Posted on: July 2nd, 2019

One of the best plays to take from the financial playbook of the Super Rich—those with a net worth of $500 million or more—is to work with professionals to help manage your financial and lifestyle concerns.

But as the Super Rich know, you can’t stop there. Just as former-President Reagan urged a “trust but verify” approach regarding a nuclear missile treaty in the 1980s, we also need to regularly assess whether the financial advice we get—and the financial solutions we rely on—are truly up to snuff. We have seen that many of the Super Rich take this step. It’s something you might consider, too.

The reason: Despite your best efforts, it’s possible to mistakenly end up working with a type of financial professional we call Pretenders—professionals who want to do a great job, but who just don’t have the skills or resources to make it happen. Even worse, you might cross paths with an Exploiter (someone who offers highly aggressive solutions that push the envelope of legitimacy) or even a Predator who wants to steal your assets.

That’s where a technique known as stress testing can make a big difference.

A stress test can help you see whether the wealth management solutions you are using are not only in alignment with your goals and objectives, but are also appropriately state of the art. Stress testing is a systematic way to determine how the wealth management solutions you have are likely to hold up under different scenarios—and ultimately deliver the results you expect.

The rationale for stress testing by the Super Rich is twofold (see Exhibit 1):

One big reason why wealth planning efforts may possibly be in need of fixing or fine-tuning is because, based on our experience, some investors—including both the Super Rich and the “merely affluent”—do piecemeal planning. The result is there’s little to no coordination between the various professionals helping them, and little to no coordination between the various financial solutions or strategies they implement. Because of the fragmented and disjointed nature of how a plan may have been developed, it isn’t set up for potential success nearly as well as it could be.

Stress testing allows individuals and families to look at their situation holistically to see whether their goals and objectives are being addressed and they are using the most appropriate, cost-effective and up-to-date wealth management solutions.

Not surprisingly, we see stress testing being used by many of the Super Rich—especially those with truly significant wealth who have family offices. But it’s also an approach taken by some “merely wealthy” investors who want to boost the probability that they’re using the best wealth management solutions for their particular situations. The overall trend of democratization in financial services—which has brought once-exclusive solutions to more investors—is also bringing stress testing to a bigger audience.

There are many wealth planners who can skillfully address the technical aspects that stress testing involves. They might, for example, critically evaluate a family’s estate plan to hunt for any operational errors and/or identify more appropriate and more cost-effective strategies. They might also determine whether there are synergies between the various types of wealth solutions the family uses—and if there aren’t, how such benefits could be created.

All that said, technical proficiencies will not get you the results you are looking for.

The real key to effective stress testing is profiling. To decide whether the wealth management solutions you have are viable—and the very best for you—you must understand exactly what you are trying to achieve. That means asking questions such as:

Answers to these (and related) questions should be the driving force behind stress testing, because stress testing is never simply about legal strategies or financial products—it is about you and what is important to you. Without sensitivity and responsiveness to this human element, stress testing loses its power and value.

Just like their wealthier peers, many affluent individuals and families who aren’t (yet) at the Super Rich level want to make sure mistakes aren’t being made and that they’re not missing out on opportunities.

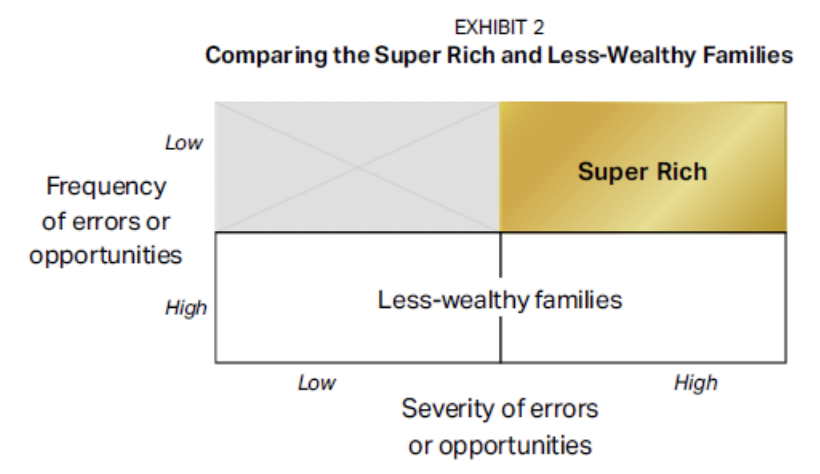

However, in our direct experience working with both Super Rich families and with less-wealthy families as advisors and consultants, we have often seen a difference between stress testing with these two groups. In stress testing the wealth management solutions of the Super Rich, there are likely to be fewer errors or opportunities for improvement compared with those for the less wealthy (see Exhibit 2).

The difference essentially boils down to the caliber of wealth management professionals engaged by many Super Rich families. These professionals tend to be more diligent about their clients’ matters. One caveat: When problems are found among the Super Rich’s solutions, they may be quite severe due to the amount of money involved and the level of complexity of the solution.

Example: In stress testing the estate plan of a multibillionaire, it’s determined that because of the significant changes in family dynamics and needs that have occurred between the time when the estate plan was signed and today, the likely outcome after his death would be an all-out war among his children. That conflict would probably be the death knell of the 200-plus-year-old family business. By thinking through the situation with an intense focus on the human element, a new estate plan and well-structured succession and asset protection plans were designed.

When the relatively less wealthy stress test their wealth management solutions, more errors and missed opportunities tend to crop up. One possible reason: This group is more likely to be working with Pretenders who, despite their great intentions, don’t have the expertise and ability to dot every “i” and cross every “t.”

Example: Most “merely affluent” families do not have a large enough umbrella policy, which can set the stage for a very costly and emotionally draining outcome. This is an issue that is easy and usually inexpensive to correct. Similarly, we see that business owners who do stress tests commonly find they have life insurance that is poorly structured and therefore isn’t set up to mitigate risk as well as they assumed.

When is the right time to consider a stress test on your finances? Bottom line: Whenever you are not 100 percent sure you are using the best available wealth management solutions—and, as a result, you are concerned that:

By stress testing your plan or specific aspects of it, you can potentially confirm that you are on target—or identify corrections that will put you on the right track toward the end results you most want to achieve.

Discuss your wealth plan and solutions with your advisor to ensure they remain set up to accomplish your goals

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.