Posted on: October 1st, 2017

William, an entrepreneur making around $300,000 a year, suffered a debilitating injury that left him unable to stand—let alone work. For the next ten months, he was unable to do much of anything.

Lacking disability insurance, he was forced to take money from his company’s coffers to pay his bills and take care of his family’s financial needs. He also needed to come up with funds to pay for someone to come in and run his firm while he was flat on his back. In the end, he burned through his cash and very nearly went bankrupt.

If you don’t think this could be you someday, think again. Do you realize that you may be three times more likely to become disabled for an extended period than you are to die before age 65?

While death and taxes are life’s only two certainties, it seems disability may be close behind.

Here’s why that’s such a big deal. We’ve discovered that far too many business owners have not taken steps to protect themselves—and their incomes—from the financial carnage that can occur in the wake of suffering a disability.

It’s time to ask yourself a few questions:

Despite the sizable threats that becoming disabled can present to financial security, few business owners actually have disability insurance protection in place.

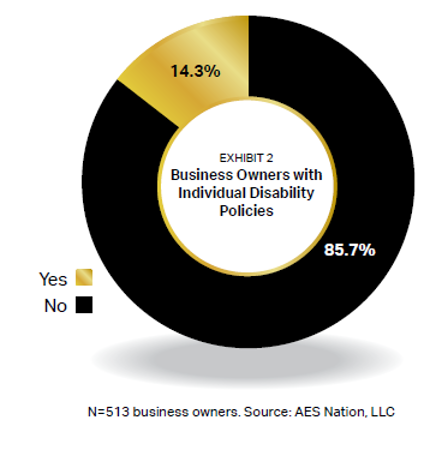

Example: Less than one-fifth of entrepreneurs we studied have individual disability insurance—policies purchased by the business owners themselves that can offset the loss of income that would occur from their being unable to work (see Exhibit 2).

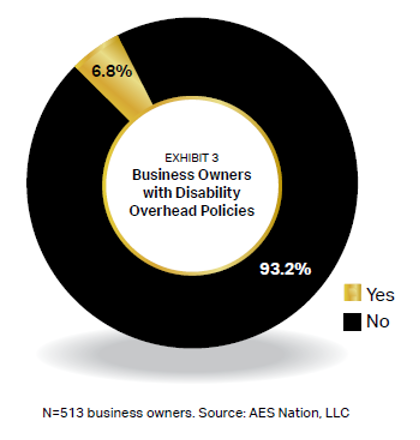

Even fewer entrepreneurs have bothered to buy business owners’ expense disability insurance—which covers business expenses if owners are disabled (see Exhibit 3). These expenses can include rent and property taxes, utilities, leasing costs, accounting costs, business insurance premiums, employees’ salaries and benefits, and other key expenses that help keep the lights on.

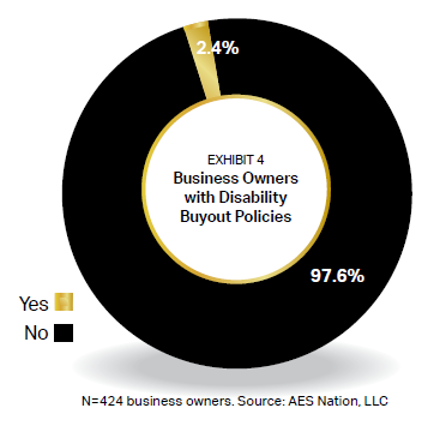

Finally, a minuscule percentage of business owners have buy-sell disability insurance, which is designed to allow a partner to buy out another partner who has become disabled and is unlikely to continue in his or her role (see Exhibit 4).

Not surprisingly, disability insurance—like many other types of policies—can be a jumbled mess of terms that create more confusion than clarity. To break through the noise, start by considering these eight questions when evaluating disability insurance.

There are three basic definitions: “own occupation,” “any occupation,” and “partial” or “residual” disability.

Advice: Look for a disability income insurance policy that considers you disabled if you cannot perform the substantial and material duties of your own regular occupation. Note, however, that this option is not always available. Based on your occupation, you may be eligible for a less comprehensive definition of disability. Don’t dismiss that coverage. Having some sort of protection is better than having none. You can further enhance your policy with coverage that provides benefits in the event of a partial disability.

Note: Benefits are typically not paid until the end of the month following the waiting period. If you have a 180-day waiting period, you’d receive your first benefit check after at least 210 days.

Pro tip: Buy the longest benefit period you can afford. If you remain in good health, most insurance companies will allow you to upgrade your coverage down the road.

By now, you may have realized that you’re among the vast majority of entrepreneurs who lack one or more types of disability insurance, and that you are putting your financial well-being at risk.

If so, what are you waiting for? The time has come to safeguard yourself, your family and your company from potential catastrophe.

Or you may be part of that select group of business owners who have insurance policies to protect their business and income in the event of a serious disability.

If so, it’s time to reassess your current level of coverage and the type of new options available to you. We find business owners often discover that the disability coverage they bought years ago and forgot about doesn’t meet their current needs in one or more of the eight categories outlined above. That’s especially true if your income has risen substantially.

The upshot: As your needs, level of success and health status change over time, your disability protection has to keep up—or else you needlessly put yourself at risk.

Contact a legal or financial professional who can evaluate your unique situation to determine your disability insurance needs, what types of policies could meet those needs and whether any existing policies you have are up to snuff.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.