Posted on: December 1st, 2022

Among the affluent today, family is paramount. We find that many affluent investors have a “family steward” personality profile—they care deeply about how their wealth can help them take care of their loved ones.

We also see this among specific types of affluent individuals. Example: Taking care of loved ones is the top reason why entrepreneurs seeking to become seriously wealthy want so much wealth, according to our research.

If wealth and family are among your top issues, it’s likely you expect to use your assets to give your family a good life in the here and now—things like health care, travel and college tuition. But here’s a question: Have you thought nearly as much about positioning your assets so they’re ready and able to help the people you love after you’re gone?

Even if you have made some headway in this area, as many affluent families have, your plan for your estate could be a little—perhaps a lot—out of date.

If that describes your situation, don’t panic. Even if your financial life has lots of complexity, you can likely get on track by focusing on just three main areas of estate planning: wills, trusts and fiduciaries.

Here are some ideas about how to do it.

Read this next sentence three times in a row: Everyone should have a will.

Got it? A will should be the basic foundation of every estate plan—the starting point for a well-conceived strategy to transfer assets at death.

A will identifies precisely what you want to have happen to your assets and estate. Dying without a will means you have decided that the state knows what’s best for you and your family. Having no will also can make the settling of your estate difficult, costly and highly publicized.

As with just about any financial document or strategy, there are both positives and negatives to a will. That said, we strongly believe the benefits of writing a will far outweigh the drawbacks.

Advantages

Disadvantages

A typical second component of a smart estate plan is a trust. Essentially, a trust is simply a means of transferring property to a third party—the trust. A trust lets you transfer title of your assets to trustees for the benefit of the people you want to take care of—your selected beneficiaries, such as family members. The trustee will carry out your wishes on behalf of those beneficiaries.

Trusts can be used in a variety of ways to transfer wealth and determine how it will be deployed. Trusts also can be useful when it comes to wealth protection strategies—shielding your assets from plaintiffs and creditors who seek to (often unjustly) take them.

Broadly speaking, there are two types of trusts: living (established while you are alive) and testamentary (created by your will after you’ve passed).

Additionally, there are two fundamental trust structures.

| Is a trust for you? Ask yourself these questions: Yes No Are your beneficiaries unwilling or unable to handle the responsibilities of an outright gift (investing the assets, spending the gift wisely, etc.)? ___ ___ Do you want to keep the amount and the ways your assets are distributed to heirs a secret? ___ ___ Do you want to delay or restrict the ownership of the assets by beneficiaries? ___ ___ Do you need to provide protection from your and/or your beneficiaries’ creditors and plaintiff? ___ ___ Do you want to lower your estate taxes? ___ ___ If you answered “yes” to any of the five questions, you may find it beneficial to set up a trust. |

A living trust is becoming more and more popular to avoid the cost of probate. In the probate process, your representatives “prove” the validity of your will. The probate process also gives any creditors the opportunity to collect their due before your heirs get anything. There can be long delays in settling estates that go through probate. On top of all that, probate can be costly.

A living trust can potentially avoid or mitigate the effects of probate. It is a revocable trust that you establish and of which you are also typically the sole trustee. The assets in your living trust avoid probate at death and are instead distributed to your heirs according to your wishes.

Living trusts come with some attractive benefits, including the following:

Warning: For a living trust to be meaningful, it must be funded. That is, the assets you want in the trust must be transferred to it. If you set up a trust but never fund it (it happens), probate will not be avoided. You can also write your will to ensure that assets you want in the trust that are not there when you die are transferred to your living trust.

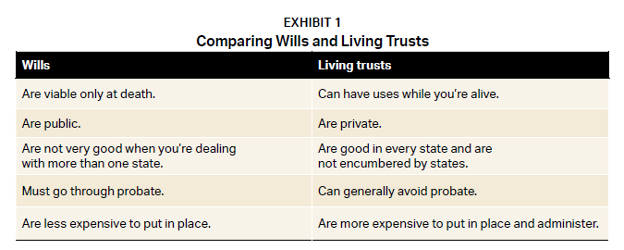

Living trusts are sometimes said to be superior to a will, but that is not the case for everyone. It’s important that you understand how the two compare (see Exhibit 1).

Is a living trust for you? It depends on your particular situation. Nevertheless, you should certainly consider it in consultation with a trusted advisor.

Important: Laws and regulations governing trusts can (and often do) change over time. Consult with a trusted professional about the latest developments regarding the rules of various types of trusts.

A fiduciary is a person or organization that is ethically and legally bound to act in the best interests of another person and to oversee that person’s finances.

Example: Regarding your will, you need to name an executor. When it comes to trusts, someone (or some institution) has to be the trustee. And if you have children who are minors, it is imperative that you name guardians for them—people who will be willing and able to take care of your children if anything were to happen to you and your spouse.

After you’re gone, wouldn’t it be nice if there were someone who would make decisions about your estate as you would have? When you name an executor of your will, this is possible.

An executor has a number of responsibilities, including:

When you set up a trust, you are specifying how you want a situation managed in the future. It is the responsibility of the trustee to make sure that your wishes are carried out. The explicit responsibilities of the trustee vary depending on the nature of the trust you have set up, but they may include the following:

There are three key criteria that you need to consider in making this decision:

Sometimes the decision about who should be guardian of your children is obvious. Example: Your sister-in-law wants the responsibility, and you are confident she will do an excellent job (as she has the same views on raising children that you do).

That said, the “right” person or couple doesn’t always exist. Keep in mind that your decisions are not set in stone. As circumstances change, you should adjust your decisions accordingly. You can change your will or, for that matter, your entire estate plan if your situation changes.

It’s extremely common to review an existing estate plan and find that it’s been five years or longer since it was created. That’s more than enough time for changes in tax laws, your personal situation or your family to have made that plan outdated—and therefore out of touch with your wishes.

We recommend that your estate plan be reviewed every year or two. The review should be conducted by a wealth manager or tax professional who has estate planning experience and expertise—but who also takes the time to learn what’s changed since you put your solutions in place, assess how those changes might impact your strategy, and make recommendations for getting your solutions current and in accordance with your wishes.

It’s this combination of technical ability in estate planning coupled with a deep interest in truly getting to know you and your situation that we find tends to lead to the creation of the most effective estate plans.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.