Posted on: April 1st, 2022

If you’re like most successful people we know, you’re probably seeking truly valuable financial advice that’s designed around maximizing your ability to achieve your most important objectives. That’s likely the case whether you’re an entrepreneur or an employee, or you’ve inherited significant wealth.

One often overlooked way to help make that happen is to work with professionals who are able to connect with you and relate to you. You want to surround yourself with experts who know you well enough to really “get” what you want your money to accomplish, and why.

In fact, we’ve found over the years that a personal connection between advisors and their clients is as important to financial success as traits such as advisors’ competence and resources. That doesn’t mean you have to be best friends with your advisor, of course. But there should be some sort of affinity there.

To get advice that works, it’s incumbent on you to understand your own high-net-worth (HNW) personality so you can select and work with advisors who are an ideal match.

HNW psychology is all about understanding what the affluent want from the professionals they work with, as well as the “how” and “why” behind their attitudes and decisions about their money. Developed in the late 1990s, HNW psychology has been verified through the study of thousands of wealthy investors ever since. It’s also been adopted by elite, forward-thinking financial advisors and other professionals.

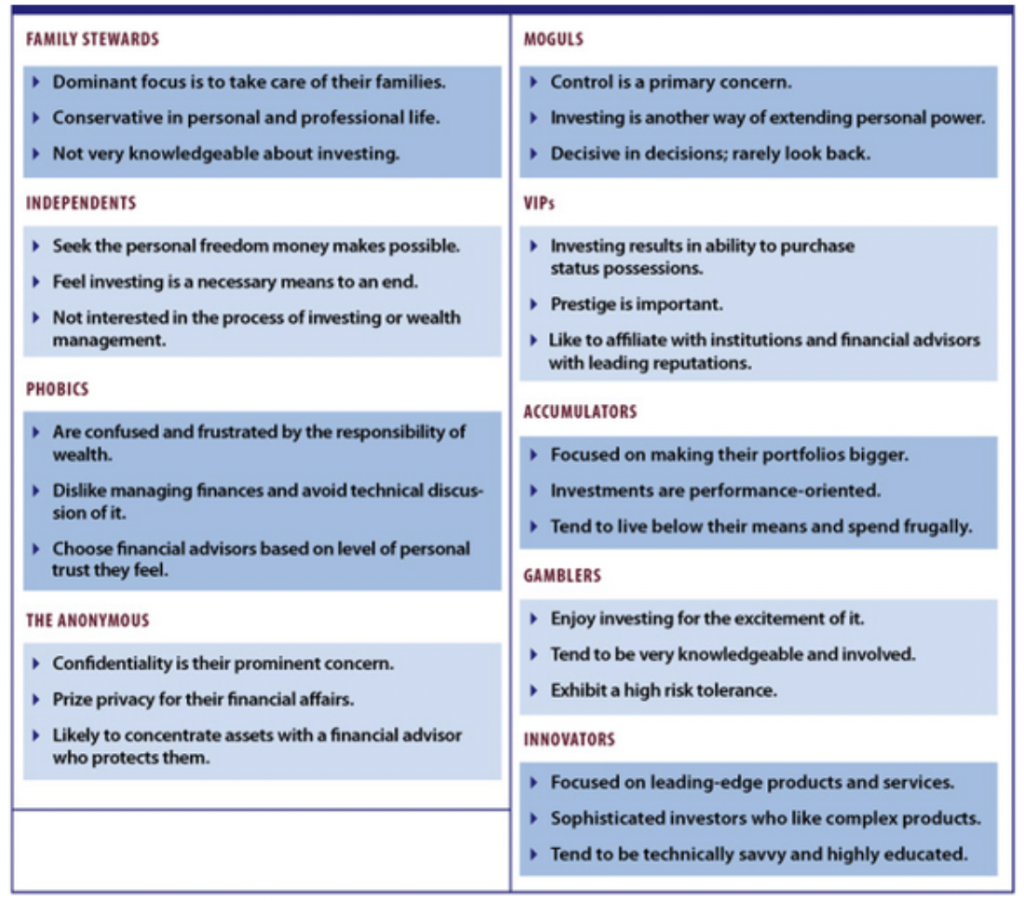

The results of this work in HNW psychology have helped researchers identify nine HNW personality types (see Exhibit 1). Chances are, you fall into one of these nine categories:

Exhibit 1

At a Glance: The Nine High-Net-Worth Personalities

Note: There’s nothing inherently good or bad about any of the personality types. Each one simply reflects someone’s core beliefs and ideals about money and wealth.

If you choose to work with an advisor, it’s important to partner with one who shares your particular HNW personality—or who at least knows how to work well with your type.

It’s not just because it’s nice to work with someone who thinks similarly to you. We believe that working with an advisor who doesn’t understand or appreciate your core values could potentially cost you financially.

Example: Say you’re a Mogul personality type who is seeking outsized returns and willing to take substantial risk to maximize the probability of obtaining your goal. You’ll probably be poorly served and disappointed by an advisor who favors conservative investments. Likewise, if you’re a Phobic and your advisor constantly wants to talk about the investment process and the gyrations of the markets, you’ll find yourself having an unsuccessful—and unenjoyable—investment experience.

The upshot: Your wealth needs to be positioned to support what you care about most in life. And you need to be able to trust the advice you’re getting, as well as the source of that advice. If your advisor doesn’t “play well in the sandbox” with someone like you, you’ll receive none of those benefits—which, in turn, could mean you won’t grow and protect your wealth according to your wishes and beliefs.

Which type fits you closest? You may find there is some overlap, but chances are one category describes your personality best most of the time. We tend to see that most people are Family Stewards—they do what they do in order to help give their spouses, children and grandchildren more opportunities in life.

If you’re not sure or want to conduct a reality check on your assumption, write down some answers to these four questions:

If, by contrast, you’re an Independent, your answers will probably include goals like buying your dream house or sailing around the world. In other words, you will place the highest value on using money to buy personal autonomy and freedom to do exactly what you want to do in life—and your advisor will need to understand and account for those drivers when serving you.

If you associate feelings of power, importance and control with money, you are most likely a Mogul. You see having more money as having more ability to influence people—ranging from family members to business contacts to community leaders—and events to your advantage.

If you really enjoy being recognized and acknowledged, and enjoy prestigious surroundings and possessions, you are likely a VIP. That means you are interested in what money can do for you mostly in terms of gaining material possessions: a wonderful new house, fabulous trips, a new boat. VIPs tend to invest for what money can buy and the lifestyle it can confer.

How important to you is confidentiality of your financial affairs? Just about everyone cares about confidentiality, of course. But if you are deeply concerned about this issue and feel almost secretive about your financial affairs, consider yourself an Anonymous personality type. You’ll want an advisor who has systems in place to ensure the security and confidentiality of your financial data—and who explicitly details those measures to you.

Armed with a good idea of your high-net-worth personality type, you can assess whether the advice you are getting today reflects that type. It’s another key step in helping to position yourself to achieve an elite wealth management experience.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.