Posted on: October 1st, 2020

You can do thorough wealth planning and implement a financial product, tool or strategy only to end up with unexpected and disappointing results.

Why? Perhaps something about the strategy you implemented changed. Or maybe a new law was passed that impacted its effectiveness. It’s also possible that something occurred in your own life that made your current strategy insufficient or less than ideal. Let’s face it: Life isn’t static—and new developments can sometimes mean existing solutions no longer cut the mustard.

The Super Rich—those people with a net worth of $500 million or more—are fully aware of this. What’s more, they often take steps aimed at avoiding being surprised by negative or undesirable results from their wealth planning.

The good news: You can do the same thing, even if your bottom line is far smaller. Here’s how.

Some of the Super Rich have single-family offices to engage the very best professionals to help manage their finances and address lifestyle concerns. Single-family offices are organizational entities dedicated to the financial (and often personal) well-being of very wealthy families.

A major reason for the single-family office is to ensure the family is getting the best results possible. Consequently, one objective is to work with the best of the best. These professionals can be employees of the single-family office or external experts engaged to address specific matters.

The complication: There are times when even single-family offices are not working with the best of the best. Sometimes they end up working with Pretenders—well-intentioned professionals who are just not as technically proficient as circumstances require. But sometimes mistakes and oversights happen even when the very best professionals are engaged.

So what do they do? To make sure they’re getting what they need and want in terms of expertise, services and solutions—and to determine whether those solutions remain on track to deliver expected results—the Super Rich and single-family offices engage in stress testing.

Stress testing is a systematic way to evaluate whether the financial (and other) expertise the family is using likely will deliver the results they expect and to ensure they are not missing any meaningful opportunities that could enhance their outcomes.

Stress testing generally is done because of anxiety about the current state of affairs. The Super Rich—as well as many other less-affluent families—might opt to stress test when they feel uncertain about their overall current financial or legal situation or about some particular aspect of their situation. By stress testing, a single-family office can help make certain that the family is indeed getting or employing the best solutions for their unique circumstances.

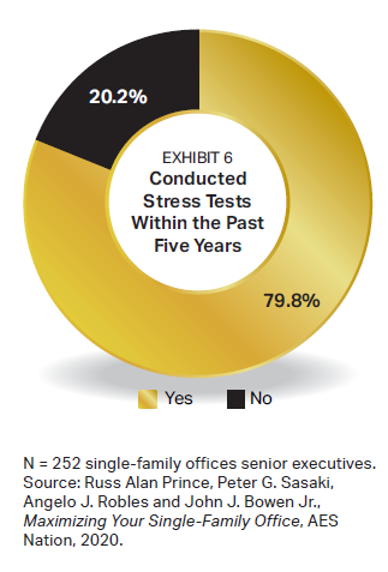

In a survey of 252 single-family office senior executives, about 80 percent of them engaged in stress testing within the past five years (see Exhibit 6). This demonstrates the pervasiveness of stress testing among even extremely wealthy families—who we find tend to employ some of the finest professionals available. Even they are strongly inclined to make sure everything works the way they want it to.

Important: You don’t have to be extremely worried that something is amiss with a strategy before you engage in a stress test. Stress testing can be valuable even when the probability of something being wrong with a solution is quite low. Say, for example, that a mistake or error involving a particular strategy you’ve implemented likely would be extremely harmful to your financial well-being. It might make sense to stress test that strategy just to be certain that you’re not headed for a disastrous result.

It’s important to note that stress testing is not one approach. There are actually two types of tests: comprehensive and focused.

Comprehensive stress testing involves many aspects of a family’s financial and nonfinancial lives. For stress testing to be considered comprehensive, we believe three or more particular sets of services or products initiated within the same 18-month period should be assessed. In contrast, focused stress testing involves fewer than three sets of services or products initiated in the same 18-month period. Often just one aspect of an overall wealth plan is tested at a time.

Comprehensive stress testing is much more involved, time-consuming and costly than focused stress testing. In contrast, focused stress testing is more targeted (and thus less expensive and time-intensive).

As seen in Exhibit 7, focused stress testing is far and away the more common approach used by single-family offices. Generally speaking, only when the single-family office is experiencing a system failure of some kind—something dramatic that impacts many aspects of a family’s world—is it likely to undertake comprehensive stress testing.

The goal of stress testing is to identify errors and missed opportunities. And it turns out, that’s what happens fairly regularly. In the study, more than 40 percent of single-family offices found faults because of stress testing. Clearly, mistakes occur—even among top professionals. Thanks to stress testing, they potentially can be fixed before problems get serious.

It is important to note that stress testing at single-family offices can and often does extend beyond addressing wealth management and related legal matters. It also is applied to evaluating lifestyle decisions. For example, more of the wealthy are stress testing their family security measures—such as making sure their homes are truly well protected from burglars.

Let’s assume you’re not a multimillionaire with your own single-family office. You can still engage in stress testing to help you determine whether your wealth management solutions remain on target to deliver the desired results. And you still can use stress tests to see whether there are any opportunities that you aren’t currently taking advantage of but should consider, given your goals and situation.

In other words, you can take a page from the playbook of the Super Rich and evaluate your current solutions. We also see that a growing number of professionals are becoming familiar with and adept at the stress-testing process. This is translating into more stress testing, which is a good thing. Many mistakes are just that—mistakes. They are unintentional but can have severe consequences. By stress testing, you can make sure the professionals you are working with are indeed getting everything right and you are not missing out on meaningful opportunities.

Some areas where we frequently see focused stress testing being done include investment portfolios, estate plans and business succession plans.

The upshot: You can put some, many or even all aspects of your financial life through their paces to see whether they’re still set up to do what you want them to do and deliver the results you expect. If you take this step and engage in stress testing, you’ll be following in the footsteps of some of the wealthiest, most successful families—the Super Rich.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.