Posted on: June 1st, 2020

For many affluent families, the issue of effectively transferring assets from matriarchs and patriarchs to kids and grandkids is a key part of their wealth planning efforts.

Those assets might come in the form of stocks and other marketable securities as well as family businesses. Regardless, many affluent families want to pass on their wealth in ways that meet their wishes and result in as light a tax burden as possible.

In seeking to draw on lessons from the Super Rich (those affluent individuals with at least $500 million in net worth), let’s examine how they “pass the baton” when it comes to one very specific aspect of their wealth—single-family offices, which are entities established and run to address the financial and lifestyle concerns of extremely wealthy families.

As with a family business or a sizable portfolio of assets, an often-critical consideration for many of the Super Rich families is transferring their single-family office and their affluence to succeeding generations.

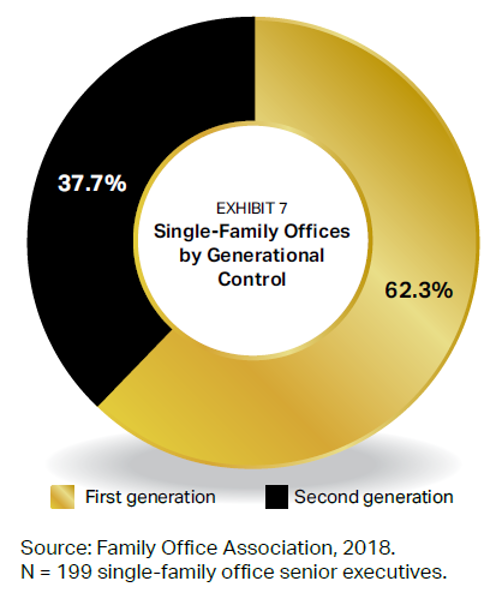

To compare the generations, a sample of first- and second-generation single-family offices was developed (see Exhibit 7). Slightly more than 60 percent of the single-family offices are controlled by the creating (first) generation, with the rest controlled by the second generation, who inherited the single-family offices from the original creators.

Among single-family offices, it is common for the wealthy families to have considerable oversight. That oversight may involve setting broad strategy and making key decisions as well as addressing the acquisition and compensation of talent (such as senior management, dedicated investment professionals and other key personnel).

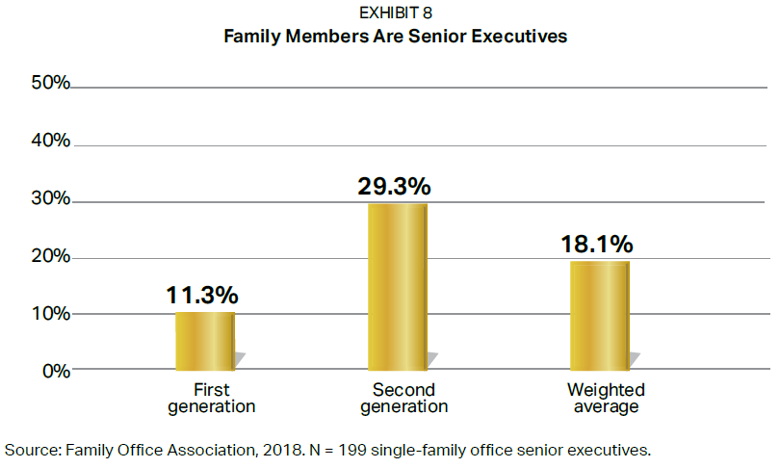

That said, there’s a clear distinction between the first and second generations with respect to who is responsible for the day-to-day operations of single-family offices (see Exhibit 8). Overall, nearly one in five wealthy family members is a senior executive within their single-family office. But note: This is true for just over 10 percent of the family offices controlled by first-generation family members. In stark contrast, nearly 30 percent of wealthy family members in the second-generation-controlled family offices are senior executives.

Why? In our experience, we see that the first generation creates single-family offices to address financial and lifestyle concerns but generally turns to outside professionals to manage the offices. Many of the first generation still have operating businesses to run, and those companies are usually the source of their fortunes. Alternatively, they may prefer to involve themselves in charitable or personal pursuits.

However, for many inheritors, the single-family office is their family business. They are much less likely to be involved in other family business ventures, and more likely to gravitate toward running the single-family office.

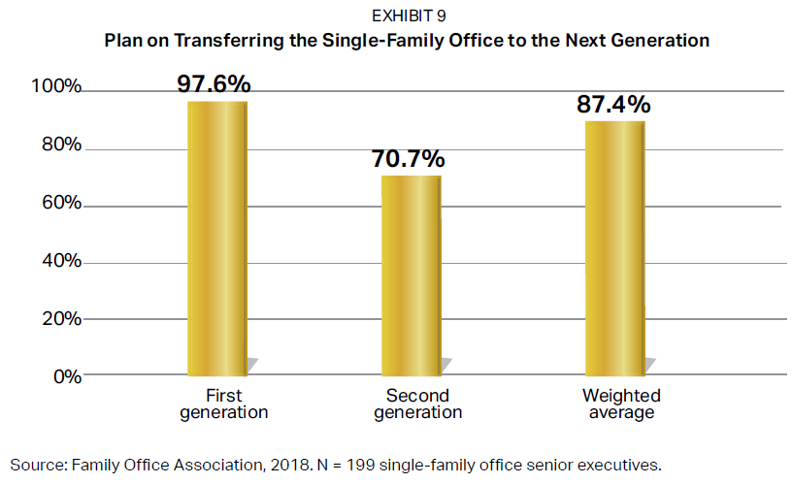

Overall, nearly nine out of ten of the surveyed single-family office senior executives anticipate handing the reins over to the next generation at some point (see Exhibit 9). Close to 100 percent of the family senior executives at first-generation offices expect to do so—versus 70 percent of those at second-generation-controlled single-family offices.

There are generally two major considerations in transferring control and ownership of the single-family office to the next generation: financial and operational. The former addresses ownership concerns in the context of taxes, legal control and related issues. The latter deals with matters such as management structure and ensuring that proper expertise needed to run the single-family office is in place.

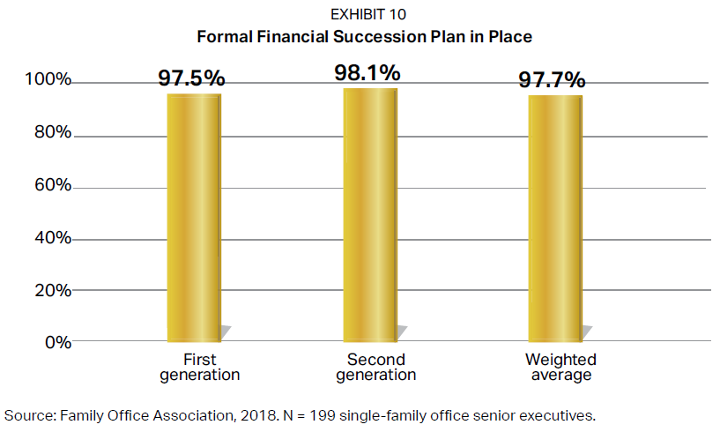

Having a formal financial succession plan in place is characteristic of nearly all the single-family offices (see Exhibit 10). Very often, financial succession plans are interlaced with (or subsumed by) broader family estate plans. That said, ownership and control may still be transferred incrementally over time while everyone involved is still alive.

Caution: While it’s good news that so many formal financial succession plans are in place, it’s possible that those plans are not structured to deliver the results that the families want and expect to see. Existing succession plans can be—and often are, in our experience—outdated due to changes in family circumstances, laws and regulations, and other factors.

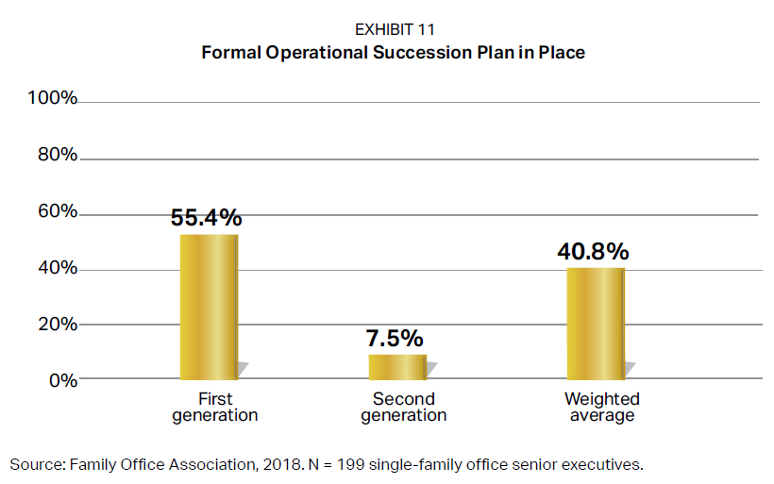

But while formal financial succession plans have largely been addressed, the same cannot be said for formal operational succession plans (see Exhibit 11). Note that just over half of the first-generation single-family offices have such plans in place—and a mere 7.5 percent of the second generation are prepared in this way. In aggregate, just around 40 percent have taken action here.

This lack of comprehensive succession planning may explain why a mere 13.3 percent of second-generation family members said they felt prepared when they took control of their family’s single-family office.

Clearly, even the Super Rich can improve on their wealth transfer and succession efforts. When we examine how they have—and have not—planned for the transfer of assets to their heirs, we can see a few important lessons that all of us should review and consider in our own lives:

The fact that the Super Rich with single-family offices may be overlooking important issues suggests that even the wealthiest (and seemingly savviest) families don’t always have their ducks in a row as well as they could (and should). Be sure you’re tackling wealth transfer from all angles!

Next step: Contact your financial and/or legal professional to discuss your wealth transfer and estate planning goals for yourself and your family.

Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.