Posted on: December 2nd, 2019

Effective wealth management should be an important aspect of all stages of your career. That’s because wealth management is designed to coordinate a broad range of components of your financial life over time—from investments to estate planning, asset protection planning and charitable giving—around your needs and wants. It’s also designed to coordinate a team of experts to help deliver the financial outcomes you seek.

That said, wealth management may be at its most powerful and beneficial when it comes time to sell your business. One reason is that the sale of your company is likely to be the biggest financial transaction of your entire life. As such, it will likely impact nearly all of your post-sale options and decisions.

Consider the role wealth management can play going into a sale. Advanced wealth planning in areas such as taxes and wealth transfer can potentially enable you to create a situation in which you walk away from a sale with more money in your wallet for you and your family.

For example: Prior to a sale, a high-quality wealth manager may be able to stress-test the legal and financial strategies you’ve implemented thus far—in order to assess whether your planning has been effective and is likely to enable you to achieve your goals. Stress testing often reveals opportunities to refine and improve upon existing strategies and actions—which can result in better, more profitable outcomes.

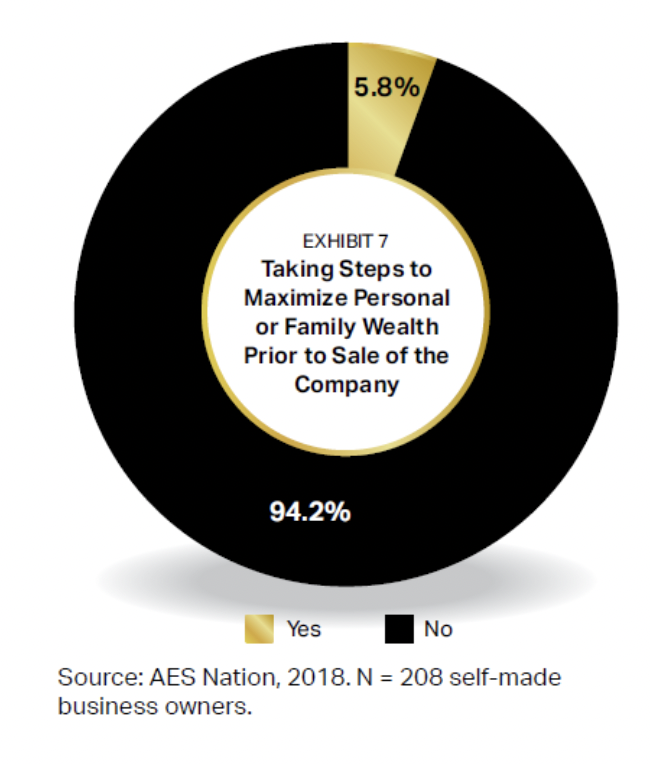

Unfortunately, we see that most business owners are not paying much attention to pre-sale wealth management opportunities. In an AES Nation survey of 208 successful business owners looking to sell their companies within the next five years, only about 6 percent of them are presently taking steps to maximize personal or family wealth (see Exhibit 7).

The AES Nation research also shows that many entrepreneurs are missing wealth management opportunities post-sale.

For lots of entrepreneurs, creating a successful company is a lifetime endeavor. As a business becomes more successful, it often creates enough corporate wealth for the owner to start to amass significant personal wealth. In this type of situation, a business owner tends to find and work with financial advisors and other professionals to help find and implement the most appropriate wealth management strategies.

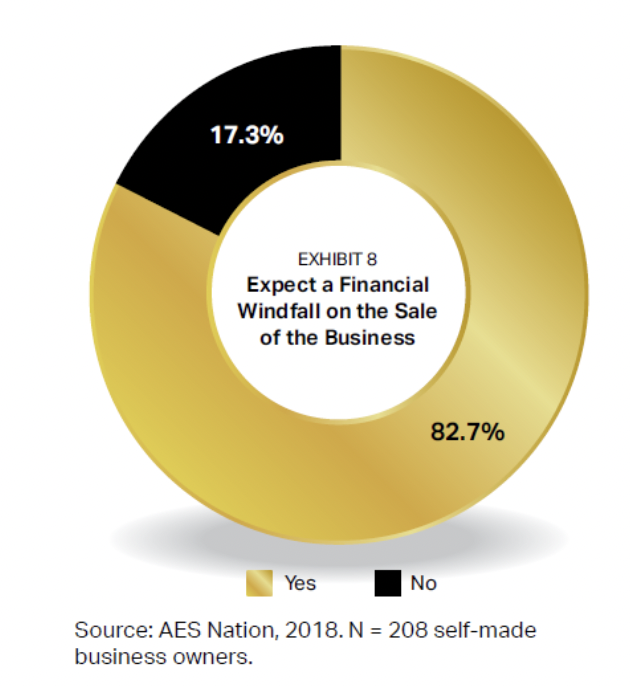

The great majority of business owners expect a financial windfall with the sale of their companies, according to the survey (see Exhibit 8). They anticipate selling for a good price and turning “tied-up” non-financial wealth into liquid financial wealth.

Some important issues to consider once that expected windfall becomes real include how the assets will be invested and managed as well as advanced wealth planning concerns.

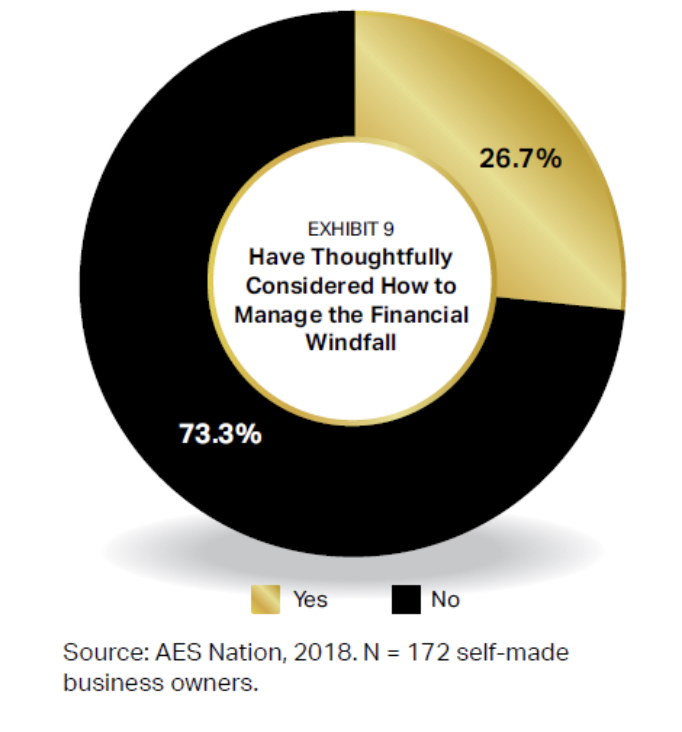

Investment decisions about the money from a sale are often overlooked because entrepreneurs are focused so intensely on getting the transaction done. Less than a fifth of the entrepreneurs who expect a windfall have thoughtfully considered how to manage it, according to the survey (see Exhibit 9).

A huge influx of liquid wealth can be problematic. If not handled knowledgeably, there is the possibility of serious problems, such as:

There are different philosophies, approaches and methodologies to managing money, and many factors need to be considered to find the appropriate approach—what you seek to accomplish with your wealth, your comfort with various types of financial risk and so on. It’s vital you have confidence that the way your money is being managed will achieve the results you are looking for.

Estate, asset protection and charitable planning are all specialties under the umbrella of wealth planning. Working with professionals who can look at your aims and situation holistically can potentially help you with wealth planning and get you synergistic results.

Bonus: There are ways of combining investment management and wealth planning to mitigate (and in some cases eliminate) the taxes on investment portfolios. Some former business owners who have more than $5 million in investable assets should explore these combinations.

If you want to maximize your personal wealth from the sale of your business, it can be an excellent idea to do some careful planning going into the transaction and once you’ve converted your years of hard work to liquid financial assets.

Given the amount of money and the complexities involved, you will likely need to work with top-of-the-line wealth managers and other professionals. They will be in a position to help you review any existing plans for effectiveness and to put together various strategies that make good sense given your unique situation and are aimed at delivering the outcomes you most want.

Contact your financial professional to discuss your financial needs before and after you sell your company.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.