Posted on: February 1st, 2018

Do you own an asset that you’re confident will see a major increase in value over time—like, say, your business, some real estate or even a concentrated stock position?

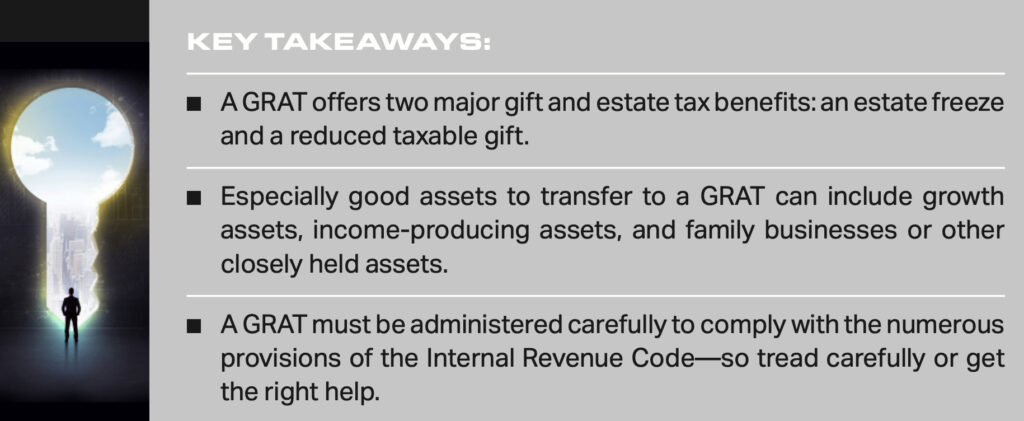

If so, it’s probably the right time to look into a grantor retained annuity trust—or GRAT—as a way to take that future appreciation out of your taxable estate and eventually transfer wealth to heirs in an extremely tax-savvy way.

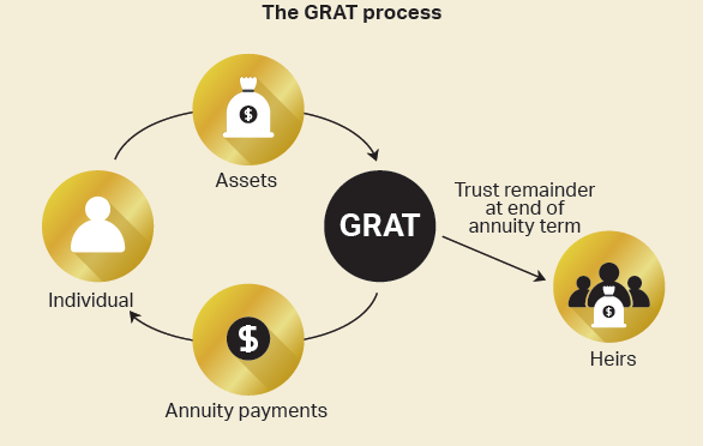

At its core, a GRAT is a trust that can enable you to transfer the capital appreciation on an asset to one or more of your heirs (or another beneficiary) while potentially eliminating the estate and gift taxes that would otherwise have to be paid on the value of the appreciation passing to the beneficiary.

But unlike some other types of trusts, a GRAT gives you an “extra” you might find very valuable: an annual stream of income payments.

Here’s an example of how it might work. Once you transfer assets to a GRAT, the trust is required to provide you an annuity payment for a set number of years (based on the value of the asset contributed and a government-prescribed interest rate). At the end of the annuity term, the assets that are still in the trust pass to your beneficiaries—tax-free.

Important: A GRAT is irrevocable—once you set it up, it cannot be changed. Also, the annuity payments from the GRAT must go to you as the person establishing it—and nobody else.

In effect, the assets in the trust are “frozen” at the value of the annuity payments received. The amount that passes to the beneficiaries of the trust—your heirs—is the appreciation on the property above those annuity payments.

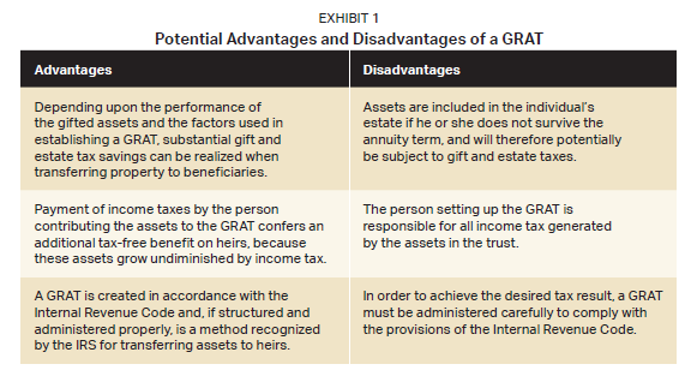

For income tax purposes, the assets transferred to the GRAT are treated as if you still own them. Although you won’t pay taxes when you transfer the assets to the trust, you will pay income taxes on the annuity payments you receive. The good news: That further enhances the GRAT’s effectiveness—since you’re essentially making tax-free gifts to the trust beneficiaries by paying the GRAT’s income taxes, thereby leaving more for your heirs once the annuity term is up.

Warning: Your mortality is far and away the most important driver in a GRAT’s ultimate success as a wealth-transfer vehicle. Simply put, you must survive through the annuity term—otherwise, some (perhaps all) of the assets in the GRAT will be added back to your estate.

To create a GRAT, you determine the terms of the trust and select the assets to contribute. Especially good assets to transfer to a GRAT include:

Each year, the GRAT must pay the grantor the annuity amount. The annuity can be paid in several ways:

After the annuity period ends, any remaining assets pass to the heirs identified in the GRAT. Those beneficiaries can receive the GRAT property outright, or it can be creditor protected and held in further trust for their benefit (depending on the provisions in the trust).

Check out some ways that GRATs can have a tremendous impact on enhancing—and transferring—wealth.

An entrepreneur owns a single stock, valued at $10 million, from an emerging industry that’s become hot with investors. The stock is expected to grow at 15 percent annually for the next few years. The entrepreneur would like to move the appreciating stock out of his estate and transfer wealth to his family.Working with his wealth manager, he decides to contribute the stock to a GRAT. The trust will pay him an annuity for four years, and the remainder will be held in trust for the benefit of his children.

Because the trust is structured so that the value of the gift to the trust is zero, there is no gift tax owed. To allow greater appreciation to compound inside the trust, the investor will initially receive relatively small annuity amounts. Each year, the annuity payment will rise by 20 percent. In years one through four, the annuity payments will be approximately $2 million, $2.4 million, $2.9 million and $3.4 million, respectively.

At the end of the four years, using the assumptions above, the investor will transfer more than $4.5 million to his children—free of estate and gift tax.

A real estate investor owns a portfolio of properties in a limited liability company. The properties don’t generate a great deal of income, but they are expected to grow by 8 percent annually for the next decade. The investor wants to transfer wealth to his descendants but also seeks to continue having an interest in the investments.

Working with his wealth manager, the investor creates a GRAT structure and contributes a $25 million interest to the trust. After the appropriate discounts for lack of marketability and control (non-voting interests) are applied, the interests are appraised at $17.5 million. No gift tax is owed, due to the planning. The trust will pay the investor an annuity for ten years, and the remainder will be held in trust for the benefit of his descendants. The annuity payment will be just under $800,000 in the first year—and just over $4 million in year ten.

The annuity can be paid out of the limited liability company’s interests, in which case annual revaluation will be required. To allow greater appreciation to compound inside the trust, the investor will at first receive a lower annuity amount, with each year’s annuity increasing by 20 percent. Appreciation will be based on the non-discounted value of the interests.

At the end of the ten years, assuming the above rates, the owner will transfer more than $27 million to his descendants, free of estate and gift taxes. The real estate also provides a significant income tax shelter through depreciation, which will continue to benefit the investor during the ten-year GRAT term.

A GRAT must be administered carefully to comply with the numerous provisions of the Internal Revenue Code if you want to achieve the desired tax result.

Action step: If you think this strategy may help you achieve your goals, contact your financial or legal professional to explore whether a GRAT could be the right move for you, your company and your heirs.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.