Posted on: January 1st, 2019

Do you want to have a major impact on a charity or cause that means a great deal to you? Do you want to do well financially by doing good for others in need? Do you want to leave your mark and “make a dent in the universe” as Steve Jobs once talked about?

If so, you’ve got plenty of company.

When we asked 247 highly successful business owners why they wanted to be wealthier, 71.3 percent—nearly three-quarters—told us they wanted to build additional wealth so they could be more meaningfully supportive of charitable causes.

As an entrepreneur, you know that the best results usually come from the best plans—and that’s no different when it comes to giving.

Planned giving is the process of making a significant charitable gift, during your life or at death, that is part of a broader financial or estate plan. In contrast, a charitable donation made from your cash flow is not a planned gift.

Smart planned giving is usually best accomplished as part of your overall financial situation. By taking into account the various assets you have and how they are structured, you can achieve results that are very worthwhile to all parties involved—including you, your business, your family and the charitable organization. To get those results, planned giving is often coordinated with estate or income tax planning that uses advanced legal and tax strategies and/or financial products.

Planned gifts take a number of forms. Generally speaking, planned gifts provide you with a financial benefit on top of tax deductions—benefits that were put into the tax code specifically to encourage planned giving.

The best first step in planning is to understand the lay of the land. Numerous types of charitable gifts fall under the umbrella of planned gifts and planned giving.

1. Will bequest. This is the simplest gift—and the one that is by far the most common among those who have already made a planned gift. Through a will bequest, you leave a charitable gift in your will, and the gift does not go to the charity until the will is probated.

A will bequest meets the personal needs of many people, and it does not require a great deal of involvement during your lifetime. Also, a will bequest does not require a lot of administrative oversight; the estate simply pays out the designated amount to the charity during the probate period. What’s more, will bequests are convenient because the assets are still available to you during your lifetime. Your estate is also able to take an estate tax deduction for the value of the charitable bequest.

2. Private foundation. This is a private, nonprofit organization that receives most of its contributions from a single wealthy individual or family. With a private foundation, a minimum amount of the foundation’s assets must be distributed annually (currently about 5 percent).

3. Donor-advised fund (DAF). Think of DAFs as charities that invest in pooled investment vehicles similar to mutual funds. What you donate earns a federal income tax deduction for the entire gift, because the DAF is technically a nonprofit. You can then, at your own pace, pinpoint certain charities and decide how much to give to each one. The fund will send a check to the charity when you request that it do so.

4. Charitable trusts. For many people with wealth and strong charitable intent, charitable trusts are extremely attractive planned gifts. There are two types of charitable trusts:

5. Supporting organization. A supporting organization is a charity that “supports” one or more other charities. Very similar to a private foundation, the supporting organization must be structured and operated exclusively for the benefit of (or to carry out the purposes of) one or more specific charities. Therefore, once the supporting organization is established and the charities it supports are designated, changes to the beneficiaries aren’t allowed.

6. Charitable gifts of life insurance. This approach to planned giving uses a traditional financial tool—life insurance—in an innovative way. As the donor, you designate a charity as the owner of your life insurance policy. Generally, you can take a tax deduction for the premiums and create a significant charitable gift.

7. Charitable gift annuity. Thisis a contract between you and a qualified charity that exchanges your gift to charity for an annuity (or guaranteed lifelong income) to you. There is a modest income tax deduction for the actuarially determined value of the gift you pass on to charity. As a consequence, charitable gift annuities can be used to reduce capital gains taxes for gifts of appreciated assets—and also reduce estate tax liability.

8. Pooled income fund. A pooled income fund is akin to a mutual fund. The major difference is that the pooled fund is specifically for donors who give to only one charity. Donors contribute securities, cash or other acceptable assets to the pooled income fund, and the charity manages the assets in the fund. An income tax deduction is received for the actuarially determined value of the gift passing on to charity. Pooled income funds are used to help eliminate capital gains taxes for gifts of appreciated assets. Estate tax liability can also be reduced.

Planned giving is often facilitated by an array of professionals, including many working within charitable organizations. This is mainly due to practicality: There are many “moving parts” to coordinating a planned giving effort because of the multiple parties involved—donors, charitable organizations—and the multiple goals that may be being pursued (charitable impact, tax mitigation, estate tax reduction, family legacy development, etc.).

Taking a do-it-yourself approach to charitable planning and giving is possible—but the probability that you’ll miss something important that could impact your ultimate results can be very, very high.

The good news is that there are many high-caliber wealth managers, private-client lawyers and accountants who can be very useful in helping you evaluate whether planned gifts make sense for you—and which options may be ideal for your situation. The expertise of these professionals is especially valuable in helping you implement your planned giving strategy.

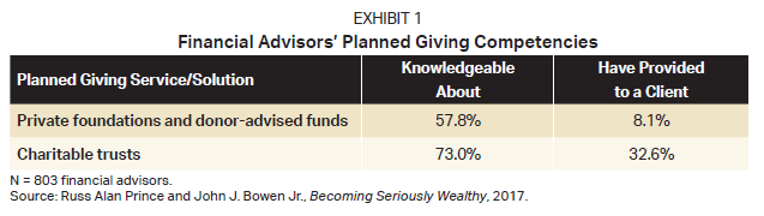

That said, a great many financial advisors are not knowledgeable, not experienced or both when it comes to planned giving. Just look at Exhibit 1, which shows what financial advisors told us when we asked them about their knowledge and use of some common charitable tools.

Therefore, one of the smartest moves you can make is to get a second opinion—either about your current approach to charitable giving and how it is being managed, or about a particular planned giving strategy or product that you are now considering.

Getting a second opinion before taking action is also a wise move even if you have taken action already but are a little unsure and anxious about the path you’re on. This gives you the opportunity to correct mistakes or use solutions and products that can do a lot more to help you accomplish your charitable goals—and have a major impact on a cause you care about.

Action step: Contact your financial or legal professional to assess whether you’re on track to achieve your charitable goals and determine any gaps that could be addressed to help you get there. This can also be a good time to discuss any other financial concerns you may have.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.