Posted on: June 25th, 2022

Entrepreneurs should always be looking for ways to strengthen their businesses, enhance their success and grow their personal wealth. The top business owners we know and work with are not only highly focused on those goals, they’re also open to fresh and novel ways to achieve them.

Take advisory boards, for example. As we’ve noted in the past, it’s common for business owners to establish advisory teams—organized groups of leading professionals who contribute their expertise to help both the company and the owners excel. The experts on these teams are able to help guide the business forward by enabling the company to avoid obstacles. They may do this by sharing industry best practices and dealing with specific problems the firm faces. Advisory teams can be especially critical to ensuring that a family business continues as a family-owned and

-operated enterprise over several generations.

But there’s another type of team that some business owners may find especially valuable: an advisory board consisting of a select, handpicked group of the company’s existing clients.

We call this a client (or customer) advisory board (CAB), and we’ve seen that it can be an excellent way to gain insights into how to provide an exceptional client experience at all steps—and capture new opportunities. Here’s a look.

A CAB is a forum in which business owners invite a select group of top clients to share their insights, ideas and advice about the business. It involves regularly scheduled, in-person or virtual group meetings to discuss key practice management issues that the entrepreneur is facing and to seek creative solutions together.

Essentially, a CAB is a focus group consisting of highly valuable clients of a business who are both willing and able to help the owner enhance the overall value and effectiveness of the firm and grow the company.

Important: A CAB is different from client-driven appreciation events or get-togethers. It’s a more formal and systematic approach to enrolling clients in the future of the business. Also, it’s designed to provide owners with insights and strategies from a group of top clients brainstorming in a collaborative, work-focused environment that encourages creative solutions.

It’s probably easy to see the value of creating an advisory board of other business owners and professional experts, but perhaps less obvious why entrepreneurs would want to include clients in their initiatives.

There are several key reasons to form a CAB. If you’re a business owner, your clients view your success as an entrepreneur as an important part of their own overall success. You might not realize this, but it makes perfect sense. We all want to work and associate with top people. Your clients have a vested interest in helping you and your practice achieve tremendous success. In fact, it’s in their enlightened self-interest to do so. They want you to continue to provide them with excellent service and solutions. The upshot: Many of them, if given the opportunity, would be eager to provide you with insights and resources that could help you grow your practice and become even more successful.

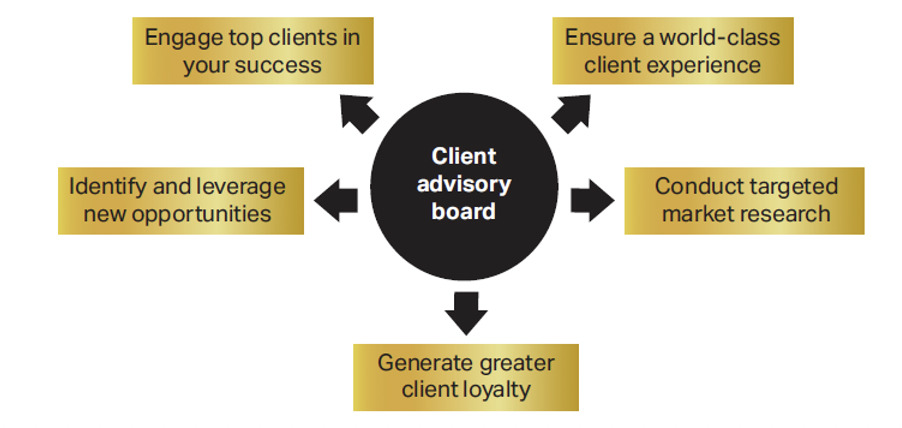

There are several important reasons to consider enlisting top clients as formal advisors (see Exhibit 3):

Exhibit 3

Reasons for a Client Advisory Board

To create a CAB, you must recruit ideal participants from among your client base. These four steps will get you started:

Develop a list of your ideal clients, and identify the top 20 percent in terms of the revenue they generate for the firm or their overall profitability. You might also consider select clients who are not among the top 20 percent—for example, clients with access to a particularly helpful center of influence. From your list, look for 12 to 15 clients who would be ideal candidates to join your board. A CAB consisting of 15 members or less will be large enough to generate plenty of good ideas but small enough to be manageable and avoid too much “groupthink.”

Pro tip: Ideal board members will be those who can bring to the table skills and perspectives that are different from your own yet are complementary. In particular, look for clients who have specific skills or experiences that relate to your main customer base. Ideal board members also will be those who are willing to collaborate with others.

Call each ideal candidate and tell them you’re developing a focused approach to your marketing and business development and would like their help. Ask to take them to lunch to get their ideas and opinions about your plan. You don’t need to dive into the CAB concept at this time. Simply obtain the buy-in for the initial meeting.

Now determine if the client can provide high-value insights. Ask questions that will allow the client to identify and share with you the most important aspects of working with you: why the client chose you, what the client most values about your relationship, and how you should position yourself to work with similar people. Take notes during the conversation. If you are not sure you captured a response accurately, read back what you wrote down and ask if you understood correctly. Above all, do not make the mistake of trying to sell any additional services at this time. You are there to get input, period.

If the interview was worthwhile, tell the client that you are creating a client advisory board and invite the client to join. Explain that your CAB will consist of a few top clients who will be asked to meet as a group two to three times per year to share their perspectives on key client experience and marketing issues you are focused on (such as identifying new business opportunities, ensuring a world-class client experience and so on).

Explain why you are asking the client to join your board—for example, because you value their insights and believe that with their help you can do an even better job serving them and capturing opportunities to become more successful. Point out that their experiences, both in life and as a client, give them a unique perspective to support the continuous improvement of your firm and that by joining your board, they can help you have a significant and positive impact on a lot of people’s lives.

Regardless of what business you’re in, it’s vital to accomplish a few goals: Understand your clients’ evolving needs, give them an exceptional experience, build rock-solid client loyalty and capture new opportunities for growth. A well-executed CAB can potentially generate all of these outcomes for you and your practice by enabling you to fully leverage the experiences, knowledge, connections and insights of some of your most valuable assets—your top clients.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.