Posted on: November 1st, 2021

One reason why the rich and powerful are the way they are is because they commit to achieving extreme success—they “reach for the stars,” as it were—by setting outsized goals that they conclude are attainable. They don’t always succeed, of course, but they have a drive that separates them from much of the rest of society,

Their drive to achieve is reinforced by their actual achievements. In other words, their successes will often breed even greater success—which is known as the Matthew effect, identified by the sociologist Robert K. Merton. It refers to a verse in the biblical Gospel of Matthew describing the preferential acquiring of “rewards” and “stature” by those who already have rewards and stature.

Put in a more modern way: The rich get richer.

When it comes to the rich and powerful, their stature and accomplishments open many new doors. For example, they tend to be introduced to a larger percentage of moneymaking possibilities. Moreover, these various opportunities tend to come with terms that are preferential to them. While there are certainly questions about the fairness of the Matthew effect and its impact on the world, it is a structural facet of society.

Another factor contributing to the greater achievements of the rich and powerful is self-efficacy, which is an individual’s belief in his or her ability to achieve desired results in specific situations. It’s important to see that people with high self-efficacy are quite adept in certain areas that translate into more affluence and greater influence. When they are smart about their strengths and weaknesses, they will delegate other roles and responsibilities to people more proficient in those areas than they are.

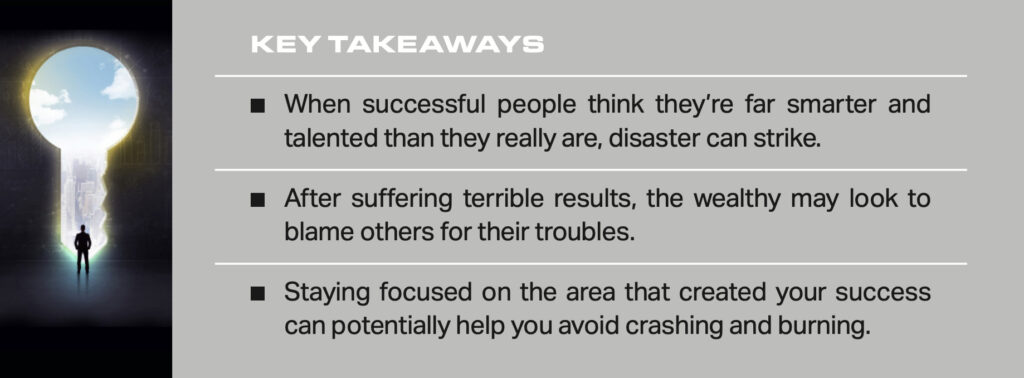

For some of the rich and powerful, the factors that work in their favor—such as the Matthew effect and high self-efficacy—can also lead to serious problems. These factors can warp their perceptions of who they are and what they can realistically accomplish. They can dull a high achiever’s understanding of his or her limitations. While there are some exceptions, there are a meaningful percentage of the rich and powerful who lose sight of what they did to become very influential and wealthy. Instead, they start to see themselves as more knowledgeable and more capable than they actually are.

Among these rich and powerful individuals, narcissistic tendencies start to bloom. They may increasingly believe the world revolves around them and that it is their knowledge and skills that are essential to making things happen. These accomplished and affluent individuals increasingly conclude that they—and only they—are able to sort through the morass and solve the problems across a broad range of situations. Instead of recognizing their strengths and their weaknesses, their perception of their strengths becomes greater as their weaknesses seemingly vanish.

Often, at this stage of the game, these individuals crash and burn—losing much of the wealth and influence they have built. The reason is hubris: an excessive and misplaced level of self-confidence.

Their expanding, unchecked arrogance produced by (and coupled with) their misplaced certainty of their abilities, knowledge and the like will many times result in a series of bad judgments that continue to compound over time. To become rich and powerful, these people very likely found a niche where they excelled. It is within this niche that they showed themselves to be exceptional. Their drive, insights and capabilities translated into their being able to amass significant wealth and influence.

It often all goes wrong when they leave their dedicated niches. Problems regularly arise when they believe their successes in one area are readily—even blatantly easily—transferable to lots of other areas. Such clear cases of hubris commonly result in irrational acts and poor decisions that negatively impact their business and life.

Some famous examples of hubris from literature include:

It is their false sense of invulnerability that more often than not leads the rich and powerful to serious failures, including the degradation and possible collapse of prosperous business endeavors. In believing their decisions are unquestionably correct, even in areas where they have little expertise, they commonly set themselves on a path to failure.

In many cases, this is a function of the “gambler’s ruin.” When gamblers constantly raise their bets when winning but fail to lower the bet when losing, they eventually go bust even when the odds are on their side. Their excessive confidence in their abilities is disproportionate to the laws of probability. This same phenomenon is seen among the rich and powerful who suffer from hubris.

Complicating the whole problem for these people is the “fact” (in their minds) that their failures are outside of their control. And yes, there are times when adverse circumstances are not their fault; sometimes a business endeavor might be upended by, say, a global pandemic!

However, nearly all the time, the failures can be traced back to their poor decisions and actions that were rooted in hubris. So, even if a pandemic was disastrous to their business, the decisions they made and the actions they took to deal with the crisis may have been regularly misinformed and served only to exacerbate the adverse consequences beyond their control. What’s really unfortunate is that due to their narcissistic tendencies, they tend to strongly believe that “others” conspired to get them.

There are usually an array of reasons these “other people” are plotting and striving to bring them down, such as:

For one reason or another, they often believe it is these other people who are actively contributing to the rich and powerful crashing and burning. It is not their actions and decisions, because they were unquestionably right in their assessments and in the courses of action they chose. Rather, it’s some cabal that lays them low. Most of the rich and powerful who have seen their fortunes fall and their authority wane can easily point to people who are gloating over their downtrodden situation. They see this as proof of conspiracies and the like.

The reality is usually much simpler. As these individuals ascended to loftier heights, it is highly probable that they ruffled some feathers along the way. Many of them likely made some serious enemies. Few people amass great wealth and a position of command without antagonizing other people.

For example, an entrepreneur cannot always be nice and agreeable and still build a substantial business. He or she will likely sometimes be disagreeable and even mean to some people in order to grow the company and confront big challenges. So if the entrepreneur succumbs to hubris and consequently severely diminishes the company, people who were offended or who don’t like the business owner may gloat or call it karma. However, that doesn’t mean they created an organized effort of some sort to “take down” the entrepreneur.

Hubris among the rich and powerful is quite often a product of their achievements. Their business and financial accomplishments fuel extreme egotism and a misbelief in the unassailable rightness of their decisions. For too many of them, the consequences are substantial losses and even total disaster.

On the other hand, the rich and powerful who understand their limitations and have strong business and personal support structures tend to stay focused on what they do exceptionally well. This regularly translates into building very significant business endeavors and extreme personal wealth.

It also translates into power that stays strong and influential over time.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.