Posted on: April 1st, 2018

Caveat emptor—Latin for “Let the buyer beware.”

The phrase is sometimes used as a disclaimer for products and services you buy. But it can also apply to the professionals who provide products and services to you. Essentially, it is up to you to do your homework when selecting, say, a financial or legal professional.

And as an accomplished entrepreneur, you probably rely on various professionals (or will at some stage of your business life cycle). That’s because your talents and skills, considerable as they may be, are probably not in money management. Or tax minimization strategies. Or wealth transfer to heirs.

Nor should they be. Focusing on what you do well as an entrepreneur will likely allow you to achieve your highest level of success possible. Therefore, it’s probably in your best interests to turn to financial, legal and lifestyle professionals to help you address issues around your wealth and assets.

Here’s a system we’ve developed for identifying the right types of professionals for your needs and ensuring you work only with them.

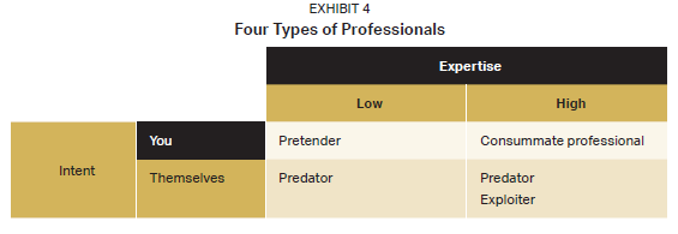

When it comes to their intent and capabilities, all professional advisors can be grouped into four categories (see Exhibit 4). But only the advisors in one of these categories are in a position to help you become seriously wealthy—and keep that wealth.

Obviously, you want to work with consummate professionals who are recognized experts and who are sincerely committed to delivering the solutions that best meet your needs, preferences and goals.

So how do you find these exemplary professionals—especially when so many financial and legal advisors do not fit the bill?

You look for two characteristics.

Successful business owners—and most everyone else, for that matter—want to work with exceptional experts. Very, very often, the exceptional experts are thought leaders.

Definition: A thought leader is a professional who is seen as an authority in his or her field by peers, other professionals, and the people he or she serves. Moreover, thought leaders freely share their expertise—with the intent of providing real value and raising the bar for everyone.

Thought leaders are quite confident in their knowledge and skills, so they are willing to readily share cutting-edge information, insights, ideas and actionable strategies.

Thought leaders typically demonstrate three key qualities:

Probably the most effective way to determine if a professional is a thought leader is to see if he or she regularly introduces you to new ideas, concepts and potential solutions that may be beneficial to you. By sharing new perspectives that might prove advantageous—and doing so often—these professionals demonstrate their breadth and depth of expertise and that they are regularly thinking about ways to bring value to you and your situation.

Important: True thought leaders will also share information and insights that are useful to you but do not financially benefit them. For example, a thought leader might help you understand what concierge medicine is all about if a member of your family is having health issues—even if he or she doesn’t earn any money from sharing that information.

Our research into the Super Rich (net worth of $500 million or more), family offices and ultra-wealthy business owners reveals a telling trend: These extremely successful, wealthy individuals rely on their existing professional advisors. They may occasionally ask a friend, associate or peer for a referral to an advisor, of course. But overall, they much prefer to turn to professionals who have already proven themselves.

When it comes to choosing a financial or legal professional, there are a number of reasons successful individuals rely on the opinions of professionals they currently work with.

You can explore the topic further with your legal or financial professional to help you consider the right next step for you given your unique situation.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.