Posted on: December 1st, 2017

These days, we are seeing the Super Rich—those families with a net worth of $500 million or more—flock to single-family offices like never before.

Should you join them? Can you join them?

As the name suggests, a single-family office (SFO) manages the financial and personal affairs of just one wealthy family. Single-family offices are used by some of the world’s “smartest money” to gain important financial advantages.

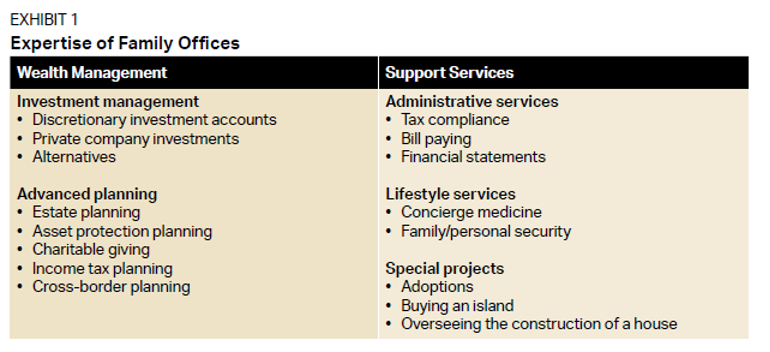

One big reason: An SFO may be able to holistically deliver diverse types of expertise and services to a wealthy family that no other type of organization can, in a coordinated and synergistic manner. By identifying and capitalizing on synergies among various services and products, an SFO may be able to help the wealthy family achieve substantially better financial results in a broad range of areas as well as enjoy a better lifestyle. (See Exhibit 1.)

Example: Investment management services can be made more cost-effective by adroitly combining the investments with certain advanced planning strategies (such as private placement life insurance, charitable trusts and captive insurance companies).

Sounds tempting, doesn’t it?

There’s just one catch: money.

The expertise needed to run a single-family office well and manage a family’s financial assets can be an expensive proposition. One reason single-family offices are used by the very wealthiest families is that SFOs often require a family to possess around $100 million of investible assets in order to be managed effectively.

Money isn’t the only factor people should consider when evaluating whether an SFO makes sense for them—and that $100 million figure is hardly set in stone, as families with less wealth can and do benefit from going the SFO route. But in many cases, money is the key factor that causes families to give SFOs a thumbs-up or thumbs-down.

The good news: Families with less wealth are increasingly able to get access to SFO-like services and experiences.

Here are two options if you haven’t yet hit the Super Rich status—but want to be treated like you have!

Many of the high-end services of a family office are now being offered virtually by networks of experts who are linked together, usually via technology. These experts are extremely interested in working with successful business owners, and technology enables them to offer their services cost-effectively. Therefore, business owners can increasingly build their own personalized near-virtual versions of the traditional SFO.

Near-virtual single-family offices can range in complexity. For example, on the more complex end of the spectrum, we created a near-virtual single-family office for a perpetual tourist. He wanted a single-family office after having decided that the private banks he was relying on were gouging him and not matching his expectations. His major concern was being able to access just about all his resources and elite professional talent anytime, anywhere. Based on his requirements, the answer for him was a near-virtual single-family office.

Essentially, the structure we created for him consisted of a central team of three professionals, supported by six boutique accounting firms geographically dispersed. Each one serves as the resource solution of his near-virtual single-family office when he is in that geographic region. Each accounting firm functions, in part, as the coordinator of a litany of external experts. To ensure privacy, everything runs through his personal team and many communications are encrypted. Finally, a number of customized apps were created to speed up the communications.

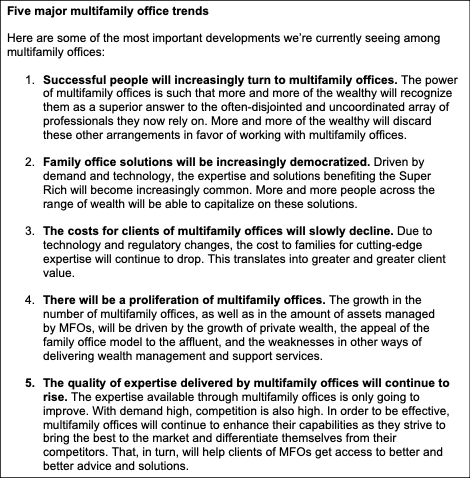

Increasingly, successful entrepreneurs and their families can receive the same roster of high-caliber services and products available to the Super Rich through SFOs by using so-called multifamily offices (MFOs). MFOs can deliver these Super Rich-level solutions holistically and cost-effectively.

Conceptually, the multifamily office emphasizes building deep and lasting advisor-client relationships that are centered on customized financial solutions, specialized expertise (often teams of experts) and highly responsive service and attention. An MFO provider generally serves several families—perhaps as few as three or as many as 50. The amount of wealth needed to tap into a multifamily office model might fall around $10 million to $20 million or so (but this number can vary greatly).

Unfortunately, identifying high-quality multifamily offices can be a little confusing.

There is no standard for what constitutes a multifamily office. In fact, anyone can call themselves a multifamily office—so it’s important to look beyond the title or label a provider uses.

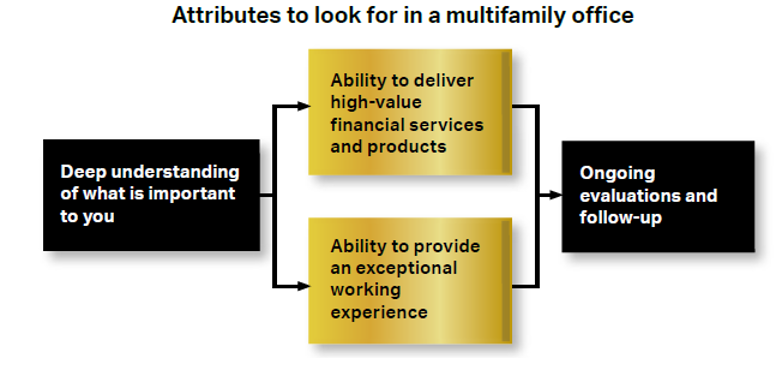

For example, all manner of professionals—including wealth managers, accountants and private client lawyers—can act as multifamily offices. When assessing a particular professional’s skills and abilities, look for the following attributes:

Some other key questions to consider when assessing MFO providers:

If you would like to explore this topic further, we recommend that you contact your legal or financial professional.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.