Posted on: November 1st, 2019

As a successful entrepreneur, you’ve probably engaged in business planning to some extent to help you get your company moving in the right direction. But how confident are you that your planning is set up to deliver the results you expect, want and need?

If you’re even the least bit uncertain, it may be time for a stress test.

Stress testing is a process that carefully examines your business and wealth planning efforts and “puts them through their paces” to determine how the strategies you have in place are likely to hold up in various scenarios. Ultimately, stress testing can help you see if your planning is likely to lead to the outcomes you desire.

We’ve seen stress testing used by the self-made Super Rich (those with a net worth of $500 million or more) for years. But we’re seeing it become increasingly common among less affluent entrepreneurs as well—to assess both personal wealth planning and business strategies (and the interplay between those two areas).

Here’s why you might want to bring stress testing into your business and your life.

For starters, it’s important to realize that stress testing is focused on results. Some entrepreneurs—as well as some legal and financial advisors—mistakenly believe that it’s about the specific financial products or legal tools being used. But while stress testing may uncover opportunities where superior tools and products could be used, its main purpose is to determine whether there is a severe disconnect between what the entrepreneur is aiming to achieve and the results he or she is likely to get using certain strategies and planning approaches.

Also keep in mind that when it comes to stress testing, the human element is a key factor—maybe even the most important factor, in many cases. Thehuman element is the personal and emotional component of wealth planning for you personally or for your business. It includes everything and everyone that is important to you, as well as everything and everyone that could be affected by the wealth planning.

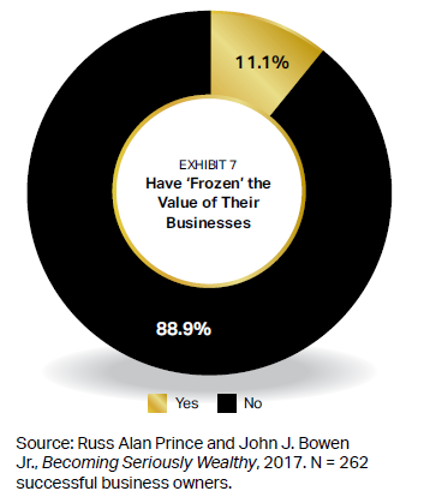

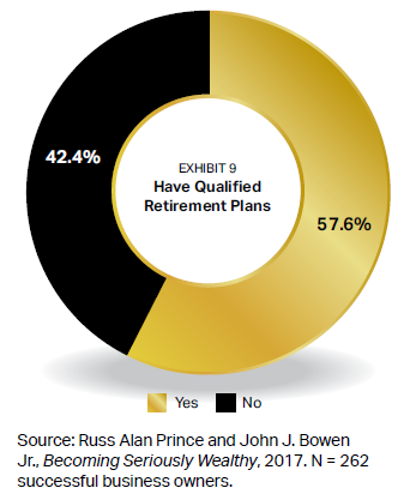

A high-caliber professional who conducts a stress test will focus intensely on those aspects of your life and how well your planning is set up to meet your unique agenda. The specific tools available to these professionals are less important—mainly because high-level tools and expertise have become easier to access. For example, we find that there are now many attorneys who can use certain trusts that freeze the value of a business to mitigate future estate taxes. Likewise, there are quite a few wealth managers who can bring the complete array of qualified retirement plans to a business owner.

For the best professionals, it is not the toolkits they have that differentiate them and allow them to conduct effective stress tests. Instead, we find it’s their skill at identifying the most appropriate tools and strategies for helping you achieve your specific, personal agendas.

Stress testing can be highly focused—addressing, for example, a particular set of wealth planning, such as succession planning. Or it can be much more encompassing, assessing various planning areas and identifying synergies (or overlap).

When it comes to stress testing your wealth planning around yourself and your business, there are a number of areas to evaluate. Our experience tells us that there are three areas that tend to be of great interest to successful entrepreneurs:

Minimizing future estate taxes can be a major component of exit planning. However, only about one in ten successful entrepreneurs has acted to “freeze” the value of the business for this purpose, according to research by AES Nation (see Exhibit 7). Such a move dovetails with estate planning.

If you are considering the sale of your company, skillfully executed stress testing can identify ways to walk away with more wealth from the sale—money that can go to family instead of to the government.

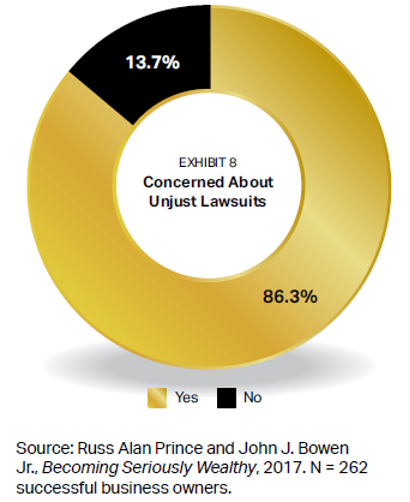

AES Nation research also found that more than 85 percent of successful business owners are concerned about being involved in unjust lawsuits (see Exhibit 8).

The obvious question: What are they doing about it, and are they likely to get the results they are looking for through their actions?

We find that successful business owners often do take steps to protect their wealth, but that they generally don’t cover all the bases. For example, ask yourself:

Another matter to possibly consider is how you are structuring your business interests. For example, some entrepreneurs with multiple companies have ownership in each—when a smarter approach could be to set up a holding company.

Stress testing can help determine whether your wealth is well insulated, taking into account your risk tolerances and concerns.

Nearly three out of five successful business owners have qualified retirement plans, according to AES Nation (see Exhibit 9). For some companies, they are not viable. In some cases, there are certain types of qualified retirement plans that would be very appropriate but were never offered to the business owners.

In stress testing a retirement plan, the first consideration should be the intended outcome or outcomes. Some business owners want to use a retirement plan as a way to help attract and retain top talent. Others are looking to lower taxes.

It is then possible to examine how likely an existing plan is to achieve that goal—or to identify various plans that match up especially well with the intended outcomes.

Depending on circumstances, stress testing can be expensive. Even if the costs are minimal, a stress test requires time and effort on your part. So should you stress test at all?

Consider these questions to help you determine your next move:

If you’re not sure of the answers—or if you know it’s been years since you last looked at these issues—it may be time to stress test. Stress testing often uncovers that wealth planning done some time ago, which was ideal at that time, has become imperfect as a company has grown. In other words, business success has created holes in the existing business planning. What’s more, entrepreneurs’ goals and needs change over time, and stress tests that focus on the human element noted above can spot where existing planning is no longer in sync with current agendas.

Some other questions to consider:

We find that many accomplished entrepreneurs turn to stress testing to make sure they are not missing opportunities. It is not about correcting mistakes as much as it is about taking full advantage of planning that reflects the current environment and state-of-the-art options.

The upshot: It’s probably worth considering stress testing for at least some key areas of your business. Whether it is a question of plans being up to date or making sure all available financial and legal options are considered, stress testing aims to give you the clarity you need to move forward with purpose and confidence.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.