Posted on: August 1st, 2019

If you’re like many investors with significant assets, you may feel you’re in a kind of tug-of-war between two goals:

The good news: There’s a philanthropic tool that can help you strike the balance you want between those two objectives. It’s called a charitable lead trust, or CLT, and it can enable you to have a major impact on both your family and your favorite causes.

Here’s an overview that spells out the ABCs of CLTs—and how to decide whether this powerful approach to charitable planning may be a good option for you.

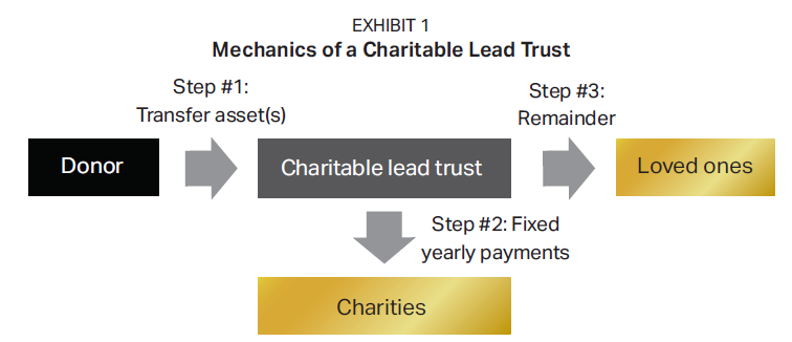

The basic mechanics of a charitable lead trust are well-established (see Exhibit 1).

Step #1: Establish a charitable lead trust and fund it. You can establish a charitable lead trust while alive or through your estate plan. To fund it, you contribute assets—such as cash or appreciated securities—to the trust, which invests and manages those assets.

Step #2: The trust sends payments to one or more charities. The trust provides an annual income payment to a chosen charity (or charities, as the case may be). These charitable payments can go on for a fixed number of years, for the life span of an individual or a combination of the two. In addition, the trust can be structured to allow you to replace the chosen charity with another during the term.

Step #3: The remaining assets are distributed to you or your loved ones. At the end of the charitable term, the remaining assets are distributed to your loved ones (typically those who are of your same generation or one generation down, in order to avoid the generation-skipping tax). Ideally, the trust assets have grown over time—leaving a nice amount of wealth left over.

Voila! You’ve helped fund a favorite cause and also taken care of your heirs.

Because the government wants to encourage charitable giving, it has attached some serious tax benefits to CLTs. For example:

Warning: Charitable lead trusts are irrevocable. That means once you put assets into one, you cannot change your mind later and pull them out. The upshot: Don’t even think about creating and funding a CLT unless you’re sure you want some of your wealth to go to one or more charities!

You can use a wide variety of assets to fund a CLT. Some examples include:

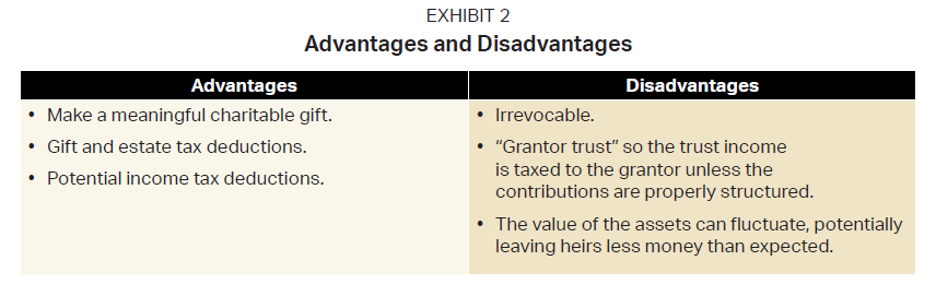

As with all wealth planning strategies, a charitable lead trust has advantages and disadvantages (see Exhibit 2).

To see how CLTs can work for some types of investors, consider these case studies:[1]

A corporate executive in his late 50s will generate $2 million of income this year, due to the exercise of vested options. In the long run, the executive wants to benefit his wife and children. But he also has consistently been giving to several charities for years, and he is interested in establishing some type of planned giving strategy.

The executive and his advisors devise a 20-year-term charitable lead trust with zero gift tax due. The executive, who is highly liquid, places $2 million of cash into the CLT. The trust will distribute an annuity among the charities selected by the trustee, with the annuity increasing 20 percent annually.

This results in a relatively small distribution (approximately $17,000) in the early years, which will allow for more of the assets in the CLT to grow tax-deferred. The executive will receive an upfront $2 million charitable deduction, which will help offset the income recognition. The 20 annuity payments to charities will add up to approximately $3.2 million (with the final payment of about $553,000). Assuming that the charitable lead trust assets grow at an annualized rate of 6 percent, the remainder left over after 20 years to benefit his spouse and children will be approximately $2.1 million.

A real estate investor in his late 40s wants to donate annually to his alma mater. Working with his advisors and the school, he establishes a charitable lead trust with a 20-year term and places $1 million of real estate with high growth potential and a strong rental stream into the trust.

The charitable lead trust is structured so zero gift tax is due and so the annuity increases 20 percent every year. At the end of the 20-year term, the real estate investor would like to benefit his younger niece and nephew who work with him in the business.

The real estate investor will receive an upfront $1 million charitable deduction that will help offset his income. The 20 annuity payments to the school will add up to approximately $1.6 million. Assuming the real estate in the charitable lead trust grows 7 percent per year, the remainder to his niece and nephew will be worth approximately $1.6 million. To the extent the real estate throws off depreciation and other deductions, the real estate investor will still be able to use the CLT deductions on his personal 1040.

A business owner in her 30s sold a number of shares of her company after an initial public offering, and she expects a significant upside on her remaining shares. She speaks with her wealth manager about a way to minimize her tax bill this year.

Her wealth manager discovers that the business owner has been consistently donating to a number of nonprofits based in her hometown that empower inner-city youth. The business owner decides to use $5 million of cash to fund a 15-year term charitable lead trust, which will provide an annuity (increasing 20 percent every year) to the nonprofits. The remainder assets will then revert back to her.

The charitable lead trust produces zero gift tax. She will receive an upfront $5 million charitable deduction. The 15 annuity payments to the nonprofits will add up to approximately $7 million. Assuming the assets grow at 8 percent per year, the remainder to the entrepreneur will be $5.9 million.

Clearly, charitable lead trusts can be extremely useful and powerful wealth planning tools if you’re philanthropically minded and have significant assets. They can allow you to have a major impact on a charity you value—potentially a much bigger impact than you could have otherwise—while also benefiting your bottom line significantly in the form of lower taxes and enabling you to help heirs financially.

If you are considering making charitable giving part of your wealth plan, you’ll want to talk with the financial professionals you work with to determine the best vehicle and strategy for your situation. You also should consider discussing your goals with your family.

Best bet: Make sure your advisor is a professional with expertise in the areas of charitable giving and philanthropic wealth planning—or that he or she has access to such a professional via a network of experts.

Contact your financial professional to discuss your charitable goals and how you might position your wealth to best pursue them.

[1] Disclosure: Examples are calculated with an IRS required interest rate, under Internal Revenue Code Section 7520, of 3.20 percent and are zeroed out to avoid use of gift tax exemption.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.