Posted on: November 1st, 2017

Among today’s top business owners, family is paramount. Taking care of loved ones is the No. 1 reason entrepreneurs seeking to become seriously wealthy want so much wealth, according to our research.

Certainly, you expect to use your wealth to take care of family in the here and now—health care, travel, college tuition and the like. But chances are you haven’t thought nearly as much about positioning your assets so they’re ready and able to help the people you love after you’re gone. Even if you have made some headway in this area, your plan for your estate is probably a little—and maybe a lot—out of date.

If that describes your situation, don’t fret. Even as a successful entrepreneur with many moving parts to your finances, you can get on track by focusing on just three main areas of estate planning: wills, trusts and fiduciaries.

Here’s how to do it.

Read this next sentence three times in a row: Everyone should have a will.

Got it? A will should be the basic foundation of every estate plan—the starting point for a well-conceived strategy to transfer assets at death.

A will identifies precisely what you want to have happen to your assets and estate. Dying without a will means you have decided that the state knows what’s best for you and your family. In addition, dying without a will means you want to make the settling of your estate as difficult, as costly and as public as possible.

As with any decision, there are both positives and negatives to a will. That said, we strongly believe the benefits of writing a will far outweigh the drawbacks.

Advantages:

Disadvantages:

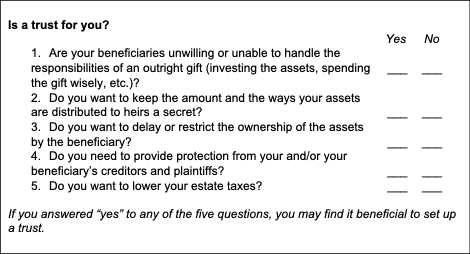

The second component of a smart estate plan is often a trust. A trust is nothing more than a means of transferring property to a third party—the trust. Specifically, a trust lets you transfer title of your assets to trustees for the benefit of the people you want to take care of—aka your selected beneficiaries. The trustee will carry out your wishes on behalf of your beneficiaries.

Trusts are ingenious. You can use them in all sorts of ways to transfer your wealth and determine how it’s to be deployed. They also can prove to be very useful in shielding your assets from plaintiffs and creditors.

In crafting a trust, you are limited only by your own imagination, the ingenuity of your financial and legal advisors, and (of course) the law. As long as you do not establish a trust for an illegal purpose, you have an awful lot of leeway.

Broadly speaking, there are two types of trusts: living (established while you are alive) and testamentary (created by your will after you’ve passed).

Additionally, there are two fundamental trust structures.

A living trust is becoming more and more popular to avoid the cost of probate.

In the probate process, your representatives “prove” the validity of your will. The probate process also gives any creditors the opportunity to collect their due before your estate is passed to your heirs. There may be a long delay in settling your estate as it goes through probate. To add salt to the wound, probate can be costly.

A living trust can avoid or mitigate the effects of probate. It is a revocable trust that you establish and of which you are also typically the sole trustee. The assets in your living trust avoid probate at death, and are instead distributed to your heirs according to your wishes.

Living trusts come with some attractive benefits, including the following:

Mistake to avoid: To make a living trust meaningful, it must be funded. That is, the assets you want in the trust must be transferred to it. If you set up a trust but mistakenly never fund it, probate will not be avoided. You can also write your will to ensure that assets you want in the trust that are not there when you die are transferred to your living trust.

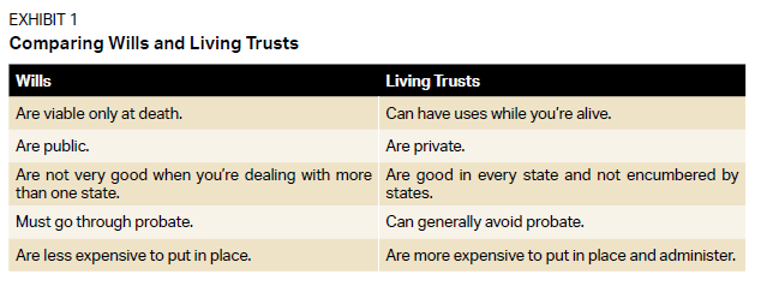

Living trusts are sometimes said to be superior to a will, but that is certainly not the case for everyone. It’s important that you understand how the two compare (see Exhibit 1).

Is a living trust for you? It depends on your particular situation. Nevertheless, you should certainly consider it in consultation with your advisor or wealth manager.

A fiduciary is a person or organization that is ethically and legally bound to act in the best interests of another person and to oversee that person’s finances.

For example, with respect to your will, you need to name an executor. When it comes to trusts, someone or some institution has to be the trustee. And if you have children who are minors, it is imperative that you name a guardian for them—the person or people who are willing and able to take care of your children if anything were to happen to you and your spouse.

After you’re gone, wouldn’t it be nice if there were someone who would make decisions concerning the disposition of your estate as you would have? When you name an executor of your will, this is possible.

An executor has a number of responsibilities, including these:

When you set up a trust, you are specifying how you want a situation managed in the future. It is the responsibility of the trustee to make sure that your wishes are carried out. The explicit responsibilities of the trustee vary depending on the nature of the trust you have set up, but may include the following:

There are three key standards that you need to follow in making this decision:

Sometimes, the decision about who should be guardian of your children is obvious. Example: Your sister-in-law wants the responsibility, and you are confident she will do an excellent job as she has the same views on raising children as you do.

But many times the “right” person or couple doesn’t exist. Keep in mind that your decisions are not set in stone. As circumstances change, you should adjust your decisions accordingly. You can change your will or, for that matter, your entire estate plan anytime your situation changes.

Pro tip: An often-used strategy is to put control of the money in the hands of a trustee and make someone else the children’s guardian. This way, the trustee will make sure the monies earmarked for the children will indeed get to them.

We find that about 85 percent of the estate plans that successful business owners have in place are more than five years old. That’s more than enough time for changes in tax laws, changes in your business’s fortunes and your personal wealth, and changes in your family situation to make your plan outdated and out of touch with your wishes. We recommend that your estate plan be reviewed every year or two. The review should be conducted by a high-caliber wealth manager or tax professional—one who takes the time to learn what’s changed since you put your solutions in place, assess how those changes might impact your strategy, and make recommendations for getting your solutions current and in accordance with your wishes.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.