Posted on: April 2nd, 2020

We find that, by and large, people seeking financial advice know to look for a financial advisor who has high levels of integrity and who wants to do what is in their clients’ best interest at all times.

But it seems that fewer people pay attention to the orientation of their financial advisor candidates. As a result, they may risk choosing an advisor who isn’t a great fit.

Here’s a look at four different types of advisors you are likely to encounter and how they stack up against each other in some key areas.

Armed with this information, you should be able to better assess which type is best suited for you based on factors such as your goals, the complexity of your financial situation and your net worth.

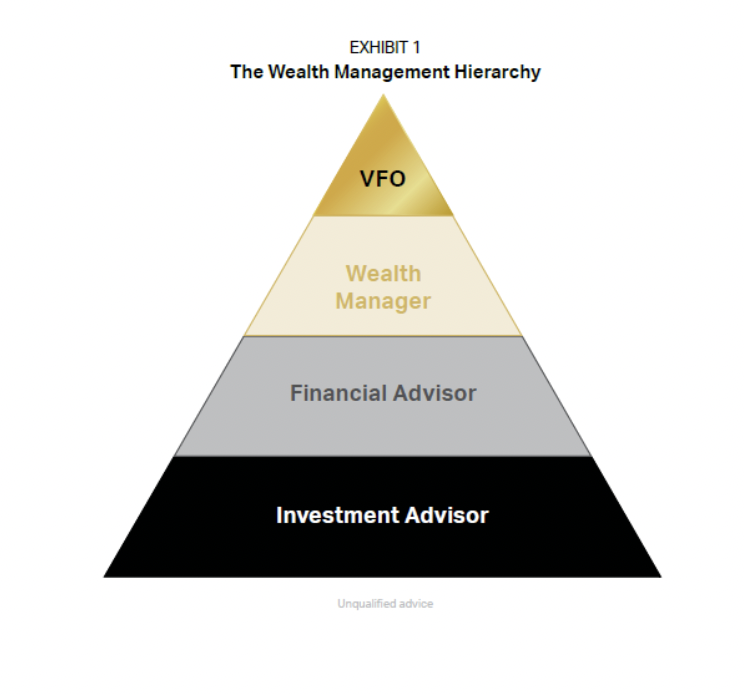

The wealth management hierarchy illustrates the range, depth and breadth of the financial solutions you can get from different types of advisors (see Exhibit 1).

Generally speaking, the affluent—be they inheritors, executives or entrepreneurs—want to address an array of family, financial and lifestyle concerns. The defining characteristics of these individuals are the multifaceted complexity of their lives and their desire to deal effectively with this complexity.

The upshot: The more complex your life, the more likely you’re going to want to use an exceptional financial professional who is pretty high up in the wealth management hierarchy.

That said, let’s examine each group.

A good way to think about the wealth management hierarchy is that it’s progressive or additive. We start with the base. Investment advisors are excellent financial professionals who do a very good job managing money—but that’s all they do.

While investment advisors provide a single solution—money management—that one solution can have multiple variations (from securities to investments in private companies, real estate, artwork and so forth).

If all you want is someone who manages your money well—positions your investment capital, reallocates it as needed and so on—you can stop at this level. If you want or need expertise beyond money management, you’ll need to move up the wealth management hierarchy.

When you move to the next level of the wealth management hierarchy, more types of expertise are available to you. Like investment advisors, financial advisors are primarily focused on delivering money management services and products. However, they also provide some wealth planning services.

The wealth planning capabilities of financial advisors tend to be relatively basic and fall within a fairly narrow range of expertise. This typically makes them appropriate for individuals and families with lower levels of complexity in their financial lives. Again, if your financial situation is not complicated, an expert financial advisor may be what you need to pursue the types of outcomes you want.

If you work with a wealth manager, you can also get excellent money management services along with planning services. However, the level of services you will receive will be elevated because wealth managers and their teams can address truly complex situations requiring multiple specialties.

The biggest difference we see between financial advisors and wealth managers is that the latter can typically deliver a more extensive and in-depth range of wealth planning expertise. That expertise might include income tax planning, cross-border planning and financial life management planning.

Wealth managers also tend to offer greater coordination of solutions to address their clients’ financial issues and concerns. For example, a client’s tax-mitigation plan might be informed by her charitable giving strategy along with her eventual wealth transfer desires. As a result, none of the strategies work against or conflict with the others.

Working with a wealth manager will indeed get you most of the best solutions aimed at helping enable you to achieve a well-structured financial world.

The pinnacle of the wealth management hierarchy is the high-performing virtual family office, or VFO. A VFO incorporates exceptional wealth management with robust attentiveness to administrative and lifestyle matters. High-performing virtual family offices are also able to deal with the important one-off special projects that might arise.

By providing extensive and coordinated solutions that address clients’ financial situation and many aspects of their family’s well-being, a VFO can build and protect personal wealth while also making clients’ daily lives much easier.

Not surprisingly, a high-performing virtual family office is not the right choice for everyone—especially if your needs and challenges are not sufficiently complex. But if you need a level of support and capabilities that goes beyond the other three categories, a VFO could be a good fit.

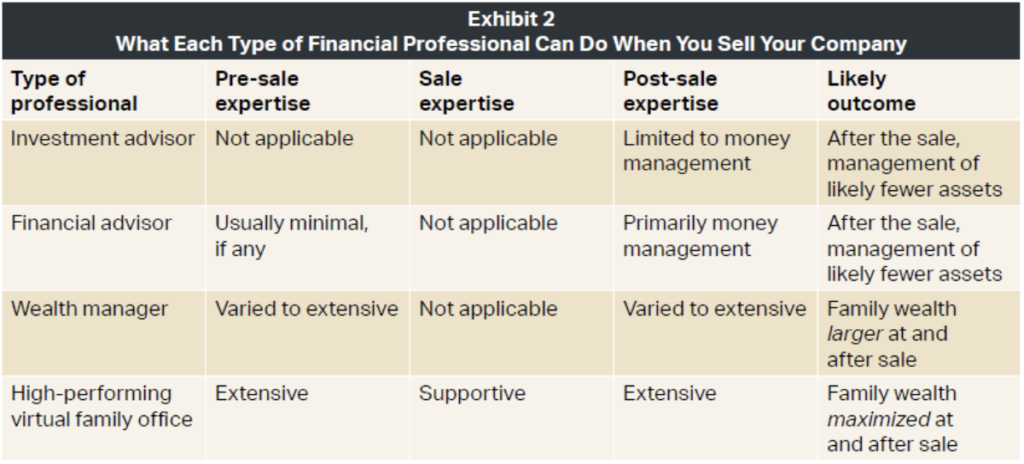

To see how each category measures up, consider the needs of a successful entrepreneur seeking to sell his or her company. The sale of a business can result in substantial liquid wealth—but just how much a business owner ends up with can depend to a great degree on the expertise received throughout the sale process (see Exhibit 2).

Keep in mind that benefits accumulate as you go up each level in the wealth management hierarchy. You continue enjoying the advantages of the previous level and gain many more. For most entrepreneurs selling their companies, a high-performing virtual family office will likely maximize family wealth at and after the sale.

The “perfect” financial professional for you and your family depends both on your situation and the level of expertise you need to address your needs, goals, concerns and wants. If you need help only with investments, an investment advisor may be a great fit. If, however, you are facing complexities regarding a range of non investment financial issues, then another type of advisor may be necessary.

So keep this hierarchy of wealth management in mind as you meet and assess potential advisors. It could help guide you to the right advisor for you.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.