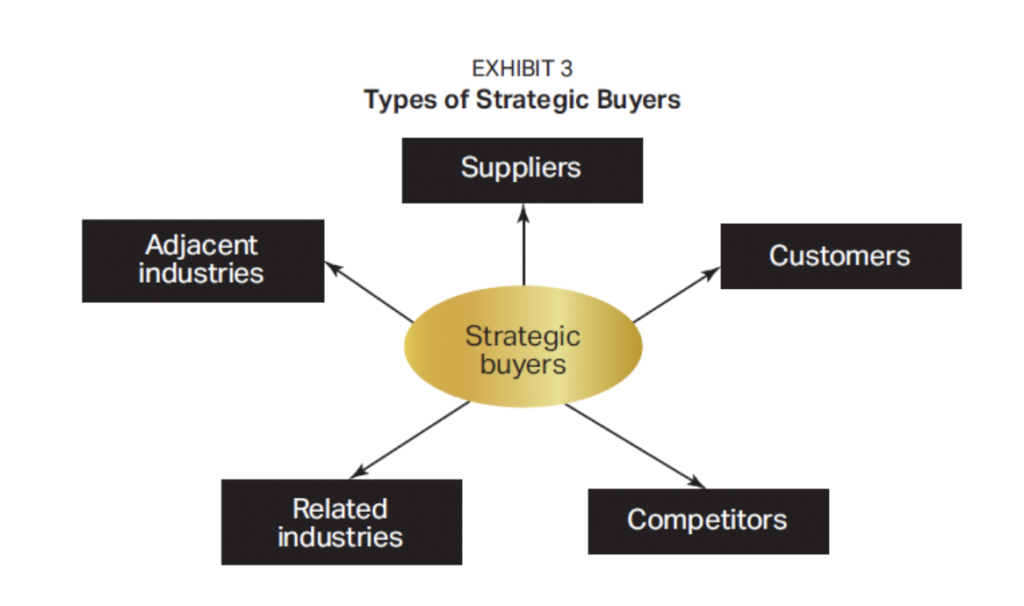

The types of strategic buyers are many and varied (see Exhibit 3). They include:

Which is better—a financial buyer or a strategic buyer? The answer, of course, is that it all depends on your goals and objectives. But here are some guidelines to help you arrive at the right decision for you.

Strongly consider a financial buyer if:

Think twice about a financial buyer if:

Strongly consider a strategic buyer if:

Think twice about a strategic buyer if:

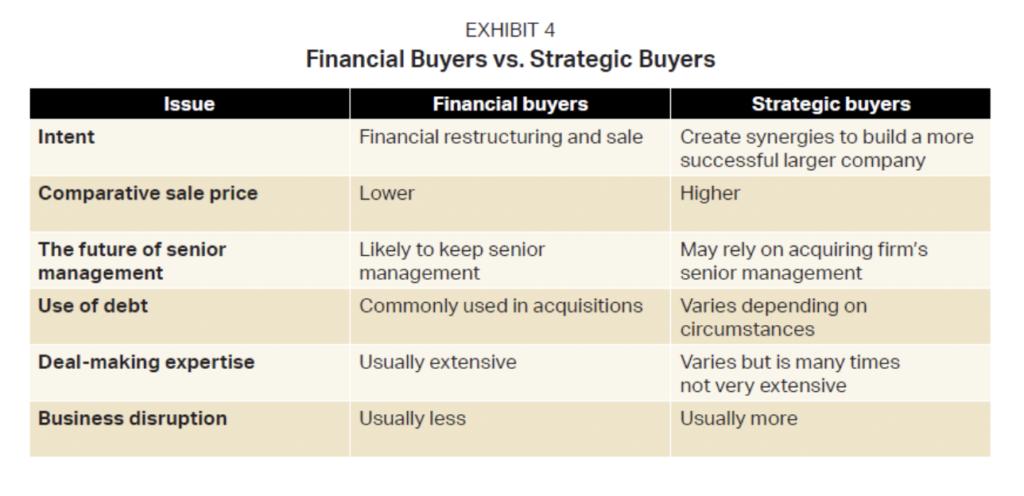

Exhibit 4 summarizes financial and strategic buyers on a number of key issues. By understanding the differences, you may be better able to make a more informed decision that reflects the goals and priorities you have for yourself and your company.

When you sell your company, you’ve got one chance to get it right—there are no do-overs. Thinking ahead about to whom you want to sell can set the stage for much of the rest of the journey—and potentially enable you to get the specific results you care about most.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.