Posted on: November 2nd, 2018

Selling your business is one of the most important, complex and emotionally challenging experiences you’re likely to face as an entrepreneur. You’ve got one chance to get it right—there are no do-overs—so you’ve got to play it smart.

That’s probably why we see so many business owners seeking out professionals such as investment bankers, business brokers and other specialists to help guide them through the pre-sale, the transaction itself and even some post-sale decisions.

If you’re preparing to sell your company—or even if you think a sale is possible at some point down the road—you should consider whether it makes sense to join your peers and enlist an investment banker (or similar professional) to help you along the way.

Here’s how to decide—and what to look for if you determine you need an investment banker.

While it is certainly possible to sell your company entirely on your own, it’s very likely that an investment banker on your side will result in better deal terms, a higher sale price or both. Indeed, those are the main reasons so many business owners seek out I-bankers.

For example: In one study, 84 percent of the surveyed group—business owners who sold their businesses with the help of investment bankers for between $10 million and $250 million—said the final sale price was equal to or higher than the banker’s initial sale price estimate.

There are many reasons why these results occur. I-bankers tend to possess knowledge and skills in key areas that help you get better results than you could achieve on your own. Key skills they bring to the table include:

Pro tip: Enlisting an I-banker can be a good idea even if you have already identified one or more potential buyers and don’t need help in that area. For example, say you lack experience in business sale transactions. You might end up with a subpar deal if you do it all yourself. What’s more, an I-banker can find additional potential buyers apart from the ones you know—and create a competitive situation that could lead to a higher sale price for you.

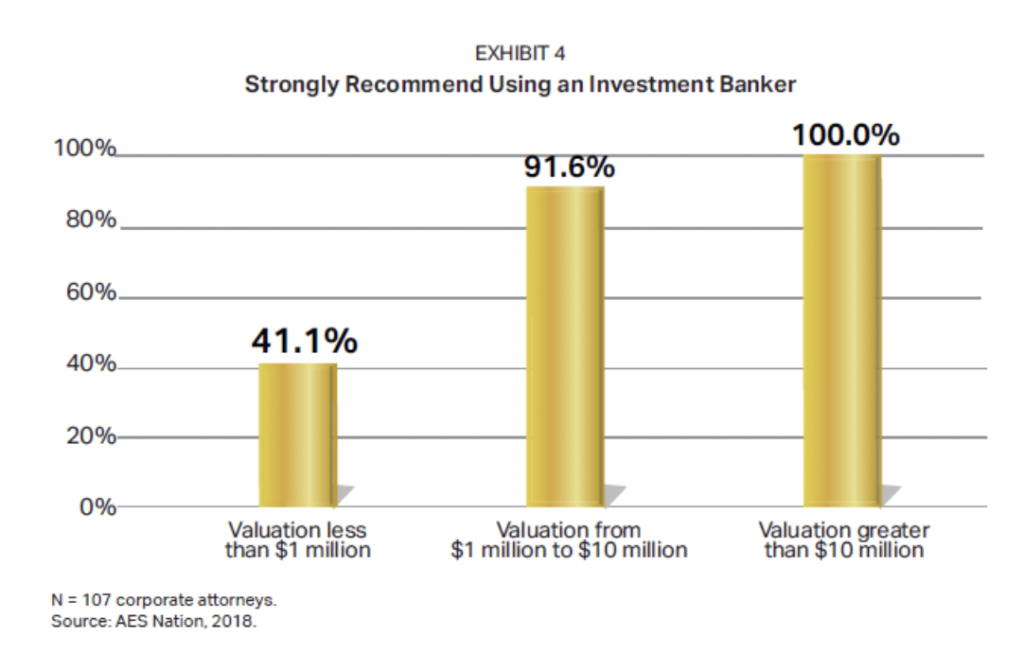

There’s an important caveat to working with an I-banker: These professionals tend to add the most value for owners of businesses valued at $1 million or more. And the greater the valuation above $1 million, the more likely engaging an investment banker would be a smart move. For example:

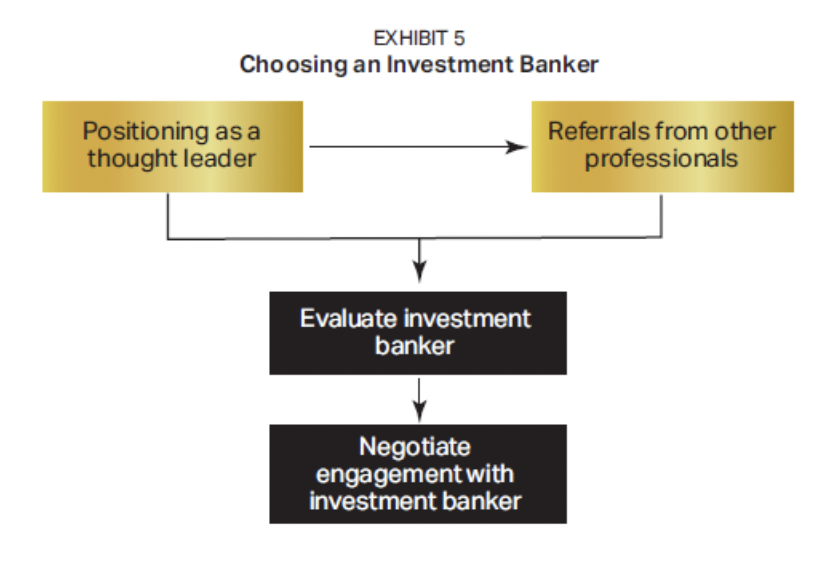

If you decide that engaging an investment banker is a good idea, you’ll need to find talented investment bankers who are likely to be a good fit for you and your company. The factors that often determine the selection of an investment banker are shown in Exhibit 5.

Most investment bankers for private companies are referred by other professionals working with those company owners. Corporate attorneys, wealth managers and accountants are often recommending investment bankers to business owners who are interested in selling their companies.

Another powerful factor is the investment banker’s reputation among privately held companies. As with all high-end professional service providers, you should be looking for industry thought leaders who demonstrate their expertise regularly.

When introduced to an investment banker, you still have to take a measure of the person and the firm. One good way to do that is to examine the financial models and marketing materials they have produced for other companies. You might also ask questions such as:

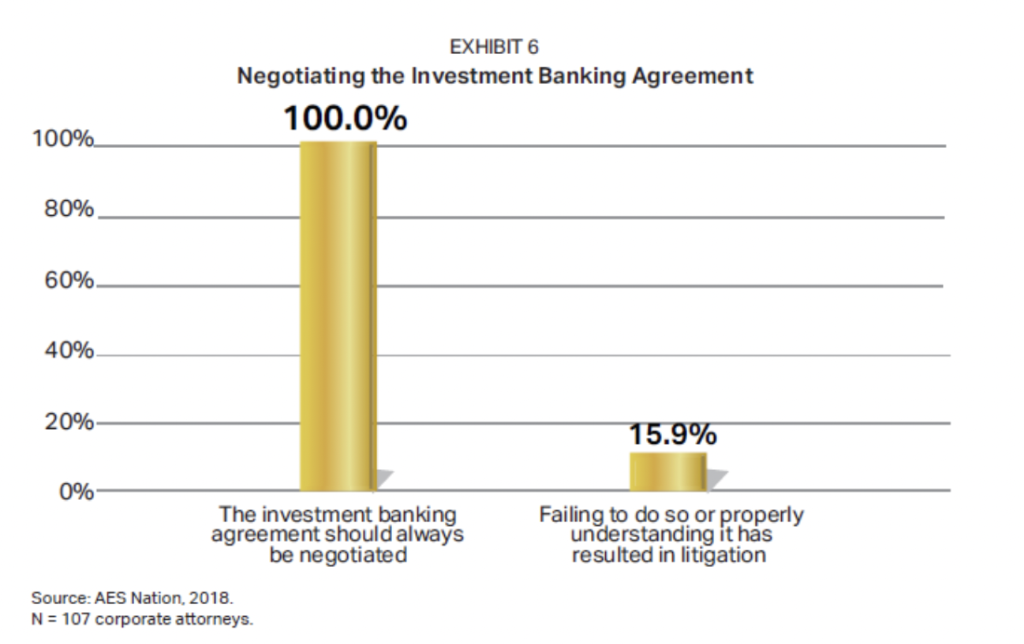

Once you have selected a banker to work with, you should negotiate the engagement. According to all the corporate attorneys surveyed, it is a potentially big mistake not to negotiate an investment banking agreement (see Exhibit 6). And about a sixth of the corporate attorneys reported that, in their experience, failing to negotiate the agreement (or not properly understanding it) resulted in litigation within the last five years.

Some possible mistakes in these agreements include:

Relying on talented, experienced professionals to help you deal with financial transactions where you lack expertise—such as selling your company—is often a very good idea. Remember, one of the main reasons for using an investment banker is to get a better price for your company—and research suggests that I-bankers do a good job at this task.

If you think that an investment banker would be helpful, you need to connect with a high-caliber professional—by which we mean one who has the requisite skills and experience, and who also understands the specific dynamics of your industry and companies of your size. That said, it’s important to vet anyone you work with on a sale—and that means, among other things, being crystal clear on the arrangements you make with any banker and the terms of the engagement.

If you think you could potentially benefit from working with an investment banker to prepare your company for a sale and guide you through the transaction, contact your legal or financial professional to explore the topic further.

This report was prepared by, and is reprinted with permission from, VFO Inner Circle. AES Nation, LLC is the creator and publisher of VFO Inner Circle reports.

Disclosure: The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS.

Fusion Wealth Management is not affiliated with Kestra IS or Kestra AS. https://www.kestrafinancial.com/disclosures

VFO Inner Circle Special Report

By Russ Alan Prince and John J. Bowen Jr.

© Copyright 2021 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, includ- ing, but not limited to, electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the authors nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The authors will make recommendations for solutions for you to explore that are not our own. Any recommendation is always based on the authors’ research and experience.

The information contained herein is accurate to the best of the publisher’s and authors’ knowledge; however, the publisher and authors can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

Unless otherwise noted, the source for all data cited regarding financial advisors in this report is CEG Worldwide, LLC. The source for all data cited regarding business owners and other professionals is AES Nation, LLC.