Posted on: June 1st, 2019

The self-made Super Rich—those with a net worth of $500 million or more—aren’t immune to making mistakes with their wealth. But we find that they do tend to avoid certain crucial errors that might otherwise impact their bottom lines and financial futures.

What’s more, these are the same mistakes that can trip up investors and families at just about any level of wealth. The upshot: You can potentially do yourself and your wealth a big favor by learning what the Super Rich don’t do with their money!

With that in mind, here are three of the biggest financial blunders that the Super Rich make a point to watch out for so they can sidestep them.

The Super Rich often establish family offices to address the multiple financial and personal objectives they have. These family offices are extremely adept at helping Super Rich families develop and spell out their goals and even their broader philosophy about wealth and values. They might, for example, craft a family vision statement about the family’s optimal outcomes and the reasons for wanting them. Then they create a mission statement and plan with the steps to take to realize that vision.

From there, all decisions about wealth are made only after considering the family’s vision, values and action plan. Any moves or changes should reflect those underlying factors. By having systems in place to never lose sight of their key goals, the Super Rich do a superior job of not chasing “hot” investments.

That’s not to say the Super Rich are entirely rigid with their wealth planning. Without question, in order to adapt to changing circumstances—in family needs, for example—high-functioning family offices are designed to be quite flexible. When goals change significantly enough, adjustments are made.

The lesson for everyone: Be very clear about what you want to accomplish. While it is often important to be flexible, the decisions to make adjustments should be deliberate and not a product of a lack of oversight or because you’ve discovered a shiny new investment “opportunity” that has nothing to do with your financial goals, values and philosophy.

The Super Rich, because of their wealth, understand that a lot of professionals would like to do business with them—but that not all of those professionals are worthy of consideration. Indeed, we find that the world is often filled with “professionals” who are actually:

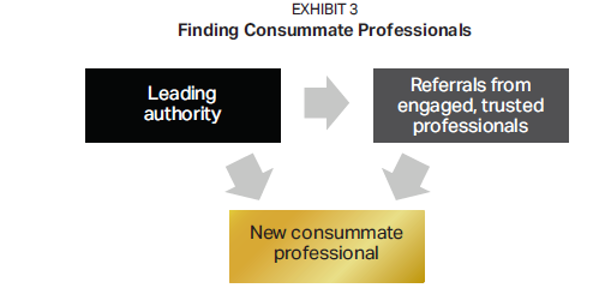

Often it’s hard to separate the good from the bad. So how do the Super Rich identify and avoid these three types of “professionals”? The most successful family offices take certain steps to help confirm they are working with consummate professionals (see Exhibit 3).

For starters, the Super Rich gravitate to leading authorities. Whether for senior management positions or as external providers, the objective is to work with recognized experts—industry thought leaders.

They also rely heavily on referrals when seeking out consummate professionals. The most consistently effective method is to garner referrals from high-quality professionals they are currently engaging. That’s because, generally, high-quality professionals tend to know other types of consummate professionals. Example: A top money manager likely knows elite wealth planners and leading insurance specialists.

Finally, they’re willing to pay well for results. While the Super Rich make a concerted effort to minimize costs, they are not going to forgo desired results simply because pursuing those results might require them to spend some money. The Super Rich understand that it’s important to assess a provider’s ability to deliver value, not just his or her stated fee or price schedule.

The lesson for everyone: It is essential to avoid Pretenders, Predators and Exploiters if you seek out financial professionals to work with. By turning to leading authorities—thought leaders—and soliciting referrals from high-caliber professionals you trust, you greatly increase your chances of working with a truly skilled professional who has both the willingness and ability to get you to where you want to go.

“Trust, but verify” is a phrase made famous by Ronald Reagan talking about the Soviet Union. The Super Rich, especially those using high-functioning single-family offices, take that message to heart. They are fully aware that the consummate professionals they hire can make mistakes. Therefore, the Super Rich rely on second opinions and stress testing.

Ideally, a second opinion occurs before action is taken. Example: If a single-family office is considering a particular tax mitigation strategy, its senior management might get a second opinion from another noted leading tax authority to be certain about the validity and viability of the tax strategy. Second opinions are commonly sought whenever there is any question or any sense of uncertainty. That said, second opinions can be done at any time. For example, many investors (both Super Rich and otherwise) conduct second opinions about their overall financial strategy if they’re worried they might not be on the right track—or that the professionals they’ve enlisted aren’t up to snuff.

Stress testing is when the Super Rich turn to consummate professionals to evaluate an existing strategy already in place. It is a check to make sure what they did remains both viable and valid—that things are working as predicted. For many of the Super Rich, stress testing is like an annual medical checkup. Something does not have to be wrong, but it is a very good way to catch a problem before that problem becomes severe.

The lesson for everyone: No matter your level of wealth, getting a second opinion when you are even slightly unsure or uncomfortable is usually worthwhile. Similarly, periodically stress testing your planning and investment portfolio can enable you to avoid problems now or down the road.

By and large, the self-made Super Rich have proved that they know what to do—and what not to do—in order to create, grow and maintain sizable wealth. By taking steps to make savvy moves while also avoiding major slipups, you can potentially put yourself in the best possible position to join their ranks.

One way to get started: Consider getting a second opinion about the current state of your finances and how effectively they’re being managed. A comprehensive review of where you are today, where you want to be and the gaps between the two may indicate that it’s time to find the expertise that will truly add value to your life—and the lives of those you care about most.

Contact your financial professional to discuss your goals and how your plan is helping you make progress toward them.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.