Posted on: April 2nd, 2019

Many entrepreneurs looking to sell their companies focus most, if not all, of their attention on getting the best price—maximizing the sale value. Most professionals who help business owners sell their firms do exactly the same.

They all could be making a big mistake.

The fact is, selling a business is typically not simply about getting the best price. It’s as much about how much money the entrepreneurs (and their families) pocket coming out of the sale—and what to do with all that wealth. (Often, there are other concerns that transcend money, such as ensuring that senior management keep their jobs.)

These and other issues fall under the broad umbrella of comprehensive exit planning—a type of advanced-level planning that a growing number of successful entrepreneurs are engaging in when it comes time to sell their businesses.

Let’s take a closer look at this important step in the process of selling a company.

Selling a business is usually one of the most significant—if not the most important—transactions in an entrepreneur’s career. The owner has created value in his or her company and is now about to harvest a great deal of that value!

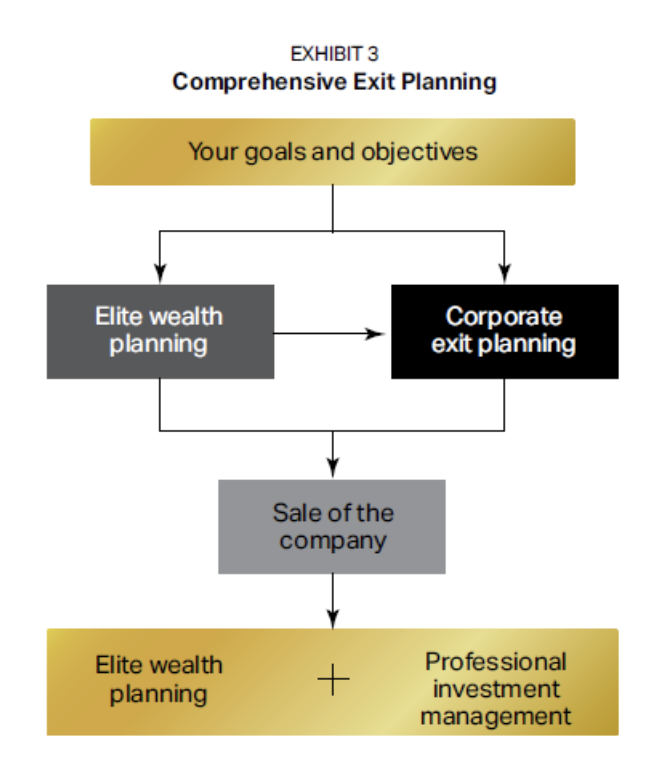

Comprehensive exit planning takes corporate exit planning—the sale of the business itself—and adds in strategies and solutions involving both personal wealth maximization and family wealth protection to get a broader range of results the owner desires (see Exhibit 3).

If you are a business owner, the starting point of the comprehensive exit planning process is identifying your goals and objectives. Your expectations—from what you want to happen to your business to what the next stage of your life is going to look like—are instrumental in determining how you approach comprehensive exit planning. This is where going through a discovery process with a financial professional can be extremely helpful.

Once your agenda is set—keeping in mind you will likely refine it over time—you can move on to elite wealth planning and corporate exit planning.

Elite wealth planning is typically focused on the personal side of wealth. It is a comprehensive planning process that brings together state-of-the-art technical expertise, legal strategies, financial products and the human element in a synergistic manner.

Definition: The human element is the personal and emotional component that includes everything and everyone that is important to you—as well as everything and everyone that could be affected by the wealth planning.

For many entrepreneurs, elite wealth planning seeks to achieve two goals:

Many business owners sell for less than they potentially can get. While they may be great at running their companies, they tend to know little to nothing about selling businesses for maximum value. As a result, they make mistakes and shortchange themselves.

Corporate exit planning is a strategic guide for selling your business. It addresses the sale process—taking into consideration your overall goals and the concerns you might have.

It makes sense to start this planning well in advance of a sale; depending on the nature of your company, it might take months or even years to make sure all the pieces are in place to generate maximum sale value.

Example: Many privately held businesses are dependent on the founders to continue making the company successful. Therefore, they need to be made redundant. That can mean putting highly capable people in place who can essentially replace the founders and who will stay with the company when it’s sold—a process that could take years.

There are a number of steps to creating a strong corporate exit plan, including:

Effectively marketing the company. Marketing can play a major role in selling a company. The ability to identify a larger number of interested buyers, for example, can create a competitive environment that can prove very beneficial to you.

After the sale of your business, your personal world will change—usually quite significantly. It’s then that elite wealth planning comes roaring back into the picture. For example, you may very well need to upgrade your estate plan. You might also benefit from restructuring your asset protection plan.

Of course, there’s also that large pool of liquid assets that the sale probably created—assets that you need to decide how to manage. If you lack the expertise, it is critical to identify high-caliber professionals who can invest your wealth in alignment with your goals and objectives.

We see other issues that also become important post-sale. For example, families often embrace philanthropy in a bigger way after selling their companies—as they suddenly find they have the time and money to donate to the causes that are deeply meaningful to them. This can open up the need for charitable planning and the formation of private foundations, donor-advised funds and other philanthropic vehicles.

Ultimately, a comprehensive exit plan will accomplish four things:

If you’re a business owner and have such a plan in place, congratulations! You may very well be set up for success.

Contact your financial professional to discuss any issues or concerns you might have around selling your company or preparing to sell it down the road. Some advanced planning now might be valuable to you when the time comes to exit.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.