Posted on: August 1st, 2020

If you want superior results in business and in life, you typically are going to need to be in control of some (if not all) of the factors going on in a particular situation. That’s true whether it’s a salary negotiation with a boss or a vacation negotiation with a spouse.

We find that the self-made Super Rich—those people with a net worth of at least $500 million—are very adept at taking control of their environments in a variety of ways that drive better outcomes.

Here’s a look at how they do it.

There are many ways to take control. There are three core ways the self-made Super Rich exert control:

The first area of control is internal; the other two address dealings with others. All three are synergistic and can provide a significant competitive advantage.

Consider your own control-related traits:

When you get angry, how do you handle the situation?

When you have to provide options to someone …

When you want to move a negotiation along …

For the self-made Super Rich, the answer to each of these questions is regularly “C.” In each case, “C” delivers control.

Let’s dive into each lever of control.

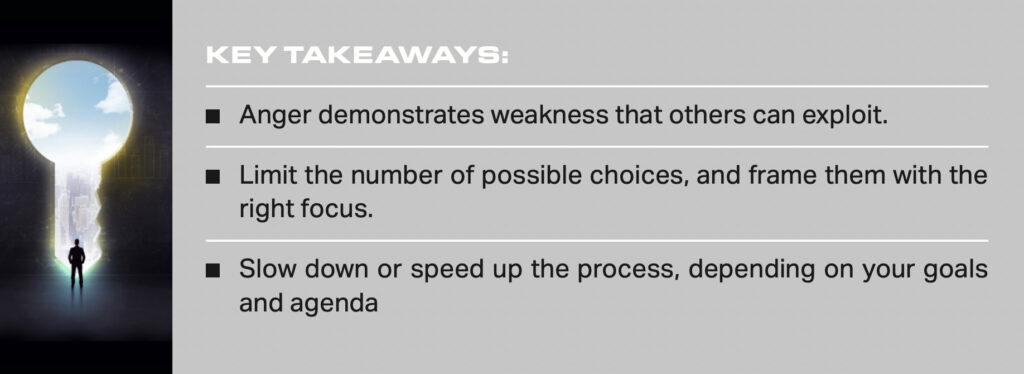

Succumbing to emotional reactions usually means you are not thinking things through as best you can. Consequently, you are very likely going to make bad judgments that could further complicate matters, engender more emotional reactions and create obstacles to the results you are looking to achieve. Anxiety, for example, regularly leads to second-guessing and an exacerbation of self-doubt that result in poor decision-making.

Anger is often a more pronounced emotion that can easily lead to disaster in one form or another. Becoming angry is fairly common in intense business and personal situations, of course. But you need to keep your anger in check and deal with those moments in a calm and objective manner if you want to come out ahead.

Angry individuals tend to overreact, blowing issues out of proportion and distracting from the important considerations at hand. Some people think angry outbursts equal power—that ranting and raving shows who is really in charge.

The reality: Anger demonstrates helplessness. It shows weakness in actions and character. People who are demonstrably angry very often cut off other options available to them. They box themselves in, thereby hurting their position and the likelihood of achieving their agendas.

It can be very easy to undermine a person who has so little self-control—and be undermined if that person is you. For example, one of the very best responses to anger is no response at all. Such a reaction proves to be very unsettling; it will commonly make the hothead even hotter, resulting in more unforced errors.

In business, even when you are angry, you must temper your responses and not take matters personally. You should always act—not react. Knowing what you really want to achieve and staying focused on it can be your best defense against anger.

The self-made Super Rich are adept at providing viable potential outcomes to others. This gives these other people a greater sense of control, as if they are the ones making the final decision. At the same time, by controlling the possibilities, the self-made Super Rich are working to ensure their agendas are moving forward.

Providing simple dichotomous choices—yes or no possibilities—is often a poor way to have other people support your actions and get results.

Instead, your aim should be to provide bounded options—but ones that are meaningful to others.

When you control the possible outcomes, you set parameters for other people’s decisions—their degrees of freedom are limited. When framed properly, this approach tends to restrict consideration of choices outside the ones presented. But this happens only when the choices presented are viable and substantial.

Most people tend to feel greater comfort when possibilities are somewhat limited. Unlimited possibilities can be overwhelming, making decisions harder as opposed to easier. It is not uncommon for people to freeze like deer in headlights when faced with too many possibilities. “Option overload” can be disconcerting and immobilizing for many.

But it’s not just a matter of offering up select options. The self-made Super Rich also are often quite adept at adroitly positioning each of the choices they present. Each choice is considered worthwhile and is presented with a focus on how it can benefit the other person and how it could help that person achieve his or her goals.

One way to help convey the image that you are in control is to avoid being seen as rushed or in an excessive hurry. By controlling the timing of things, you are more likely to appear confident and capable. Patience is very effective in communicating that you are handling things well and that you know everything will eventually work out.

Controlling the timing means not reacting to others. Instead, you decide on the most opportune times to take action. Time is a construct that the self-made Super Rich are capable of using and molding to their advantage. By taking the longer view of circumstances and considering different scenarios, you can make time work for you—and make better, more informed and thoughtful decisions.

In controlling the timing, you slow things down—giving you the time needed to think things through. Keep in mind that when you don’t act immediately, new possibilities are likely to emerge over time, and these new options may give you ever greater flexibility.

Pacing is central when doing successful deals or seeking to motivate others. Things will happen in their time, provided you do not upset the process by trying to speed things along to the detriment of achieving your goals.

Another savvy way to control timing is to upset the timing of others. The use of deadlines when negotiating, for instance, can be a very powerful tool in getting the other side to react in greater accord with your wishes. The smart use of deadlines can force them to make decisions without all the available information and take action before all issues are taken into account.

You can’t control everything that comes your way in life, and you can’t control every aspect of every situation you’re in. But if you can grab hold of the three levers that control such negative emotions as anger, the possibilities of the situation and the timing of how things play out, you can position yourself to get better results.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.