Posted on: June 1st, 2020

When making decisions about your money, it can be smart to know the steps that extremely affluent individuals and families take to grow and protect their significant wealth.

Take stress testing, for example. Stress testing is a process that carefully examines your current wealth planning strategies to assess the likelihood that they’ll deliver the results you expect them to in various environments and situations.

The Super Rich (people with a net worth of $500 million or more) often have stress tests conducted because the tests enable them to make smart decisions, to verify that they likely will get what they want and to confirm they are dealing with the right professionals. They also can be effective at identifying potential big problems—or possible huge mistakes—and make changes proactively to get the desired results.

The good news: You don’t have to be outrageously wealthy to benefit from a stress test. In fact, we believe it should be part of most people’s due process when vetting financial plans, products and services. In addition to identifying potential missteps in an existing plan or service, it may be able to deliver some peace of mind to the client when the test confirms that a plan is indeed on track.

A stress test often follows a defined process involving four main steps:

Because of the power of stress testing, leading professionals are increasingly making it a cornerstone of the way they work with individuals and families. Consider that a sizable majority—76.8 percent—of 181 senior executives at multifamily offices (organizations that serve wealthy families) call stress tests an important deliverable for their clients, according to research by the Family Office Association.

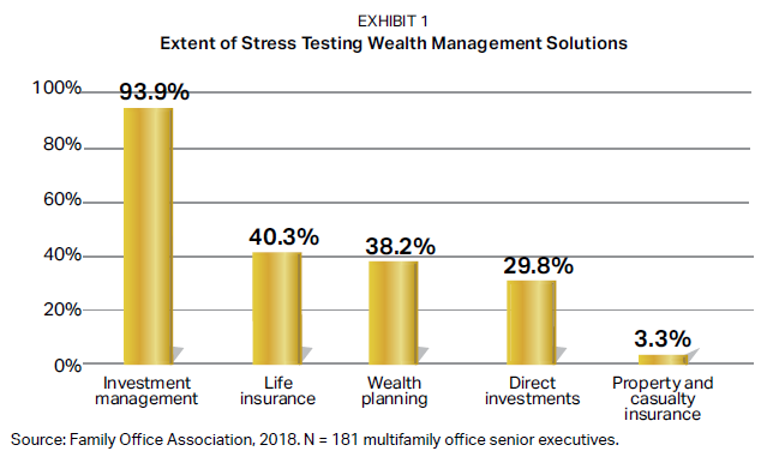

By and large, those stress tests are focused primarily on investment management solutions, with other areas getting attention to varying degrees (see Exhibit 1).

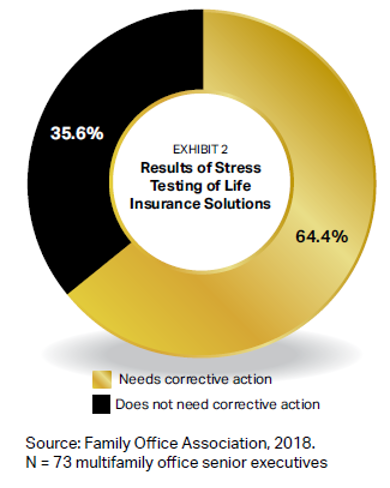

In our view, this intensive focus on investment management may be too limiting. For example, while just around 40 percent of the executives have stress tested clients’ life insurance, a full 64.4 percent of those execs uncovered problems that required corrective actions (see Exhibit 2).

This doesn’t surprise us. Many affluent families purchase life insurance to address estate tax concerns. Sometimes, life insurance is obtained to create a larger estate or to make a charitable gift at death. Other times, the intent is to benefit from the tax-free internal buildup. But it’s common that some of these affluent families end up with amounts of life insurance that exceed their wants and needs. Additionally, their life insurance may be poorly structured. When life insurance portfolios are not in sync with wealth planning strategies, trouble can occur down the road.

This suggests that stress tests should be widely applied to other areas of clients’ financial lives.

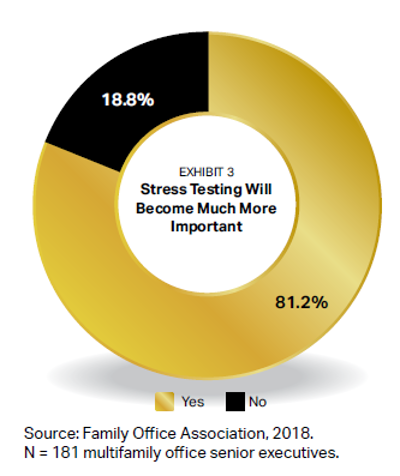

It’s reasonable to expect stress testing to garner more interest and attention among clients and their advisors, as evidenced by the fact that more than 80 percent of the executives said these tests will become more important going forward (see Exhibit 3).

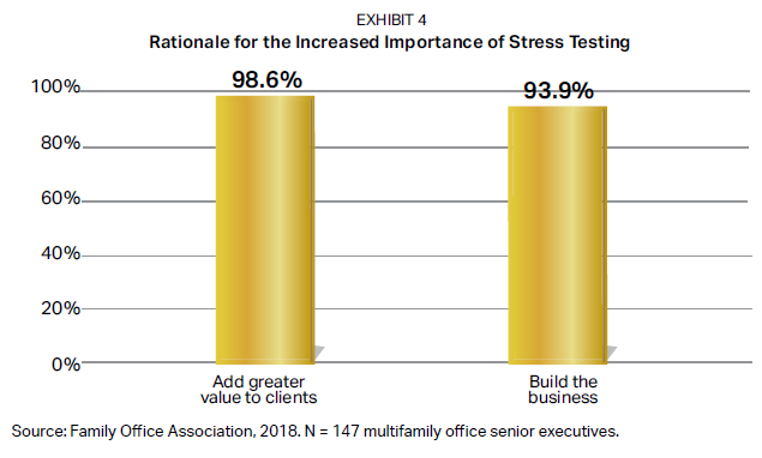

Why this prediction by the senior executives? They see stress testing as a way to provide greater value to their clients and to build their businesses (see Exhibit 4). This makes sense: Adding significant value to the lives of clients regularly translates into more business.

Consider one way that stress testing can add value: evaluating income tax mitigation strategies. While there are a number of legitimate ways to lower corporate and personal incomes (and thereby pay less in taxes), some of what is being promoted is either right on the edge of legality or clearly over the edge. Some of the more questionable strategies have monikers like “income fading” and “revolving wealth transfer trusts.” Therefore, a large percentage of the wealthy are looking to stress test these strategies in order to ensure they are not running afoul of revenue services in any way with their approaches.

Stress testing, once a feature available mainly to the wealthiest among us, is increasingly being offered to a broader range of individuals and families. As a result, you may have an opportunity to put your financial and legal strategies and plans through their paces and determine if they’re set up to deliver the results you want.

Next step: Reach out to your financial and/or legal professional to see if a stress test would be a good idea.

Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.