Posted on: August 1st, 2021

In many ways, family businesses are the foundation of the economy. Their ongoing success has a pronounced ripple effect, benefiting other businesses and society at large.

But many family businesses—especially those involving multiple generations of family members—often face a big challenge: finding the executive-level talent they need to survive and thrive for the long term.

Family businesses are well served when they develop younger family members to join the company. These people have often grown up in the family business and, consequently, share the value and norms of the family.

Unfortunately, it’s rare for a family to be the sole source of high-quality talent that can continue to lead the business.

As a result, families often have to go to outsiders to ensure they have the range of expertise and capabilities to perpetuate the family business. This need to go outside the family can become especially critical when younger family members pursue different career choices rather than join the family business.

Finding and nurturing top non-family talent can be complicated. The family business must be an environment in which capable, determined executives can succeed and are rewarded for their accomplishments.

Family businesses have used numerous approaches over time as they seek to have their businesses managed by exceptional and dedicated people. There are often three aspects to having the best talent (see Exhibit 5):

When bringing outside talent into the family business, there are many criteria the family can use to evaluate quality and competence. Some of the biggest factors are the person’s track record of accomplishments and temperament. These help the family see what the professionals have done in the past and how well their previous successes relate to what the family is looking for.

This assessment tends to be somewhat harder when it comes to family members. When family members start at or near the bottom of the company and move up, their abilities can be assessed. Another approach is to have family members demonstrate their competence by working for other companies before joining the family business. This ensures these family members are committed to the family business. They are also likely to bring new ideas to the family business.

Unlike family members, non-family talent doesn’t automatically know the values and culture that underlie and support the family company. They need to be formally trained in this area.

Educational programs as well as meetings that concentrate on family history and values are often useful in getting new non-family members up to speed. These are also good ways to clarify what is important to the family. In these sessions, it is often useful to discuss strategic decisions that were shaped by the culture within the family.

Another approach sometimes used by family businesses is to have non-family members become immersed in the values and perspectives of the family business. This might mean hiring non-family executives in the lower ranks of the company and having them “work their way up”—which can be an effective way to ensure the non-family professionals develop the same values as the rest of the family.

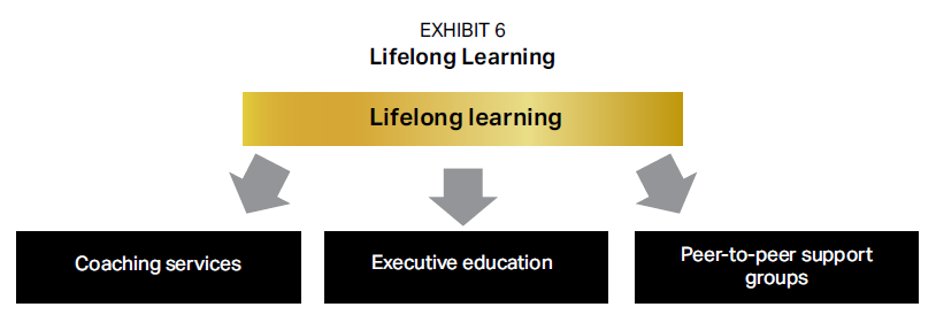

We find that many family businesses are strong believers in lifelong learning. Specifically, to keep the company competitive and successful, family business executives—both family and non-family members—need to always be expanding their knowledge and improving their skills.

Such lifelong learning takes a number of forms (see Exhibit 6):

When these learning resources are aligned with the perspectives of the family business, the attendees are likely to better understand the values and culture of the family business.

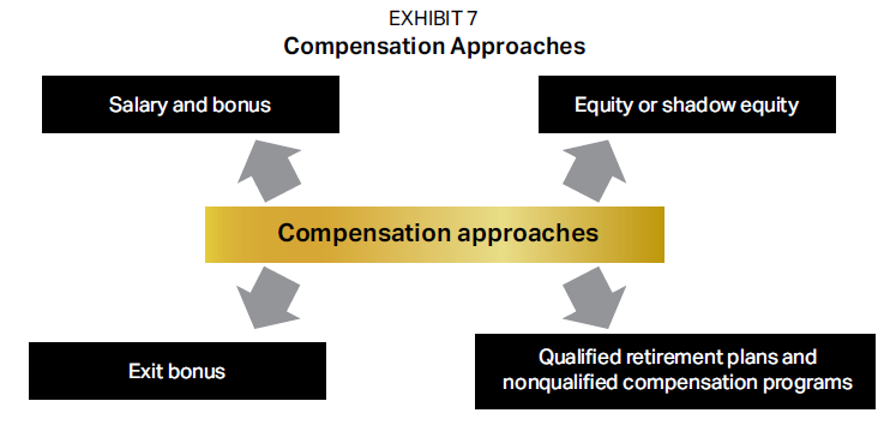

Not surprisingly, non-family executives care about how (and how much) they are being compensated for their expertise and commitment to the family business. In any scenario, the more that compensation is results-based, the more it is perceived as equitable—and the more motivational it becomes.

A number of approaches can be used to construct a compensation package (see Exhibit 7). They include:

Often, a combination of these approaches (and some others) is needed to keep non-family business executives highly engaged and committed to the success of a family business.

Ultimately, family businesses may need to look beyond their circle of family members for leadership that can help them excel. Outside executives must be highly capable, of course—but they should also fit in well with the family business’s culture. For families, figuring out compensation that is fair, smart and motivational is a key concern.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.