Posted on: November 1st, 2018

If you’ve amassed sizable wealth, or are on the right path and getting there, it may be time to consider how to pass on some of that money to children and grandchildren—without creating big problems that could harm their futures and destroy family harmony.

The fact is, family wealth—how it’s managed, transferred and used—can generate major battles and drama among family members. As wealth grows, so does the potential for that money to foment conflicts and bad financial decisions that can reduce a family’s financial position and even ruin intra-family relationships forever. That’s especially true if the asset you’re looking to someday transfer is a business you’ve built up over many years.

The good news: As is so often the case, we can look to the strategies used by today’s ultra-wealthy families to avoid or mitigate such negative outcomes—and find ways to adopt similar strategies in our own families.

One of the most effective tools used by the ultra-affluent is the family meeting—which is used to educate heirs and potential heirs about sound financial decision-making, to identify shared family financial values and to maintain (and grow) family wealth in a unified manner.

Here’s how family meetings benefit the wealthy—and how to make them work for you and yours.

For multigenerational affluent families, family meetings can help avoid the thorny problems that can arise when inheritors who receive substantial assets lack the proper preparation and education to manage the money prudently. Families who are in business together also often find family meetings valuable in helping them keep the business in the family and performing well, generation after generation.

Regular family meetings can also help families keep their wealth together and intertwined, which can have major advantages such as:

However, strong and productive family relationships are needed to keep the family wealth together and effectively manage it across geographies (as family members are often in different locations) and generations. Family wealth consists of not only liquid assets but also all other forms of wealth—from the family business to hard assets such as artwork.

The underlying objectives are family cohesiveness, superior management of the family’s future across the generations, and the preservation and growth of the family wealth.

The family meeting principally provides a venue for multiple generations to discuss business and financial matters. Common topics covered at well-run family meetings include:

Family meetings are where a family’s values and mission are discussed, debated and honed. Governance structures are often addressed and refined. In many cases, family meetings are great settings to plan the action steps needed to prepare the next generation for family leadership roles. Often, the end result is greater feelings of cohesiveness, trust and support among family members of various generations.

Important: Family cohesiveness is not the same as family unity. Most families have some degree of discord. What family meetings can help accomplish is getting the family members on the same page and in agreement over what they can achieve by cooperating. Family meetings are about coming together for a common purpose.

A well-structured family meeting is a forum where the family members work through issues and come up with solutions and actions plans that benefit the family.

Effective communication is an essential part of productive family meetings. Without it, these meetings can quickly turn into nothing more than gripe sessions fueled by heated arguments.

Warning: Family meetings should not be “one and done” affairs. The lives of family members change over time—sometimes suddenly. That’s why we recommend family meetings be held regularly. (Ultra-wealthy families tend to run their family meetings annually, and some twice a year.)

Pro tip: There can be lots of logistical issues in getting family members all in one place. If so, consider using technology such as videoconferencing.

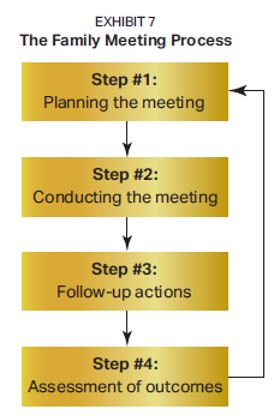

As Exhibit 7 shows, there are four key steps to arranging and executing a highly impactful family meeting.

The starting point is specifying the goals for the family meeting. The more specific and refined the goals, the better. An agenda based on those goals should be created, delineating what is to be discussed and what decisions can hopefully be made. Based on the nature of the topics on the agenda, supporting material might be required (such as the financials of the family business or the performance of the family’s investment portfolio).

Often, the planning part will be shared and rotated among various members from meeting to meeting. When it’s your turn, be sure to get input from all family members who will be involved. By taking suggestions from everyone into account, the family is more likely to achieve the desired group results.

Add some fun: Many families also include fun activities as part of their family meetings—such as golfing, a family softball game or a wine-tasting event. These bonding moments are nice on their own, and also help promote a better meeting.

The focus of the family meeting should be the goals and agenda. Therefore, it is usually wise to mitigate day-to-day distractions—for example, by holding the family meeting at a resort or a tucked-away family property.

The most effective meetings we’ve seen tend to have an outside professional—a neutral third party—involved as a facilitator. This individual will help address the more complicated and difficult issues, and keep the discussions on track and focused on the end goals and action steps. They also help ensure that all family members are involved and contributing, and they can help mitigate conflicts that may arise.

The types of third-party professionals commonly serving in this role include:

Note: Family meetings range in length and involvement, depending on the topics that are being covered as well as the number of people involved. Also, the more important the decision that has to be made, the more likely the family meeting will be a longer affair.

Typically, a set of action-based to-do steps results from a family meeting. These actions often need to be turned into formal projects, with milestones and clear expectations about who will be accountable for specific steps. The third-party facilitator or family members can be responsible for mapping out how to follow up after the family meeting. It is also worthwhile to specify how the subsequent actions will be tracked and reported back to the family.

After starting with particular goals, then identifying what actions need to be taken to achieve those goals, the final step entails determining the degree of success attained.

Based on the assessment of the outcomes, new actions to help reach the stated goals are habitually identified. These can be a refinement of current actions or a different approach entirely. Moreover, the results achieved always factor into the goals and agenda for the next family meeting.

Keep in mind: Every family has its own special dynamics and traits. Thus, the process described here can be modified depending on the aims of the family.

Family meetings can potentially benefit anyone who may pass along assets to heirs down the road—they aren’t simply a tool exclusively for the wealthiest families. Patriarchs and matriarchs can use the meetings to help instill important values about money and responsibility in heirs. Meanwhile, younger generations can use the meetings to learn smart money management and investment skills, and start to discuss their own ideas about family wealth and values. If you think you and your family could potentially benefit from family meetings about wealth, contact your legal or financial professional to explore the topic further.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.