Posted on: August 19th, 2022

Where there is a desire to pass the baton that is the family business from one generation to the next, succession planning is usually essential. The absence of a solid succession plan can potentially result in family differences and financial complications that may bring down the family enterprise—as well as inflict considerable damage on the wealth of the family members.

We have seen, more than once, how poor succession planning can lead to conflicts that literally destroy a family. These confrontations commonly binge-eat resources, draining family wealth. Moreover, they tend to cause irreparable harm to family relationships.

Keep in mind that often it’s one thing to craft and put into place a well-designed succession plan and quite another thing to ensure that the plan endures and is adhered to as expected. While legal structures such as trusts can guarantee the desired transfer of ownership of the family business between generations, they alone cannot guarantee that family members won’t fight over the company and who is at its helm.

Example: A disgruntled family member can always file a lawsuit. Even if that lawsuit does not prevail, the problems it can cause the family may be considered.

The upshot: Truly effective succession planning results not only in a technically successful transfer of the family business between family members but also in the mitigation or even the elimination of family dissent due to the transfer. This is the type of planning you should be thinking about if you own a family-run business!

It can be especially useful for a family to think of succession planning more as an ongoing process than as a one-time event. When succession planning is inculcated in a family’s thinking, the probability of the transfer going well can increase dramatically. For example, by making succession planning a regular and recurring topic on the family agenda—at family meetings, say—it’s likely that many potential complications will get worked out before they come to a head and before the actual ownership transfer.

There are a number of components we see in a well-designed succession plan. Often, the starting point of a such a plan is deciding on the future of the family business. Some of the questions family members usually need to answer include:

If the decision is to keep the company in the family, then a well-designed succession plan is needed.

The best succession plans we see are flexible. If a succession plan is not adaptable to changing conditions, unforeseen events can prove ruinous. At the same time, a well- designed succession plan has clear objectives and targets. What will happen and how it will happen are clearly delineated. Therefore, the roles and responsibilities of family members— those who will inherit the company and those who will not—are spelled out in detail.

The goals of any succession plan need to be clearly communicated to all impacted family members. This best happens personally between family members. Explaining the logic in family meetings, for instance, often proves useful if family members can voice their concerns.

At the same time, it can be beneficial if the succession plan—at least the big picture—is shared with any senior nonfamily executives at the family business. Doing so tends to help the family deal with the possibility of losing talented personnel who are largely responsible for the company’s success.

Not surprisingly, most well-designed succession plans aim to also foster family harmony. Transparency can be instrumental in avoiding serious family confrontations down the line. And by involving inheritors in the future of the family business as opposed to responding to decrees from the senior generation, there usually are fewer bad feelings (and the often accompanying lawsuits). When family members understand and accept how the family business will transition, it’s more likely serious problems can be avoided.

Important: It is impossible to guarantee all major disagreements between family members

will be avoided. Different personalities can easily lead to disagreements that cascade into major altercations. Therefore, it’s useful to have a methodology in place to resolve disputes as the succession plan is formalized. Family business mediation can be quite effective, for example. This approach can help ensure that all the relevant family members have a say and can be heard. Given time, it is a way to get consensus and sidestep potentially awful confrontations.

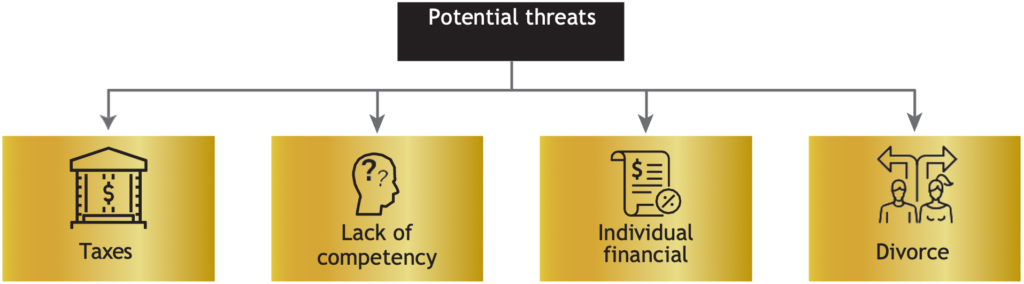

A well-designed succession plan will also ensure that potential threats to the family business are mitigated. Such threats can include the following (see Exhibit 1):

EXHIBIT 1

Potential Threats to a Family Business

Codifying the succession plan

A key step is to codify the succession plan, which usually involves putting everything down on paper. Having everything set out and made part of the legal documents makes it much harder for unhappy family members to contest the transition and related decisions.

Additionally, codifying a well-designed succession plan is valuable because it gives all family members and other involved parties a formal record of what was agreed to. (It’s also a wise move is to regularly review and update the documents.)

There are two types of documents in this process—collective documents and personal documents (see Exhibit 2).

EXHIBIT 2

Types of Documents

Without a well-designed family business succession plan, there is a strong possibility that a family enterprise might not survive the transfer between the senior generation and the inheritors. If you own and run a family business, it’s worth it to take the time and effort not just to create a plan but also make it one that really addresses the myriad key issues that need to be confronted.

Do it right, following the advice outlined above, and you will likely dramatically boost the probability that the transition of the family business will be very successful. You’ll also likely dramatically reduce the types of family conflicts that can hobble or destroy a successful family business.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.