Posted on: November 1st, 2018

In business and in life, problems are inevitable. If you think you can avoid them, you’re fooling yourself (and probably wasting too much time trying). The self-made Super Rich—those with a net worth of $500 million or more—understand better than the rest of us the nature of challenges and how to tackle them.

There are, of course, many traits and characteristics that separate the wealthiest entrepreneurs from their less successful peers. We’ve found that one of the most important is being a problem solver when it comes to their businesses.

Here’s how they approach professional challenges—and what you can learn from their methods.

The Super Rich recognize an important fact: The meaning of each problem you face in your business is dependent on how you choose to think about it, and what actions you decide to take.

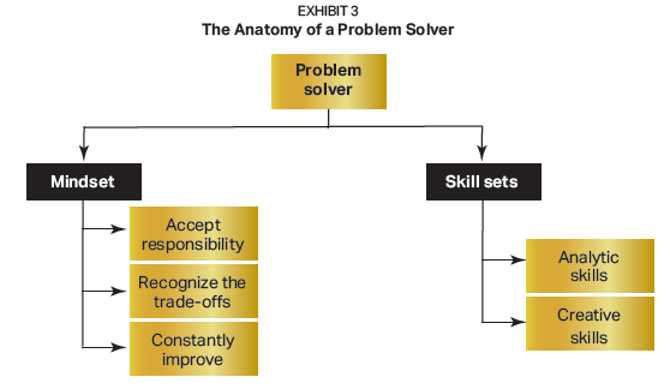

Being a truly effective problem solver is part mindset and part skill set (see Exhibit 3). Problem solvers have a certain perspective on the world that centers on accepting responsibility and knowing they are going to have to make trade-offs. They also have the drive to continually improve their problem-solving capabilities, refining and reinforcing their skill sets and their confidence in their abilities.

When it comes to working through problems, different problem solvers tend to employ various cognitive tools, techniques and processes (depending on circumstances). That said, there are three rules that are typically vital to highly effective problem solving:

One of the more pronounced distinctions between the self-made wealthy and those less affluent is that the Super Rich readily accept responsibility.

Important: You must differentiate between blame and responsibility. Blame is identifying who or what is at fault. Your business might be suffering because the entire economy is in a serious recession. The economy is to blame, in that case. However, you are still responsible for the success of your business. Because of your responsibility, you must decide in that situation what actions you are going to take. Likewise, a division in your company might be doing poorly because the person running it is not up to the job. The blame for the division’s poor performance lies with the person running it. But ultimately you are responsible—so what action are you taking?

This distinction is one that the self-made Super Rich make consistently over time. Many times, we cannot control what happens to us professionally or personally. We can, nevertheless, determine how we respond to these circumstances. The great majority of the self-made Super Rich regularly accept responsibility.

Exercise: Identify three business situations in which a set of circumstances or another person was clearly to blame for negative results. How did you react? Did you take responsibility and come up with a solution—or did you “pass the buck”?

The self-made Super Rich accept that the problem-solving process is replete with trade-offs. Put another way, solving problems means making sacrifices.

Just about all situations entail taking actions that limit you in some way or another. Say, for example, your sales team is not closing enough business. You might decide that the solution is to start accompanying them on many of their sales calls. The trade-off may be spending less time on other activities in your business or personal life.

Being an adept problem solver involves clearly understanding the trade-offs you face and their implications. By being cognizant of the sacrifices that go with your solutions, you will likely be better able to effectively implement a plan for success.

Note: Often there will be unintended consequences of the decisions you make—a trade-off that surprises you. But the aim is to make calculated responses. Taking this approach can go a long way toward not second-guessing yourself.

Exercise: Describe the solutions you came up with to the three business problems from above. Specify the trade-offs you made or will have to make to implement your solutions. Are they acceptable to you?

Even when people achieve their goals and solve their challenges, different problems persist or crop up—even for the Super Rich, who may experience significant anxiety over regressing economically by losing the great wealth they’ve amassed. Problems, which are part of being human, produce failures and mistakes. Trying to avoid failures and mistakes—big and small—is pretty much impossible.

That means you must continually enhance and strengthen your problem-solving skills. If you try to just move forward from a problem or poor result, you won’t understand the errors that led to the bad situation—which increases the likelihood that it will happen again down the road.

We’ve noticed that the self-made Super Rich accept that they make mistakes when solving problems—they’re almost enthusiastic in their acceptance, in fact. While many people see making mistakes as a negative, the self-made Super Rich view it as an opportunity to become increasingly better problem solvers.

Exercise: Think about three sets of solutions you used to solve three problems that did not get you the results you wanted. Think about exactly why the solutions didn’t work, and what lessons you learned from the process of stumbling.

Broadly speaking, there are two types of problem-solving skills: analytic and creative.

1. Analytic skills. Systematic, logical thinking is very effective in selecting the best alternative courses of action from a range of possibilities. The following are examples of analytic techniques that the Super Rich often use when solving problems:

2. Creative skills. Being clever, imaginative and ingenious is often needed when cold logic will not produce viable solutions. There are a number of core qualities to creative problem solving, including:

Some possible structured techniques used to promote creativity include:

Important: It’s possible you might possess both of these skill sets yourself. But chances are you’re either more creative or more analytical—not equally both. If so, be sure to enlist the help of others who can add value and insight in the skill area where you need help.

Problems and challenges are part of life and part of business. How you react to them can play a huge role in the level of success you ultimately achieve. By adopting some of the problem-solving attitudes and actions of the self-made Super Rich, you can potentially put yourself in the best possible position to address whatever issues come your way—and, as a result, build a great business as well as a great life.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.