Posted on: January 1st, 2019

As a busy and successful person, it’s highly likely that you prefer to get guidance on the many financial issues in your life—from investing to taxes to estate planning to wealth protection and beyond.

It’s also highly likely that you’d like that advice to come from extremely qualified and capable professionals—experts who have your best interests at heart and who have the skills and capabilities to add tremendous value to your bottom line.

The bad news: There are hundreds of thousands of financial advisors and other professionals practicing today. That can make the search for top professionals feel like finding the proverbial needle in the haystack.

The good news: You can seriously boost your probability of success by taking the steps that the Super Rich (net worth of $500 million or more) use to find their experts.

Here’s how the Super Rich do it—and how you can, too.

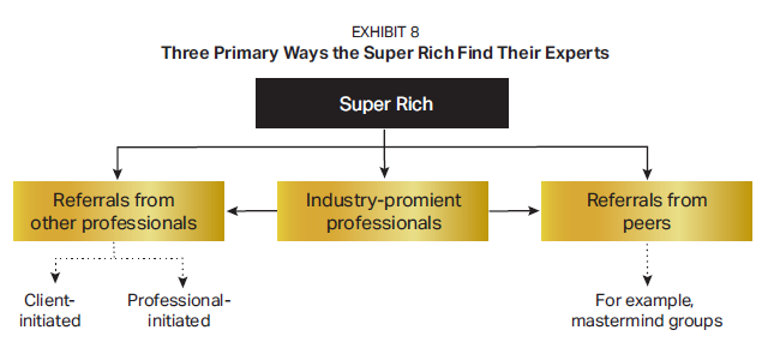

Our experience working closely with the Super Rich tells us that they consistently find high-caliber professionals in three main ways.

These three ways dominate how the exceptionally affluent find elite wealth planners. There are other ways Super Rich families connect with high-caliber professionals, but they’re more the exception than the rule. See Exhibit 8 for an overview.

Now let’s look at each method in more detail.

High-end professionals tend to know other types of high-end professionals. Their paths often cross from working with the same rich and Super Rich clients, as well as at industry events, conferences and the like. If a skilled money manager and a wealth planner work for the same client, and work collaboratively to help that client, their experience will give them a good feel for each other’s skills and integrity.

These referrals tend to play out through two main scenarios:

The second most likely way the Super Rich find a high-caliber expert is through an introduction by a business associate or another type of peer they trust. This can, of course, be a highly effective approach for you to use as well—especially if you are already on the path toward building serious wealth, as is likely the case.

Furthermore, we see that the likelihood of getting peer referrals goes up exponentially if you have built relationships with peers by getting to know them through specialized or exclusive groups.

For the Super Rich, examples include organizations and events like the World Economic Forum conferences, the Milken Institute Global Conference and Bilderberg Meetings. It is at these gatherings that the Super Rich connect with each other and build meaningful relationships. Based on those relationships, they’re usually willing to share the best professionals they’ve found in their own lives—including elite wealth planners.

For those of us not yet at the Super Rich level, there are other promising options. One example: mastermind groups. In top-of-the-line mastermind groups, very successful individuals are willing to tell other members about their experiences with the professionals they employ.

Essential: Just as the Super Rich do, you must develop rapport and trust with a peer before you can expect him or her to make a referral. That’s why mastermind groups and other organizations that foster community and an environment in which members support each other can be so valuable.

Some professionals in the financial and legal worlds are well-known among their peers and competitors for all the right reasons They have a powerful and influential professional brand that acts like a magnet—drawing the rich, the Super Rich and other leading authorities to them.

These “brand name” professionals have several key characteristics:

Important: This doesn’t necessarily mean a financial professional you see all over billboards and television. Instead, these professionals tend to be well-respected by the key players in their industry. They may very well be unknown among the mass market.

This prominence ultimately brings us back to referrals. Because of their focus on making things better for their clients and even the clients of other professionals, high-profile professionals are more likely to be referred by other professionals. They are also more likely to be referred to others by their Super Rich clients.

Example: Industry-prominent professionals tend to be quite successful in being asked to present at mastermind groups.

Clearly, to get great referrals to professionals, it’s helpful to “run in the right circles”—that is, to already be working with at least one professional you think is of extremely high quality, or to have people in your life who are already working with such professionals. Those become your access points to financial experts who may be able to add tremendous value to your life.

If you’re currently working with a professional you think is great, you can certainly ask for recommendations for other professionals he or she might know or partner with.

If not, and you’re looking to build a team of experts from scratch, you might consider reaching out to us. Our team can introduce you to an elite wealth manager* who can help you identify where you are today financially, where you want to go, any gaps and how you might bridge them.Action step: If you think you or a family member could use some help building a team of financial experts, contact your current legal or financial professional to explore the topic further.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.