Posted on: August 1st, 2017

As a successful entrepreneur, your biggest professional challenge in attaining at least $20 million in assets outside of your business—what we call serious wealth—is probably that you are busy focusing your time and energy on building your company. You simply don’t have much bandwidth left over to pay attention to the personal side of your balance sheet.

That’s okay. Your time should be spent on making your business great instead of trying to handle all the complex components of personal wealth maximization.

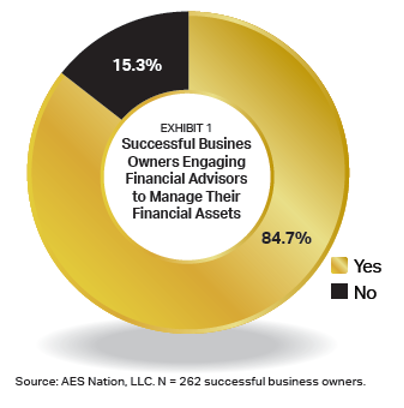

Of course, you understand this: The vast majority of successful business owners—85 percent—make a point to delegate the management of their financial assets to professionals (see Exhibit 1).

For most of you, it’s absolutely the right move to rely on financial advisors—for two main reasons:

Trouble is, far too many of you are not getting the quality of advice that you need to attain the level of serious wealth you seek.

The reason: Most financial advisors and other professionals (accountants, attorneys, bankers and others) that serve business owners simply are not familiar with many of the advanced wealth-building and wealth-protecting solutions used by the Super Rich—people with a net worth of $500 million or more—and ultrawealthy business owners to achieve tremendous personal financial success.

In short, most financial advisors—maybe even the ones you work with—are Pretenders: Advisors who don’t serve their clients well due to a lack of knowledge and ability to implement. The great majority have good intentions but severely limited expertise.

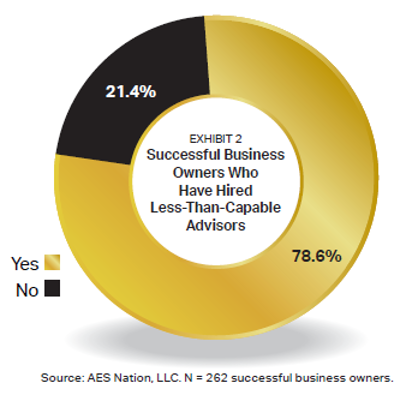

And according to successful business owners like you, there are a lot of Pretenders out there (see Exhibit 2).

IMPORTANT: We can already hear many of you coming to the defense of your financial advisors, with whom you may have worked closely for many years. So let’s be clear: Most financial advisors who work with successful people are intelligent, hardworking and well-meaning. Advisors who are Pretenders are not bad people. They want to do what is best for their clients.

But from an objective vantage point, many financial advisors are just not capable. Their earnest hard work doesn’t change the fact that a large percentage of them probably are not able to provide you with the high-level, sophisticated tools, strategies and products that are almost always necessary to becoming seriously wealthy. Their efforts and level of expertise are just not up to the standards of those professionals who can help successful business owners maximize their personal wealth to become seriously wealthy.

UPSHOT: You are most likely going to be seriously shortchanged by Pretenders due to their inability to help you become seriously wealthy using Super Rich strategies.

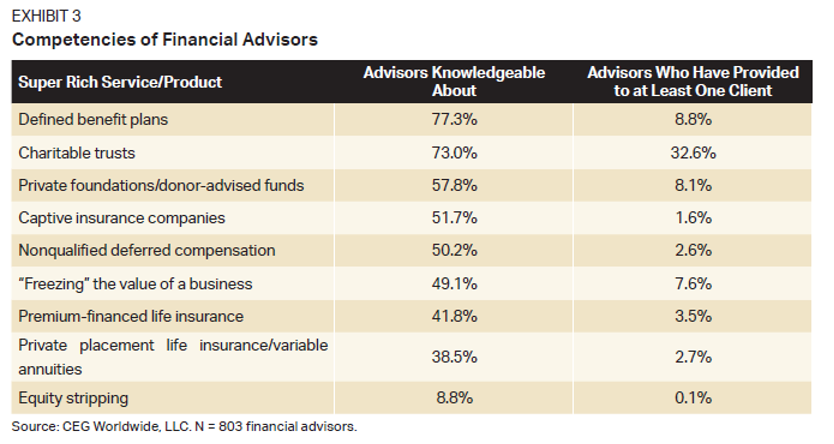

For example, here’s what financial advisors told us when we asked them about their knowledge and use of some highly advanced solutions for building serious wealth (see Exhibit 3).

These results should give you pause. Because these Super Rich solutions can prove extremely beneficial to successful business owners, the percentage of advisors who are knowledgeable about them and deliver them to their business owner clients should probably be higher.

Notice, too, the big gaps between advisors’ knowledge about these solutions and their use of them. The biggest reason we find for this disparity between professed expertise and delivery boils down to advisors’ limited level of proficiency.

Consider these examples of Pretender financial advisors who, because of a lack of true expertise, incorrectly explained a financial solution or service:

We don’t think these financial advisors were being intentionally deceptive. They simply were not very competent. Regardless, the consequences for the successful business owners were severe.

It is unfortunate, but a great many well-intentioned financial advisors are probably Pretenders when it comes to meeting your needs, wants and preferences as a successful business owner. Their level of knowledge, their access to expertise and their proficiencies are probably adequate for much of the general population. But they’re not well-suited for you on your path to becoming seriously wealthy.

Not all advisors today are capable of making a meaningful, positive and pronounced difference in the lives of wealthier, accomplished business owners like you.

That means you need to avoid Pretenders if you want to maximize your personal wealth and become seriously wealthy and find and work with a high-caliber wealth manager who can deliver.

The good news: We find that many successful business owners recognize when something feels wrong—or at least, not quite right—about their professional advisors. Years of experience building and growing a financially strong company have likely increased your ability to spot when you may not be getting enough financial value.

One of the best ways to deal with a possibly economically destructive situation in which you’re just “not completely sure” or you “feel a little uncertain” is to get a second opinion—either about your current financial situation and how it is being managed, or about a particular strategy or product you are considering (which may include strategies and products being proposed to you by financial advisors).

Not only can it be a wise move to get a second opinion before taking action, but it’s probably also a wise move to go this route even if you have taken action already and you are a little bit unsure and anxious. This gives you the opportunity to correct mistakes or use solutions and products that can do a lot more to help you accomplish your goals.

Simply put, second opinions often make a lot of sense if you want to avoid advisors who can’t cut the mustard—and help ensure that you work with advisors who can help you reach your goals. If you would like to receive a second opinion on an aspect of your situation, contact your legal or financial professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.