Posted on: May 1st, 2020

You’re probably aware that life insurance can offer some powerful advantages. When properly structured, it can deliver liquidity, leverage and flexibility.

The focus of life insurance’s features is often the death benefit and estate planning concerns. But what’s sometimes overlooked is that some life insurance can also be used to fund retirement spending.

Here’s a look at how your life insurance could potentially make your golden years a bit brighter.

A permanent life insurance policy allows you to accumulate money in what is referred to as the policy’s cash account. In other words, you can purchase a permanent life insurance policy with the intention to build up the cash account significantly in order to pay for future retirement expenses.

What’s more, the money in the cash account grows tax-deferred—that is, you won’t pay taxes until you withdraw money from the account.

That said, you might be able to do even better and avoid paying taxes at all—even on the gains in the cash account—if you set up the policy in a certain way.

Here’s how it can work. A portion of the annual premiums you pay for your permanent life insurance policy goes into the cash account. You can obtain these funds without paying taxes—it’s called return of premium. Say, for instance, that a total of $200,000 from your premium payments went into the cash account. You can withdraw the full $200,000, tax-free.

Additionally, you can take out loans on additional earnings in the cash account that have resulted from growth, if there was any growth in the cash account. Such loans are not considered to be withdrawals—which means you don’t have to pay taxes on them. (You can choose to pay back the loans during your lifetime or when you die—at which point, the amount of the loans is subtracted from the death benefit your heirs would receive.)

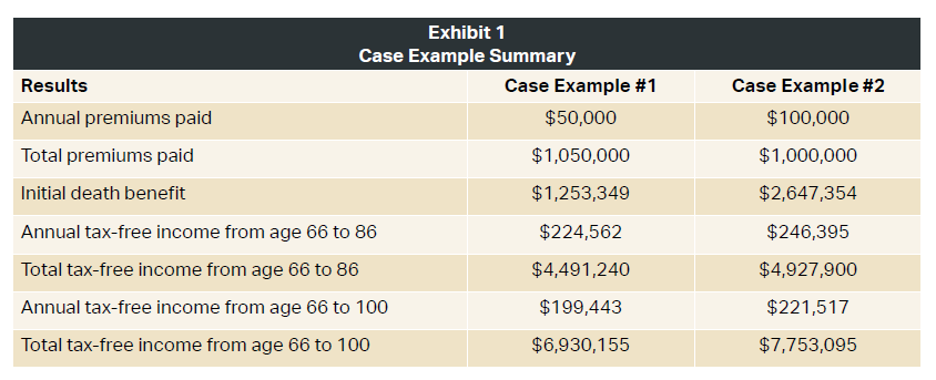

The following case examples provide some perspective on the results of leveraging the cash account in a permanent life insurance policy.

Consider a 45-year-old man in good health who receives a preferred rating from the insurance company, making the cost of a permanent life insurance policy as low as possible. He makes $50,000 annual premium payments for 20 years, until age 65. All told, he pays $1,050,000 for the life insurance (and has an initial death benefit of $1,253,349).

Meanwhile, the cash account grows at an annualized rate of 5.76 percent. At age 65, he has $3,497,980 of life insurance coverage and $2,285,757 in his cash account.

Starting at age 66, the policy provides him with annual tax-free income of $224,562 for the next 20 years—totaling $4,491,240. If he wanted to make sure he had money until age 100, he would take out $199,443 a year. Doing so would give him $6,980,505 total in tax-free income.

A 48-year-old woman in good health pays a $100,000 annual premium for 10 years ($1 million in total). This gives her an initial death benefit of $2,647,354.

The cash value account earns 5.76 percent annually, giving her $2,852,199 of life insurance coverage and $2,376,833 in her cash account at age 65. Using loans, she takes out $246,395 per year over the next two decades for a total of $4,927,900 in tax-free income. To extend withdrawals to age 100, she would take out $221,517 a year for a total $7,753,095 in tax-free income.

Exhibit 1 summarizes the case examples.

As the case studies suggest, there can be potent tax advantages when you use life insurance to help fund your future retirement. But keep in mind, those benefits come with costs—including the cost of insurance and commissions. As with most things in life, there are trade-offs.

Some of the factors that might be considered when deciding whether to use life insurance in this way include:

Important: Withdrawals and loans from a permanent life insurance policy will be effectively tax-free as long as the policy remains in force, until the policyholder’s death. If the policy is surrendered, however, there will be tax implications.

Life insurance can be a very versatile financial product—and permanent life insurance policies, in particular, can generate significant tax benefits for some retirees. Be aware, however, that navigating insurance and using it for income purposes can be challenging due to factors including changes in tax laws, mortality costs and interest rates, as well as the specific terms and conditions of individual insurance policies.

The upshot: It’s important to work with a knowledgeable insurance professional who can help you throughout the process and stay on top of changes that could impact the strategy and require you to make adjustments.

If you think you may need or want additional income during your golden years, consider whether life insurance could be the right move.

Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor.

Disclosure: Investments carry risk of loss, and returns are subject to performance of investment vehicles.

Disclosure: Case studies are based on current interest rate assumptions and current cost of insurance. Review the insurance company illustration and ledgers and contract for what each policy offers.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.