Posted on: October 1st, 2018

As a successful entrepreneur, you and the key people around you make the business decisions that drive your company—hopefully in an upward direction!

However, some decisions don’t turn out well, which can result in lawsuits that may be costly, both financially and emotionally.

The good news: There are many ways to protect yourself.

One of the more cost-effective approaches for many entrepreneurs is to have Directors and Officers (or D&O) insurance. Here’s a look at this powerful type of insurance—and how it might help safeguard you and your most important business and personal assets.

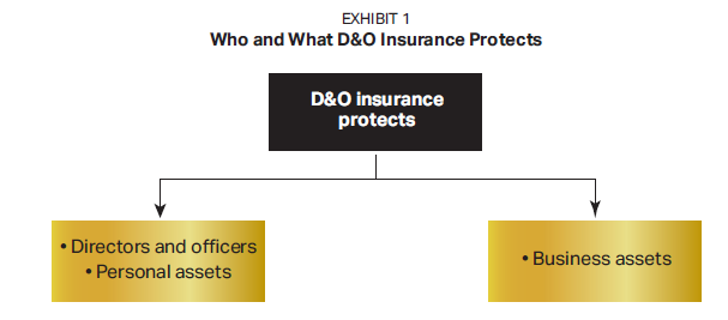

D&O insurance is liability coverage for company executives and board members, meant mainly to protect them from claims that result from their actions in running the business. It can also reimburse the company if it has to pay out claims in order to protect the directors and officers (see Exhibit 1).

The appeal of D&O insurance coverage is clear: Company directors and officers are human beings who can, and do, make mistakes. When that happens, they might be personally liable for any adverse consequences because of those errors in judgment. Considering that many businesses are operating in increasingly complicated environments, that compliance is a bigger concern now than in the past and that plaintiffs are more aggressive than ever, the probability of companies being sued because of the actions of their executives is high.

Indeed, more than 200 class action securities suits were filed last year—the highest number since 2006.[1]

A few of the reasons directors and officers might be sued include:

Example: A company’s directors misrepresent the firm’s financial status in order to win a big contract. The customer later sues when it’s discovered the company lacks the assets needed to meet the contract’s requirements.

Such mistakes don’t always result from reckless behavior, either. Even when company directors and officers are diligent and thoughtful, they can still make decisions that generate problems for the company or others—problems for which they can be held responsible.

D&O insurance provides financial protection for the supposed “wrongful acts” of directors and officers of a company. Therefore, D&O insurance can help provide a certain degree of confidence and financial security for executives—empowering them to make business decisions without the proverbial “Sword of Damocles” (i.e., financial ruin) hanging over them.

D&O insurance also helps avoid costly, time-consuming and emotionally draining lawsuits, which, as noted, are not exactly uncommon these days. And in the event of a lawsuit, the insurance can enable executives to settle many claims quickly and discreetly.

Often, D&O insurance is used to augment and enhance the indemnification provisions in a firm’s articles of incorporation or bylaws that hold harmless directors and officers for losses due to their decisions.

Mistake to avoid: Many businesses never bother to get D&O coverage because they assume—mistakenly—that they’re protected by their other insurance (such as an umbrella policy). However, other policies generally don’t address management errors.

Warning: Don’t assume you don’t need D&O insurance if your company is private and/or relatively small. All businesses face the risk of lawsuits against their directors and officers—and a small business lacking a large war chest of cash might need D&O protection as much as the biggest business in town.

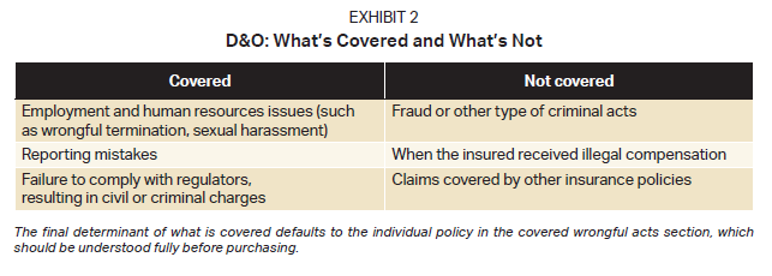

There are specific company-based risks that D&O insurance is most often meant to address. One major area is employment and human resources issues, including sexual harassment and wrongful termination claims.

That said, D&O insurance isn’t a shield for any and every action taken by company brass. There are limits to the protections it offers, as summarized in Exhibit 2. Essentially, bad actions that are intentional (i.e., illegal) or already covered by other insurance policies are not covered by D&O insurance.

Important: With D&O insurance policies, claims are covered only if they’re made when the policy is in force (i.e., the policy is currently in effect) or within a stipulated extended reporting period. What’s more, some D&O insurance policies will have a retroactive coverage period, meaning that claims will be paid for wrongful acts committed before the policy was obtained.

Bonus: D&O insurance doesn’t just provide protection. It can also help attract and retain the high-quality talent you may need to maximize your success. Top execs and professionals are often wary of joining a firm if their assets won’t be safe from lawsuits.

D&O policies can differ from each other, with each having its own specific terms and details. That said, many D&O policies tend to offer three main types of protection for directors, officers and companies:

Selecting D&O insurance can be somewhat tricky. For starters, there’s no foolproof method or rule of thumb for getting the exact “right” amount of coverage.

Example: Business owners commonly look at the average or mean amount of settlement payouts in their industry or geographic area, and choose that amount of coverage. Trouble is, many D&O lawsuit cases are sealed, so the average reported payout may not reflect the actual payouts that aren’t widely known.

That said, it can certainly make sense to factor in considerations such as:

It is often wise for accomplished business owners to think holistically about safeguarding assets and the role of D&O insurance in a broader asset protection plan. Other components of the asset protection plan might include:

The objective for entrepreneurs is to smartly manage some of the risks they are taking and to be prepared to deal with certain adverse scenarios when they arise.

If you haven’t already, consider whether D&O insurance would help you reduce a key business risk—and how D&O coverage might work in concert with other financial strategies you may be using to safeguard assets and build wealth. That said, even if you already have D&O insurance, it may be smart to assess your current coverage and terms to ensure your policy offers the protection you need. That’s especially true if your business, or the industry it operates in, has experienced significant changes in recent years.

If you think you and your business could potentially benefit from revisiting and “stress testing” your D&O insurance coverage, contact your legal or financial professional to explore the topic further.

[1] Stanford Securities Litigation Analytics, Stanford Law School

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.