Posted on: July 1st, 2019

Life does not always go smoothly. Whether you’re a billionaire, a pauper or somewhere in between, you (or someone close whom you care about) will likely suffer some type of tragedy at some point in your journey.

From the perspective of your wealth, how you respond to terrible, life-altering events will potentially have a major impact on your bottom line—growing it and protecting it. And as is so often the case, we find that many of the self-made Super Rich—those with a net worth of $500 million or more who earned their wealth through working/entrepreneurship—often have attitudes and strategies that enable them to stay on track through tough times.

Here’s how they do it, and how to take a page from their playbook when life throws its worst at you.

Death, disease and other tragedies do not discriminate based on net worth, and the self-made Super Rich are not immune from the same problems that can hit everyone else. Indeed, significant wealth can even fuel such problems as addiction. So while wealth can be helpful in dealing with personal problems, it doesn’t insulate anyone from those issues.

That said, our direct experience serving the Super Rich reveals that many of them implement tactics in the face of personal tragedies that empower them to remain on track in pursuit of their goals. Some even use the bad experience to motivate themselves toward even bigger goals. (Of course, not all of the Super Rich fall into this camp. Plenty of them do what most of us do when tragedy strikes: We pull back from our daily life to regroup.)

For the most part, the self-made Super Rich are like everyone else in that they feel great pain (emotional, psychological, physical) when tragedy occurs. (Some do not, however—see the sidebar below for their take on negative life experiences.)

Personal tragedies can be severely distracting to the task of wealth creation. Aside from the time and effort that might be required to address the negative event in life, the emotional toll can be tremendous. Still, even though they are feeling pain, the Super Rich tend to take action to further maximize their net worth.

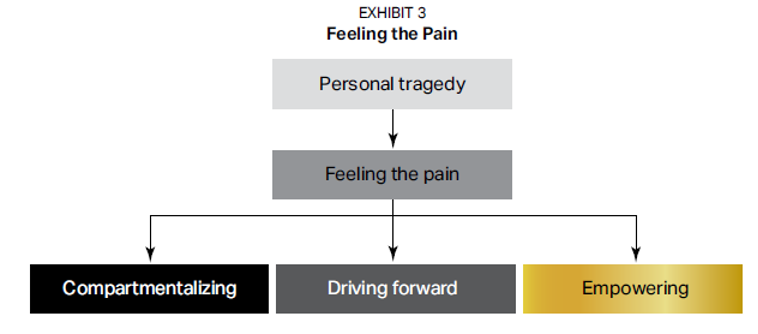

Typically, they do so by adopting one (or more) of three solutions to deal with the circumstances and continue to build their fortunes (see Exhibit 3).

One approach the Super Rich often use is to put the problems producing their pain, along with the pain, in one mental “compartment” and their business and wealth-creating thinking and behaving in another. This is a very potent psychological defense mechanism that enables people to separate the hurt and anxiety from what they need to do in order to continue to make a great deal of money.

In effect, there is a time and a place for dealing with wealth creation and a time and a place for dealing with life concerns—no matter how severe they are. Compartmentalizing often proves to be effective in allowing the Super Rich to maintain their business success.

This is commonly known as the “powering through” method. At some level, the Super Rich are always aware of the tragedy and the pain is always with them. It might be in the forefront of their consciousness only periodically, but it is never very far away. But by sheer force of will, these self-made Super Rich do not stop the endeavors that made them successful.

Often in these cases, the Super Rich are displacing the pain and angst they feel into activities they are familiar with. Staying on track becomes the distraction they need in order to keep going.

Important: Because the personal tragedy and the emotional angst are constantly part of their lives, the self-made Super Rich can potentially trip up or suffer adverse consequences when they push themselves forward. When these scenarios occur, they regularly pull themselves together and drive forward once again. For them, their personal disasters are another obstacle to be surmounted.

For a number of the self-made Super Rich, tragedies actually motivate them to continue chasing their dreams. Their desire to become considerably richer magnifies, as does their determination to get there.

One of the most pronounced examples of empowerment is when the self-made Super Rich seek to create astronomical wealth in order to find solutions to the very problems they are dealing with (or had to deal with)—such as helping fund the search for cancer cures or ways to get people off addictive drugs. They are looking to change the world for the better to help eliminate the cause of their pain.

Some of the Super Rich may even seek out greater wealth as a way to fight back against those they see as having created the tragedy—to get some type of revenge, in effect. One example: If governmental policies are part of the cause, then helping change the political landscape becomes the objective (and doing so can be quite expensive, of course).

Finally, a caveat: It’s not vital that you find ways to keep growing your wealth when tragedy strikes. It’s perfectly acceptable if you prefer to pull back and focus on shoring up your physical, mental and emotional state rather than continue pursuing great success. Some might even argue that’s the healthier decision!

But if you do decide to maintain a money-making focus—whatever the reason may be—the Super Rich can point the way.

| An attitude of indifference We find that a very small subset of the Super Rich simply doesn’t care about personal tragedies in their lives. Often this indifference stems from narcissism and a lack of empathy. If something terrible happens but it’s not about them, or possibly one or two other people they are close to, they don’t really register the event. They have limited empathy for most of the world. An emotional disconnection could also be the culprit. For example, there may be no pain when a person’s sibling gets a terminal illness and dies—if the relationship between the person and his sibling was broken beyond repair. Whatever the underlying psychology, some of the self-made Super Rich are simply apathetic about events that most of the rest of us see as tragic. Obviously, then, these self-made Super Rich are not at all distracted from their quest to amass bigger personal fortunes. |

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.