Posted on: May 1st, 2021

Family businesses are foundational to the success of economies around the world. The family business may be the oldest business model.

A true family business is one in which decision making is influenced by multiple generations. How this operates varies extensively from family business to family business, of course. In many cases, the aim of the family controlling the family business is to ensure continuity—making sure the business continues to thrive over time, with the family maintaining ownership and control.

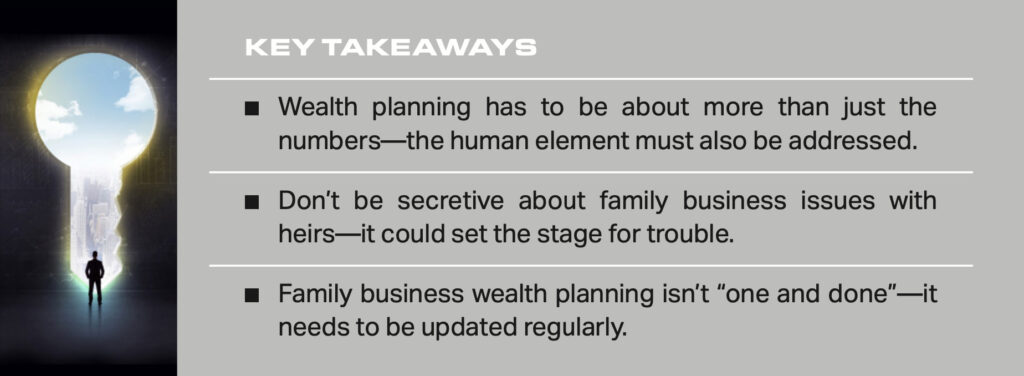

Successful family businesses typically need to engage in wealth planning to make all that happen smoothly and successfully. Wealth planning involves strategies around investing, legal and other areas, integrated in a synergistic manner so the various solutions work in concert with each other.

Trouble is, there are numerous ways for family businesses to get derailed by wealth planning mistakes and errors. Here are five of the potentially biggest mistakes to sidestep.

Working with the “wrong” wealth planners for your and your business’s needs is a critical mistake. By not engaging high-quality wealth planners, your family may face complications that can ripple throughout the family business.

All too often, wealth planners (whether they are lawyers, accountants or wealth managers) approach family businesses only from the vantage point of their own expertise and their own set of preferred strategies and solutions. This can be a sign that a planner is wrong for your family business.

Example: It is common for planners to think of family business as some form of monolithic entity. Usually, we find, the reality is very different. There are family businesses with complex structures and those with very simple structures—as well as a plethora of forms in between these two poles. Similarly, there are a range of family issues that can affect family businesses.

Family members should be seeking to engage wealth planners who can develop deep insights into the family, including the aims and concerns of its members. This is referred to as being able to address the human element—the aspects of family business and family wealth that go beyond the numbers. Families should look for wealth planners capable of providing the highest-quality expertise to address a family’s goals and pressing concerns. We see a pervasive tendency among family businesses to focus on a wealth planner’s technical proficiencies with numbers and data, and not take into account his or her ability to discern what is really important to the family itself.

Family businesses can suffer badly when they bring in state-of-the-art experts who are enthralled with their own brilliance. They tend to deliver intricate wealth planning solutions—but those cutting-edge ideas don’t necessarily address what the family cares about most.

One key role of many wealth planners is to minimize taxes for families and their businesses. And there are a number of ways to reduce or even eliminate taxes. For example, wealth planners can set up a single structure for a family business that will reduce current income taxes, better manage risks and transfer wealth to the next generation. A wealth planner might also, in some cases, be able to transfer equity to heirs at a discount from current valuations. And if family business interests are in multiple jurisdictions, a wealth planner might possibly arbitrage the tax regimes—thereby lowering the tax bill.

But if wealth planners fail to understand family members’ agendas and focus too heavily on tax minimization or elimination, the outcomes can be bad. While reducing or eliminating taxes is quite often a major objective of these families, we find that it is almost never the only objective. Sometimes it’s nowhere near the most important objective, either. For example, most families involved in business together deeply value family harmony. In families with multiple heirs who have very different levels of involvement in the family business, the smartest tax strategies from a technical standpoint may very well fuel family discord. The cost of the resulting conflict could exceed any tax savings achieved.

The upshot: Wealth planners have a duty to help the family understand the trade-offs between its aims—such as family harmony and tax mitigation.

Sometimes families are very secretive when it comes to their wealth planning. This might involve not informing the heirs of how something concerning the business or its finances is set up—meaning the kids don’t find out until the will is read.

Such extreme secrecy is often intended to maintain family cohesion, but instead it usually proves to be counterproductive.

Making sure all the heirs know the intent of the current family business owners can potentially lessen possible future conflicts. Open communication about what is happening within the family and the family business today, as well as what might happen in the future, is vitally important. Taking this approach permits family members to adapt to their roles and deal with conflicts and concerns early on instead of later—when emotions might be out of control.

In an even more extreme scenario, the owning family members do not share the financials with the next generation, based on the presumption that if the next generation doesn’t know the information, there won’t be any problems. Unfortunately, this is a major mistake that can lead to a lot of trouble. Simply accessing the Internet, for instance, may enable heirs to ascertain a fair amount of insight into the levels and nature of the family’s wealth. Not sharing this information tends to lead to inaccurate understanding, spurring intra-family fights.

Note: Not all details of wealth planning need to be made transparent. But making all the relevant parties aware of the big decisions concerning the family business (and other assets) can potentially head off damage to the family enterprise.

A prevalent error of many families with a family business is not keeping their wealth planning up to date. It takes a lot of time and effort (and often emotional energy, too) to address wealth planning. As a result, families who have engaged in wealth planning sometimes take the attitude that they have “checked that box” and are done with it forever.

The reality is that family businesses, by their very nature, are always in flux—thanks to everything from changing family dynamics to changing economic conditions. It is therefore important to address these changes as they occur. In order to ensure that the wealth planning remains accurate and relevant, it has to be an ongoing process. As changes happen, it can be wise for a family to connect with its wealth planner or planners to assess the impact and make adjustments as needed.

For families who have not kept their wealth planning current, one effective approach can be to have a wealth planner review core elements of the plan. The aim is to ensure that:

For many families, keeping the wealth planning accurate can be the difference between having the business for generations and losing it because of poor planning or inattention.

The idea that a family cannot continue to run the family business is all too often seen as sign of failure. For some family members, it is their legacy to continue the family business—and not doing so is a disgrace.

Some wealth planners may work to oppose a sale. For example, there are trust agreements that can prevent the sale of a company to people outside of the family. While the idea may be to keep the family together, the results are more likely to cause intra-family warfare.

For example, if inheritors don’t want to own or manage the family business, it is likely the smarter move to sell the enterprise. Wealth planners can play an important role in helping maximize the after-tax proceeds the family receives from the sale.

A highly effective way to deal with this matter is to ensure as much flexibility for family members as possible. The more options a family has, the more likely family members will benefit now and in the future.

These five mistakes are all too common among successful family businesses, in our experience. The good news: They can be avoided if the families work with very capable wealth planners—professionals who are both extremely technically skilled and attentive to the human element of wealth planning.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.