Posted on: July 1st, 2021

The path to success is almost never a straight line. That seems to be the case in general, and in our experience it’s even more true when it comes to successful entrepreneurship. The process of building a business is accompanied by an array of obstacles and complications.

A key distinguishing characteristic of the most successful business owners is how they handle a crisis—or multiples crises over time.

Crises come in all shapes and sizes, from business-wrecking internal conflicts between partners to global pandemics. When crises strike, the most accomplished entrepreneurs are adept at thinking about where they are right now and what actions they can take to deal with these situations.

There are a number of ways for entrepreneurs to think through crises. One approach that we’ve seen be very effective is a best practice used by ultra-wealthy entrepreneurs (meaning those with a net worth of $30 million or more). By using this approach, entrepreneurs can better deal with their current situations and come up with ways to become more successful—both in the moment and later, as the crisis lessens.

The good news: While we’ve seen this approach work well for ultra-wealthy business owners guiding their companies through crises, the principles can be applicable for just about any entrepreneur facing a truly tough road ahead.

There are two parts to the approach: assessment, followed by action (see Exhibit 4).

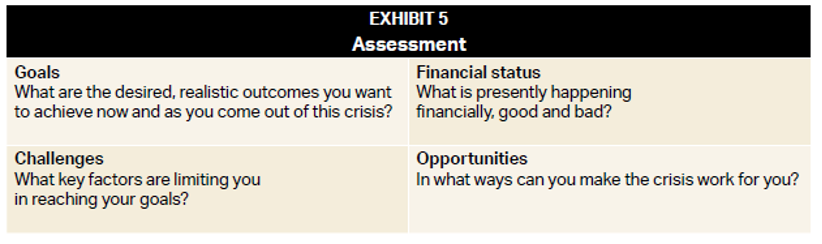

Start by getting a sheet of paper. Fold it in half and then in half again so it has four quadrants. Now repeat the process with another piece of paper. You’ll end up with two sheets of paper, each folded into four quadrants.

The first page is for the assessment, and the second page is for the actions you can take.

You’ll assess four areas: goals, financial status, challenges and opportunities (see Exhibit 5). If, for example, you are having problems with your business partners, your crisis goals might include:

Note: Your goals have to be realistic. The idea that your partner will simply retire or realize that you are the best person to run the business is likely just wishful thinking.

The next quadrant addresses your financial status. Where you are financially significantly impacts what options and possibilities you have. The stronger your financial position, the more likely you can weather the storm. If you are in economic distress, everything becomes much harder.

The third quadrant is where you assess your challenges. There are likely to be a number of factors that make it all the harder for you to achieve your goals. You want to specify these challenges and determine their level of severity.

The final quadrant is for the opportunities the crisis at hand provides. Even in dire circumstances, there may be ways for you to capitalize on the situation and improve your company in some way. Determine whether the crisis itself is creating business opportunities you might be able to take advantage of.

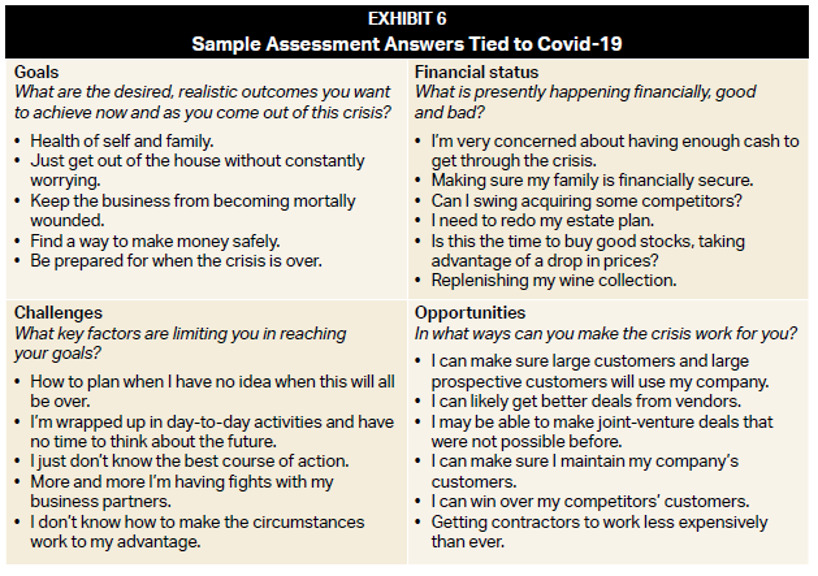

Exhibit 6 shows some of the answers many entrepreneurs we know came up with as they were dealing with the Covid-19 crisis and the accompanying economic fallout.

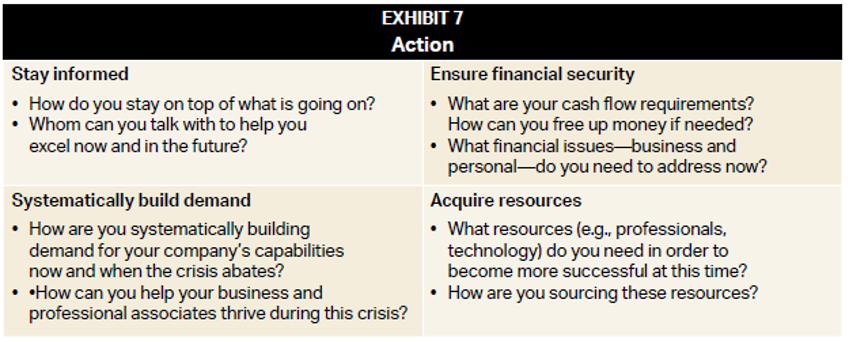

Now consider four critical steps to thriving during the crisis and beyond. Again, fill out the four quadrants (see Exhibit 7). This page, as well as some of the insights you can glean from the other page, can show you how you might potentially weather the crisis and actually become more successful.

Let’s consider each of the quadrants on the Action page.

You need good advice, especially when times are tough. To whom are you turning for advice, and why? Very importantly, which other people should you be looking to for guidance? Entrepreneurs often rely on a team of professionals (and sometimes peers) to help them get through crises. So it’s important to critically consider the advice you are getting.

The next quadrant is all about making sure you are financially secure. For example, a common issue among business owners during many types of crises is having enough cash to get through the difficulties. If this is your concern, you might need to produce an updated cash flow statement and a current balance sheet. Armed with current and accurate information, you can put yourself in a better position to make decisions.

When faced with a significant crisis, a focus of many leading ultra-wealthy entrepreneurs is building future demand. That is, these business owners find they can generate substantial revenue now and create a backlog for their company’s offerings as the crisis lessens.

To get the results you want, you may need to acquire additional resources. Some might be family related (such as concierge physicians or tutors for children). Some might be technological, such as cybersecurity experts. Or it could involve experts to help deal with the psychological dynamics of your partners. It will depend on the particular crisis, of course.

Resilience is characteristic of the most successful entrepreneurs. It is necessary, as business (and life, for that matter) rarely runs smoothly. We have seen the approach spelled out here be very effective in helping entrepreneurs think through their current situation, then decide what they can do to mitigate the negatives of a crisis and emerge in as good a shape as possible. It is also useful in thinking through what they can do to excel after the crisis abates.

Whether you use this approach or something similar, when confronting a crisis you need to be able to distance yourself from the stress and tension so you can make better decisions. This approach helps you do that and makes sure you are thinking about some of the most pressing and meaningful issues as well as the best actions you can take.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.